Examples Of AssetLiability Management_6

Post on: 10 Май, 2015 No Comment

Sections in this Topic

Overview

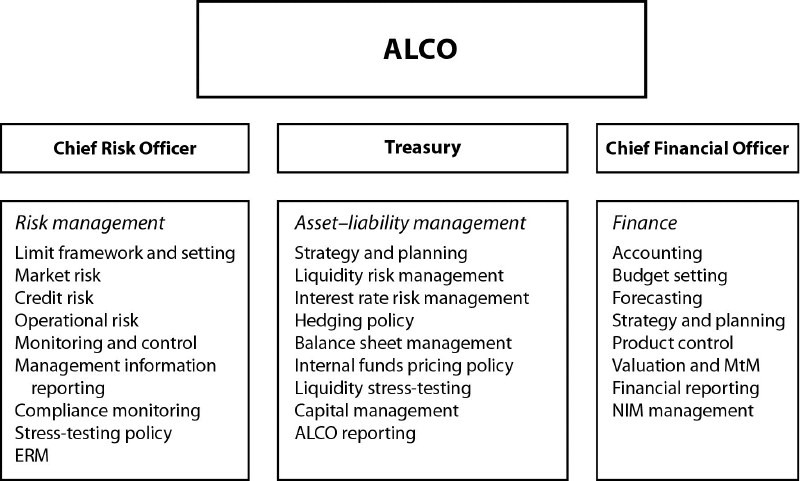

Adequate board and management supervision is essential for good risk management and corporate governance. An Asset/Liability Committee (ALCO), whether at the board or management level, provides important management information systems (MIS) and oversight to effectively evaluate on- and off-balance-sheet risk for an entire institution.

Goal of Committee

Asset/liability management involves incorporating interest rate risk and liquidity considerations into a bank’s operating model. From a regulatory perspective, one of the ALCO’s goals is to ensure adequate liquidity while managing the bank’s spread between the interest income and interest expense. Investments and operational risk are also major considerations.

A sound practice is to conduct ALCO meetings at least quarterly. ALCO responsibilities typically include managing market risk tolerances, establishing appropriate MIS, reviewing and approving the liquidity and funds management policy at least annually, developing and maintaining a contingency funding plan, and reviewing immediate funding needs and sources. ALCO would also typically be responsible for evaluating liquidity risk exposures to adverse scenarios of varying probability and severity. To validate the assumptions and data contained in internally or externally prepared management reports, some institutions ALCOs contract independent third parties with enhanced subject matter expertise.

Risk Tolerances and MIS

To allow the ALCO to manage market risk tolerances effectively and to establish appropriate MIS, reports regarding activities like those listed below should be developed and reviewed:

- Borrowings and repurchase agreements

- Funding sources and uses reports both forward-looking and retrospective

- Adverse scenario analysis reports based on contingency funding plan guidance

- Investment portfolio analysis including purchases and sales; duration and weighted average life; credit risk; interest rate risk exposures that include prepayment, price, and call risks; and potential accounting implicaitons

- Interest rate risk analysis using modeling analysis and validation

- Asset/liability management, with information on interest rate risk and liquidity policy exceptions

- Budget and general ledger/income statement comparisons

- Large depositors

- New accounts

Liquidity Policy Guidelines

Strategies, policies, and procedures should translate the board’s goals, objectives, and risk tolerances into operating standards that are well understood by management and that are consistent with the board’s intended risk tolerances. Strategies set out the institution’s general approach for managing liquidity, articulate its liquidity-risk tolerances, and address the extent to which key elements of funds management are centralized or delegated throughout the institution. Strategies also communicate how much emphasis the institution places on using asset liquidity, liabilities, and operating cash flows to meet its day-to-day and contingent funding needs.

Quantitative and qualitative targets such as the following may also be included in policies:

- Guidelines or limits on the composition of assets and liabilities

- The relative reliance on certain funding sources, both on an ongoing basis and under contingent liquidity scenarios

- The marketability of assets to be used as contingent sources of liquidity

- Guidelines for maintenance of a suitable liquid asset cushion

Contingency Funding Plan (CFP)

An institution’s strategies and policies should identify the primary objectives and methods for: (1) managing daily operating cash flows, (2) providing for seasonal and cyclical cash flow fluctuations, and (3) addressing various adverse liquidity scenarios.

The latter includes formulating plans and courses of actions for dealing with potential temporary, intermediate-term, and long-term liquidity disruptions. Contingency funding plans should formally document the following:

- Lines of authority and responsibility for managing liquidity risk

- Liquidity risk limits and guidelines

- The institution’s measurement and reporting systems

- Elements of the institution’s comprehensive CFP

Banks are also encouraged to include the Federal Reserve Discount Window among the sources of funding in a contingency plan.

Incorporating these elements of liquidity risk management into policies and procedures helps Internal Control and Internal Audit fulfill their oversight role in the liquidity risk management process. All liquidity risk policies, procedures, and limits should be reviewed periodically and revised as needed.

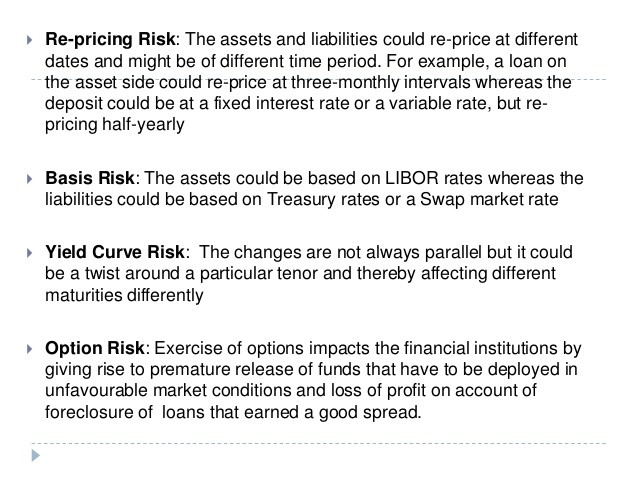

Market Risk

The following websites provide information on market risk, how bankers understand it, and what methods are used to monitor it: