Exchangetraded foundation

Post on: 16 Март, 2015 No Comment

JohnSpence

BOSTON (MarketWatch) — As exchange-traded funds and notes branch out to cover almost every asset class under the sun, more financial advisers and sophisticated investors are using these indexed products exclusively to build long-term portfolios.

Such model portfolios can be notoriously dicey, because as a general rule, one size fits none. Every investor has his or own particular tolerance for risk, time horizon and financial goals.

However, model ETF portfolios can be a good starting point for the often frustrating task of creating an asset-allocation plan and sticking with it.

ETFs and their cousins, exchange-traded notes, have many different users.

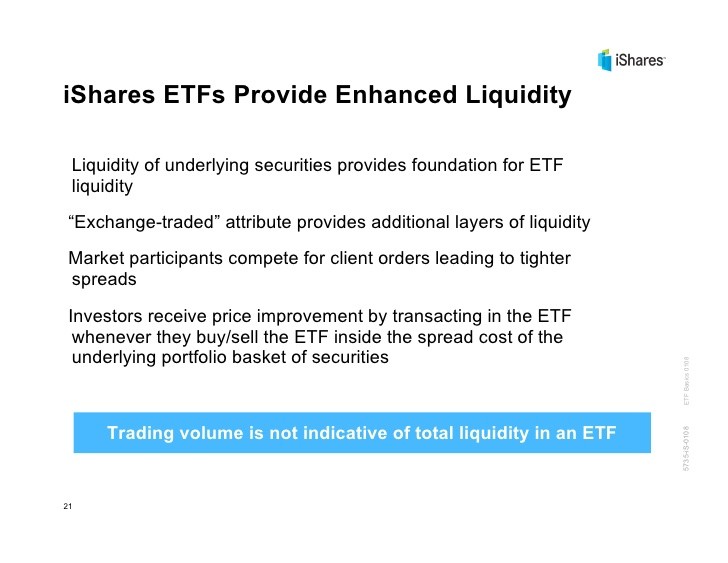

Traders and hedge funds, for instance, can jump in and out of these vehicles — the vast majority of which track indexes. ETFs and ETNs are listed on exchanges and trade much like individual stocks.

Yet due to their low costs, tax efficiency and diversification, these financial products can also be ideal vehicles for constructing buy-and-hold portfolios. Read related story on buy-and-hold investing.

Getting started

Academic studies have documented that the performance of long-term investors hinges mostly on asset allocation, or dividing money among major investment classes such as stocks, bonds, real estate, commodities and cash.

Armed with this knowledge and mindful of the draining impact of fees, some investors and financial advisers use passively managed funds such as ETFs to get cheap, broad exposure to asset classes. These investors know exactly what they’re buying because the products are transparent and follow benchmarks, so investors don’t have to keep up with manager changes or style drift, for instance.

Again, it’s important that investors take model ETF portfolios with a grain of salt. Any financial adviser, or financial journalist for that matter, can slap together a collection of funds and call it a model portfolio.

Instead, investors should regard model portfolios as a kind of recipe — a starting point that can be tweaked or seasoned according to the individual’s tastes.

Also keep in mind that the point of asset allocation is to build a diversified portfolio that doesn’t leave investors with all their eggs in one basket. Adding non-correlated assets — or those that zig when others zag — to a portfolio can smooth out risk and provide the opportunity for higher returns. Diversified investors tend not to hit home runs or strike out badly, but rather churn out a steady stream of singles to build and protect capital over the long haul.

When coming up with an asset-allocation plan, advisers usually have clients fill out a questionnaire that helps them identify their tolerance for risk, and investment goals.

Investors with a healthy appetite for risk could end up taking a relatively bigger position in stocks, which have historically seen greater volatility but also larger rewards over long periods.

Conversely, a baby boomer approaching or in retirement may want to ratchet down risk and invest more in relatively safer and income-producing bonds.

Model portfolios

Rick Ferri is chief executive at Portfolio Solutions LLC, an investment firm that manages separate accounts using ETFs and index funds.