EUR Currency Index & Volatility

Post on: 16 Март, 2015 No Comment

Relative Currency Strength

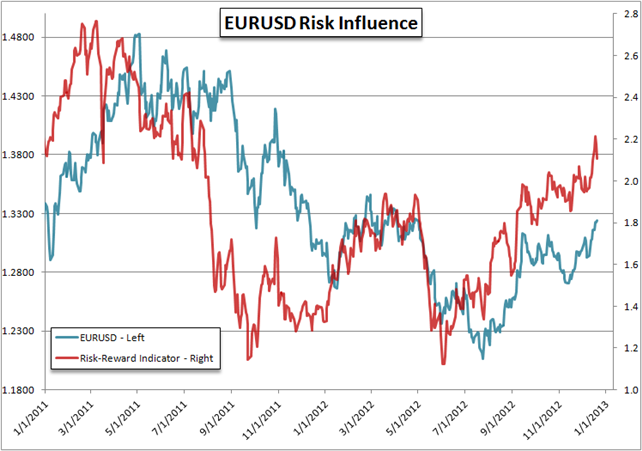

Even though the second part of the previous week was positive for the single currency, it is now 0.46% less expensive overall than it was on October 8. An impressive gain of 0.87% against the New Zealand Dollar was not able to offset 1.02% and 0.75% dips relatively to the AUD and JPY, respectively. Still, we must note that the single European currency preserves its bullish tendency and is poised to pare these losses in near future, provided that expectations of the market will come true.

Looking at performance of the EUR within the last half of a year, the currency appears to be quite weak, since its debasement for this period amounts to 1.45%, while for the last month the Euro depreciated 0.21%.

The maximum drawdown of the Euro was 1% from its base value during the previous week, as neither the International Monetary Fund nor the president of the European Central Bank were promising in their stated outlooks on the world economy and with respect to the eurozone in particular. However, subsequent performance of the EUR revealed presence of optimism in the market, being mainly associated with increased possibility of Spain’s bailout, especially after Standard & Poor’s lowered nation’s credit rating, reflecting elevated risk that the economy will not manage to overcome difficulties in its financial system on its own.

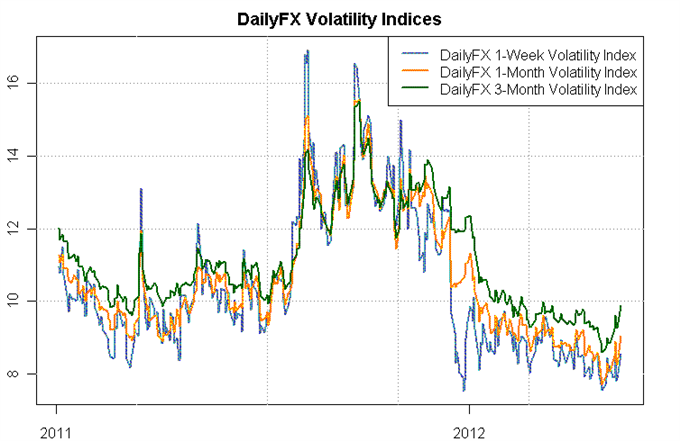

Volatility

Throughout the last week the market could have been considered turbulent in 26% of cases. Among the pairs used in calculation of the Dukascopy Bank Volatility Index, the highest portion of time spent above historical turbulence, namely 32%, was demonstrated by USD/CHF currency pair. However, its maximum variability measure was 1.9, well below the maxima of EUR/CHF and USD/SEK volatility indices, both of which attained a mark of 2.9.

Conversely, the most tranquil currency couple was NZD/USD, as its variability measure was elevated only 17% of the time, maximally reaching 1.7.

While volatility remains to a large degree decreased, it was more evenly distributed throughought the recent days. Now Asian trading sessions introduce more turbulence than they used to, as clearly seen on October 10 and 11, although it appears that the difference in volatility between Asian and European sessions has been reduced at the expense of the European sessions, during which market variability index values do not exceed a level of 1.5. This pattern was broken only once, on October 9, when arrival of German Chancellor to Greece was accompanied with public disorder, while Mario Draghi on the same day pointed out serious problems that still lie ahead of the bloc.

Currency Significance

Frequency of co-movement stays more or less the same for most currency pairs. EUR/USD and EUR/JPY tend to go in unison in 77% of cases for the last 130 days and in 81% of cases for the last 20 days. At the same time, there is no relationship observed between EUR/USD and EUR/SEK, usually having a correlation coefficient near 0.04.

The sole notable change relates to EUR/USD and EUR/CHF, correlation between which has strengthened from 0.19 to 0.43, as the currency pair has left vicinity of 1.20, alleviating pressure on the Swiss National Bank to maintain the floor and releasing the price from its movement constraints.

Judging by behaviour of the average correlation coefficient for the Euro, which rallied from 0.27 up to 0.43, the currency is gaining significance in the foreign exchange market. Nevertheless, not all of the correlations observed are direct and strong between EUR crosses, which in turn would imply heightened importance of the currency. Interrelations that fall out from the general tendency are EUR/USD & EUR/SEK and EUR/CHF & EUR/AUD, largely staying near zero and being the main subjects to changes.