Exchange Traded Notes (ETNs)

Post on: 8 Июль, 2015 No Comment

Structured Investments, Non-Traded REITs Make FINRA’s 2013 Priority Watch List

Posted on February 6, 2013

Every year, the Financial Industry Regulatory Authority (FINRA) takes note of key regulatory and examination issues that it plans to prioritize in the new year. In 2013, those priorities include a number of hot-button and familiar financial products, from structured investments, to non-traded REITs, to business development companies, or BDCs.

In a recent notice to investors, FINRA highlighted the following products and issues, along with an explanation as to why they merit top placement on FINRAs 2013 watch list.

Structured Products. These products may be marketed to retail customers based on attractive initial yields and, in many cases, on the promise of some level of principal protection, according to FINRA. Moreover, structured products are often complex, and have cash-flow characteristics and risk-adjusted rates of return that are uncertain or hard to estimate. In addition, structured products generally do not have an active secondary market.

Suitability and Complex Products. FINRA’s recently revised suitability rule (FINRA Rule 2111) requires broker/dealers and associated persons to have a reasonable basis to believe a recommendation is suitable for a customer. FINRA says it is particularly concerned about firms’ and registered representatives’ understanding of complex or high-yield products, potential failures to adequately explain the risk-versus-return profile of certain products, as well as a disconnect between customer expectations and risk tolerances.

Business Development Companies (BDCs). BDCs are typically closed-end investment companies. Some BDCs primarily invest in the corporate debt and equity of private companies and may offer attractive yields generated through high credit risk exposures amplified through leverage. As with other high-yield investments such as floating rate/leveraged loan funds, private REITs and limited partnerships investors are exposed to significant market, credit and liquidity risks. In addition, fueled by the availability of low-cost financing, BDCs run the risk of over-leveraging their relatively illiquid portfolios, FINRA says.

Exchange-Traded Funds and Notes. In many instances, retail investors may not fully understand the differences among exchange-traded index products (i.e. funds, grantor trusts, commodity pools and notes) and the risks associated with these investments, particularly those that employ leverage to amplify returns. FINRA says it also is concerned about the proliferation of newly created index products that lack an established track record. Examples include products with valuations and performance tied to volatility, emerging markets and foreign currencies.

Non-Traded REITs: FINRA’s interest in non-traded REITs centers on the fact that many customers of non-traded REITs are unaware of the sales costs deducted from the offering price and the repayment of principal amounts as dividend payments in the early stages of a REIT program.

Private Placement Securities: Private placements will continue to be a key focus of FINRA’s investor protection efforts in 2013, with particular emphasis on sales and marketing efforts by broker/dealers. To improve its understanding of private placements, FINRA implemented Rule 5123, which requires member firms that sell an issuer’s securities in a private placement to individuals to file a copy of the offering document with FINRA.

FINRA also reminds member firms that the relative scarcity of independent financial information and the uncertainty surrounding the market- and credit-risk exposures associated with many private placements necessitates reasonable due diligence on prospective issuers. FINRA notes that due diligence should focus on the issuer’s creditworthiness, the validity and integrity of their business model, and the plausibility of expected rates of return as compared to industry benchmarks, particularly in light of the complex fee structures associated with many of these investments.

Credit Suisse TVIX Highlights Potential Risks of ETNs

Posted on April 6, 2012

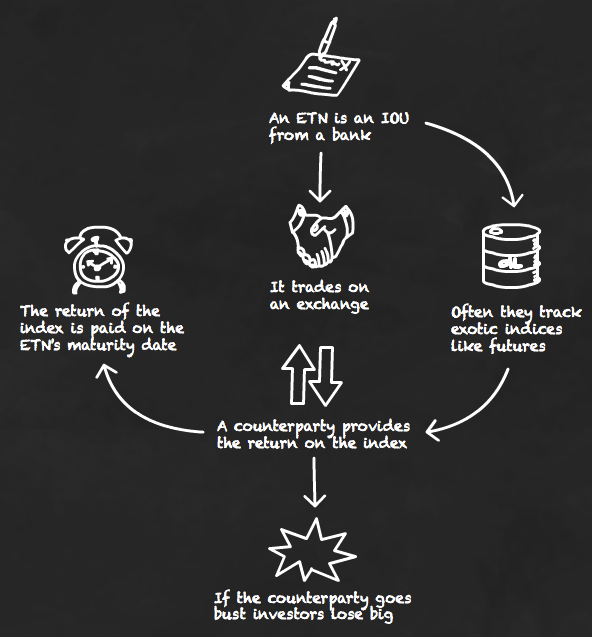

The plunge in shares of an exchange-traded note (ETN) backed by Credit Suisse Group underscores the growing risks that investors may unknowingly take on when they put their money into these complex financial products. The VelocityShares Daily 2x Short-Term ETN (TVIX), which aims to provide twice the daily return of the VIX volatility index, lost more than 60% of its value last month.

The startling free-fall raises serious questions most notably whether retail investors who own exchange-traded notes like TVIX truly understand how the products actually work. ETNs are intended for short-term trading. When held for longer periods of time, investors leave themselves exposed to potentially huge financial losses. Unlike exchange-traded funds (ETFs) that have set fees and must alert investors when those fees change, an ETN’s can change daily.

Exchange-traded notes are debt securities issued by banks. The products first arrived on the investing scene in 2006, and were intended to be a mechanism for sophisticated traders to make bets on various market sectors.

State securities regulators, the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are now looking into the volatility surrounding the VelocityShares, as well as the marketing efforts of firms that market it and other ETNs to investors.