Evaluating Financial Statements – The Balance Sheet

Post on: 2 Июнь, 2015 No Comment

by Begin To Invest on September 8, 2012

The first step in finding potential investment opportunities is to be able to go through and evaluate a company’s financial report. In this article we evaluate the Balance Sheet.

In addition to the Balance Sheet, companies also release an Income Statement and a Statement of Cash Flows.

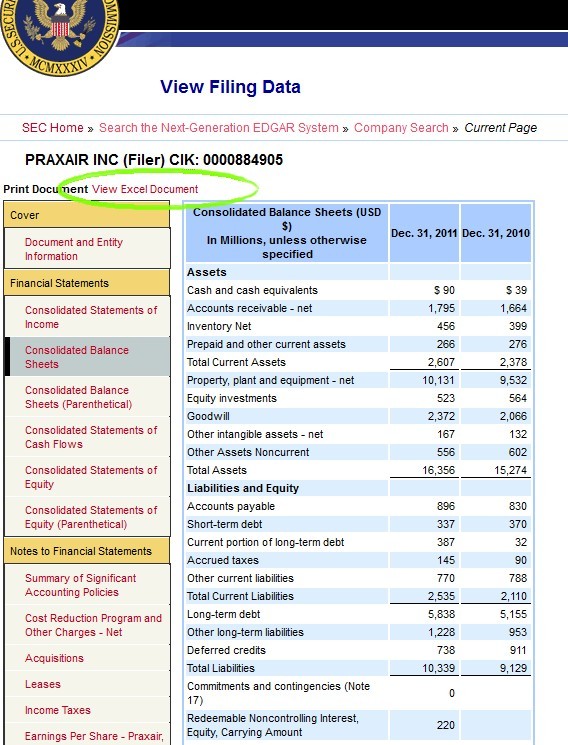

The Balance Sheet is one of three financial statements released by a company every quarter that allow investors an inside look into the companys books. The Balance Sheet shows the company’s assets. liabilities and shareholder’s equity at a specific time.

The Balance Sheet, Income Statement and Cash Flow Statement are all found within a company’s 10-Q (Quarterly report) or 10 – K (Annual report) filed with the Securities Exchange Commission.

Before you begin investing in individual companies you must have a basic understanding of what these 3 financial statements tell you. There is no better way to truly assess a company’s standing than taking the time to read these reports. How does a company make its money? How much money does the company make? Can the company afford to pay its bills? All of these questions can be answered from a basic understanding of a companys financial statements.

Sometimes this is no easy task. Annual reports are typically hundreds of pages long.

In this article we go through several examples of evaluating a company’s balance sheet and help you determine what information is significant and how to use that information to make an informed investment decision.

By being able to comb through these documents, you will know information that only a small percentage of investors know. Why?

Simply put, many investors are lazy and purchase stocks based on TV news coverage or co-worker tips. Very few do based on research of a company’s financial statements.

Later in this article I will show you how taking the time to read the 200+ pages of Facebook’s first financial filing would have given investors clues to stay clear of Facebook after its IPO (Initial Public Offering) and collectively saved investors billions of dollars. Clearly showing how important these documents are – and how little they are read!

Begin Investing — A Guide to Getting Started

These reports can be found on the SEC’s EDGAR Database found here, Or can be found listed on the company’s webpage in the “Investor Relations” section.

Although it is useful, in order to get an accurate view of the company’s financial standing you need to dig deeper.