ETF vs Mutual Fund Difference and Comparison

Post on: 8 Май, 2015 No Comment

Contents: ETF vs Mutual Fund

edit What are ETFs and Mutual Funds?

ETFs are a basket investment scheme. where large investment firms set up baskets of (usually index-based) stocks and bonds. of which investors can buy shares. ETFs are an increasingly popular investment tool and are seen as being a competitive alternative to mutual funds. As ETFs generally track an index, no active management is required, which results in lower overhead fees for investors. ETF shares can be traded. just like stocks.

A mutual fund is a pool of different shares of stocks or bonds that is purchased using the funds of investors; it requires a certain minimum investment from prospective investors. Fund managers decide which investments are attractive for a mutual fund, andmutual funds can only be bought or sold after a trading day, when the fund’s net value has been determined. The active management and cash-investment structure of mutual funds results in considerablefees for investors.

This video discusses how an ETF works and provides a brief comparison of ETFs and mutual funds:

edit Types of ETFs and Mutual Funds

Most ETFs are index funds, which means they are designed to replicate the performance of a certain market index, like the S&P 500. These primary investments may be made in stocks, the traditional and most popular option, or in bonds. More recently, commodity and currency-based ETFs have become available. From an investor’s perspective, ETFs operate the same regardless of which market they’re based on.

Mutual funds may be open-end or closed-end funds, but the term “mutual fund” usually refers to an open-end fund. In an open-end fund, the mutual fund must be willing to buy back shares from investors at the end of each day, and these shares are priced at net asset value. These funds can be based on stocks, bonds, money market instruments, or a hybrid.

edit Creation and Trading Process

Individual investors buy and sell ETF shares on a secondary market. ETFs are created by large investment companies using a basket of primary market stocks. Shares and investments can only be added to an ETF by these authorized participants. Investors then buy and sell shares of the ETF on an exchange. Share prices are determined by investor demand, and just like with traditional stocks, investors can utilize trading strategies, like buying on margin or selling short, to their advantage.

Mutual Funds are pooled investment schemes that use investors’ cash directly to buy a basket of stocks and bonds. The fund is actively managed by a team or individual manager. Investors in mutual funds are more directly exposed to the fund’s market performance since their money is used directly in investments instead of for purchasing secondary shares, as is the case with an ETF.

edit Fees

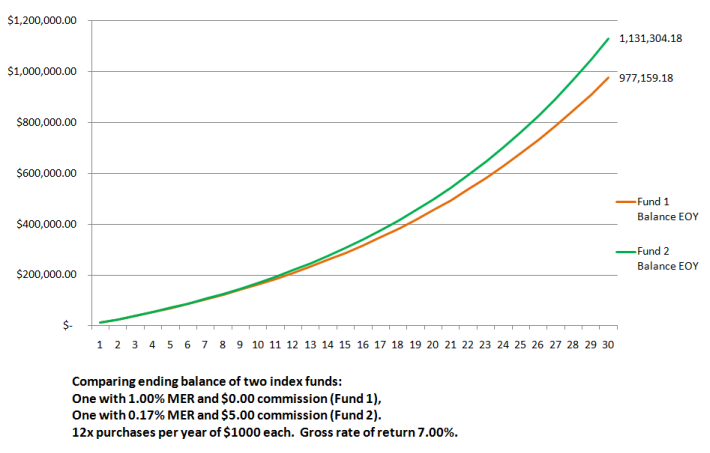

In general, ETFs cost less to invest in than mutual funds. Expense ratios of 1-2% are common in mutual funds, while ETF expense ratios are usually under 0.5%. Expense ratio is a measurement of the operating expenses of a fund as a percentage of total assets under management. The higher the operating expenses, the higher the expense ratio, and the lower the return for investors in the fund.

Mutual funds are actively managed and must pay a fund manager to make investment decisions. Mutual funds also typically have higher marketing costs. Some funds incentivize financial advisors and brokers by paying them a commission a portion of the initial investment. All these expenses ultimately lower the return for the investor.

1-2% may not seem like much of a cut, but the long-run impact is large because of the following factors:

- For long-term investors, 1.5% compounded for 10 years on a $10,000 principal is over $1,600, not factoring in any additional contributions to the investment.

- Expenses are incurred even if the value of the assets (and therefore of the investment) falls.

- Returns are usually in the single digits, so assuming a 6% return, a 1.5% expense ratio lops off around 25% of an investor’s return, and the net return is only 4.5%.

Exchange-traded funds are not actively managed i.e. investment decisions are made passively so that the portfolio tracks a specific index. ETFs also have operational expenses, but they are generally lower than mutual funds’ expenses.

edit Trading Costs

Trading costs for ETFs include:

- Brokerage fees: ETFs require the investor to have a brokerage account, which may charge an annual account maintenance fee. In addition, the broker may charge a commission of $7 — $20 per trade.

- Bid/Ask spread: Since ETFs are traded on the exchange like any other security, there is a bid/ask spread that applies to ETFs. Depending upon the trading volume, this spread could be large enough to cut into the return on investment. What’s more, an ETF share may trade at a premium or discount with respect to its NAV (net asset value) because the market price of the ETF depends upon supply and demand. For example, this Vanguard ETF had a market price of $52.78 but NAV of $52.60 as of December 1, 2014.

Mutual funds may also have trading costs, sometimes called a load or sales charge. Back-end load, also called contingent deferred sales load (CDSL), is the fees charged when redeeming the funds while front-end load is a similar fee that is charged upfront. Funds that do not charge such fees are called no-load funds.

In investing, you get what you don’t pay for. — Jack Bogle, Vanguard CEO

An investor should always choose no-load funds over funds that charge a back-end or front-end load. Comparable no-load funds are almost always available for every asset class. Other fees that some mutual funds charge include a 12b-1 marketing fee ; depending upon the fund, this annual fee may be charged for a fixed number of years or in case of level load funds perpetually every year. This article has more information on mutual fund costs.

edit Taxes

With ETFs, investors can decide when to take a capital gain or loss by selling their shares. Because ETF investors work in a secondary exchange market, they are only taxed on gains from their personal shares and investments.

With mutual funds, the fund management can sell investments at any time, and all mutual fund investors are responsible for taxes on any gains from these specific sales. This applies even if the fund is losing money overall.

edit Accessibility

One major benefit of ETFs is that, unlike mutual funds, they don’t often require a large initial investment. Investors can purchase as many or as few shares of an ETF as they want, allowing people with low initial investments to participate. This also makes it possible to diversify, as money can be spread among various ETF funds.

Mutual funds, on the other hand, have minimum investment levels; sometimes $2,000, or even up to $50,000 and beyond. This can prevent individual investors from participating or spreading their money among different funds.

edit Transparency

ETFs are very transparent, as their values are based directly on the underlying assets, and the assets are usually based on an index. Investors can see how the index is performing at any given time.

With mutual funds, however, the pool of money is spread across a diverse range of investments based on the sole decisions of the fund’s manager. Investors receive quarterly updates of the fund’s assets and specific performance, but overall there is much less transparency than with an ETF.

edit Flexibility

In terms of trading, ETFs behave like stocks and are more flexible than mutual funds. Transactions take place directly between investors and the fund. Investors can short ETFs, purchase on margin, and trade throughout the day. This enables investors to place various orders with specific limits or stop loss settings. On the flip side, ETFs take three days to settle.

Mutual fund transactions can only take place at the end of day, once the net value of the fund has been determined. They settle faster than ETF trades, however. Individual investors interact with the fund management members, rather than directly with the market.