ETFs Loaded With Low PricetoCashFlow Ratios Apple Inc (NASDAQ AAPL) Ace Limited (NYSE ACE)

Post on: 12 Апрель, 2015 No Comment

A favorite tool of value investors, the price-to-cash-flow is a gauge of the market’s beliefs in a company’s future financial health. Uses as an indicator of relative value, the price-to-cash-flow ratio is arrived at by dividing the current share price by cash flow per share .

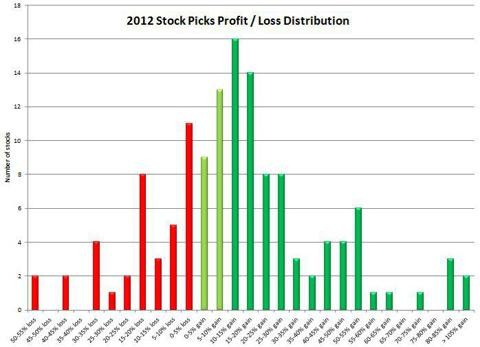

Indeed, stocks with low price-to-cash-flow ratios mean that cash flow is robust relative to the share price and these stocks having a low ratio outperform those with a high price to cash flow ratio 78% of the time, according to Thomas Bulkowski .

As is the case with other valuation metrics, high and low price-to-cash-flow ratios are not indigenous to just one or two sectors. However, some industry groups are currently home to an impressive number of low price-to-cash-flow stocks, indicating that ETFs can be a useful tool for investors looking to exploit this valuation metric.

Vanguard Information Technology ETF (NYSE: VGT ) Not only is VGT now the technology ETF with the lowest expense ratio at just 0.14 percent per year. the fund is home to fair amount of low price-to-cash-flow stocks.

A screen for mega-cap names low price/free cash flow ratios turned up just three names, but two of those were Apple (NASDAQ: AAPL ) and Microsoft (NASDAQ: MSFT ), which combine for 24.3 percent of VGT’s weight.

Other VGT holdings that fit the bill as low P/FCF names include Broadcom (NASDAQ: BRCM ), Symantec (NASDAQ: SYMC ), Cisco (NASDAQ: CSCO ), Dell (NASDAQ: DELL ), Hewlett Packard (NYSE: HPQ ) and Western Digital (NYSE: WDC ). That is not the entire list of low P/FCF VGT constituents and that tells investors this ETF has ample exposure to companies that should be financially durable going forward.

iShares Dow Jones U.S. Healthcare Providers Index Fund (NYSE: IHF ) For the purposes of the screen used to find low price-to-cash-flow stocks, low was considered to be a ratio of 15 or lower. A fair amount of health insurance providers popped up. That underscores the notion that low P/FCF stocks outperform. Over the past year, iShares Dow Jones U.S. Healthcare Providers Index Fund, an ETF often overlooked in the health care sector ETF conversation, has gained more than 19 percent.

Dow component and IHF’s largest holding UnitedHealth (NYSE: UNH ), IHF’s largest holding, and WellPoint (NYSE: WLP ), the ETF’s third-largest holding, both popped up in the screen. Those two names combine for over 19 percent of the IHF’s weight.

Also appearing in the screen were Express Scripts (NASDAQ: ESRX ), Cigna (NYSE: CIG ), Aetna (NYSE: AET ) and Humana (NYSE: HUM ). That quartet combines for over 27 percent of IHF’s weight.

SPDR S&P Insurance ETF (NYSE: KIE ) Health insurance firms are typically viewed as a sub-industry of the health care sector, but even with that, there are plenty of financial services and bank stocks that currently trade with low P/FCF ratios. Excluding the traditional banking names, which include PNC Financial (NYSE: PNC ), US Bancorp (NYSE: USB ) and Wells Fargo (NYSE: WFC ), we opted for less volatile insurance providers.

By that metric, the SPDR S&P Insurance ETF has a beta of 0.99 against the S&P 500, according to State Street data. That compares favorably with a beta of 1.23 on the Financial Select Sector SPDR (NYSE: XLF ).

KIE is nearly an equal-weight ETF and its largest holding receives a weight of just 2.83 percent. However, plenty of the ETF’s 46 holdings appeared on our large-cap screen for low P/FCF stocks. That list includes Ace (NYSE: ACE ), Chubb (NYSE: CB ), Aflac (NYSE: AFL ), Hartford Financial (NYSE: HIG ), MetLife (NYSE: MET ), Prudential Financial (NYSE: PRU ) and Dow component Travelers (NYSE: TRV ). The result is KIE has surged nearly 29 percent in the past year.

For more on ETFs, click here .

2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.