ETF Rotation Strategy

Post on: 8 Май, 2015 No Comment

www.mymoneycalculator.com.au/beginner-s-guide-to-etfs-etfs-explained/

Th ere are now eight ETFs that we time within our Rotation Strategy. Six are used for equity bull markets (the three Global regional share funds and the three Local industry sector share funds) while two are used in equity bear markets (the gold and cash funds). The ASX codes for each ETF are shown in parentheses.

International Regional Share Funds

- BetaShares Australian High Interest Cash Fund (AAA)

How it works

The beauty of the first six funds is that in a bull market at least two of them should be rallying and hence ideal candidates for holding based on their relative rate of price momentum. The gold fund is used for profiting in bear markets (since gold normally rallies in a share crash) and the cash fund is used if none of the other funds exhibits positive price momentum.

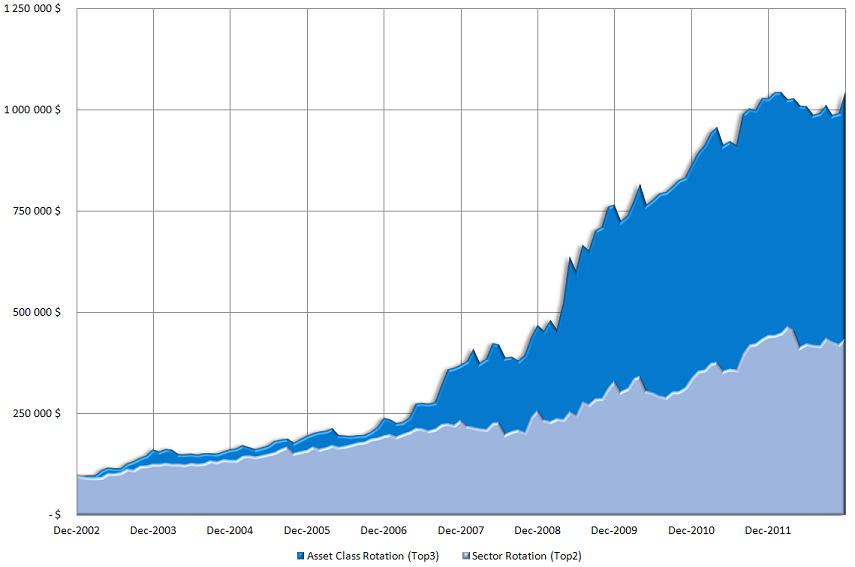

Think of the Rotation Strategy as a diverse asset class race where you always back the Global ETF doing best and the Local ETF doing best or in a share market crisis (like 2008) using a gold or cash ETF (or your own cash managment account) for protection. Its construction makes the ETF Rotation strategy the closest thing to an all-weather portfolio.

We use an ultra-conservative multiple-momentum model to time each ETF on a weekly basis (at closing prices each Friday). We then list the best performing Global and Local ETFs in our Weekly Update bulletin as Buys and signal any changes to them as Sells. When commencing this strategy, equal amounts of capital should be used to buy each ETF. At the end of each financial year the Rotation Strategys portfolio should be rebalanced so that its two ETFs are equalised in value.

Back-testing shows the Rotation Strategy works with a delay of up to 5 days in executing a signal change to sell an ETF and buy another in its place. That means you dont need a margin loan account for bridging finance between one ETF being sold and its replacement being bought. Nevertheless, the sooner you act after an ETF rotation alert appears in MarketTiming s Weekly Update bulletin the better should be the result.

How its performed

Because market timing the full set of ETFs only became possible after the 6th February 2012 we are not able to back-test our models performance before that date.

But between that date and the 12th December 2014, the Global part of the ETF Rotation Strategy (comprising a US share fund, a non-US developed markets share fund, an Asian share fund, a gold fund and a cash fund) delivered an average annual return 20.9%.

The Local part of the ETF Rotation straegy (comprising an Australian finance sector fund, an Australian resources sector fund, an Australian real estate sector fund, a gold fund and a cash fund) generated an average annual return of 11.1%.

The combined average annual return of 16.0% was after brokerage of 0.20% per trade and before ETF income distributions. The comparable average annual return on an Australian share fund (the SPDR S&P/ASX 200) over this period was 8.0%.

The Rotation Strategy has about 6 switches a year (i.e. six occasions where an ETF is sold and replaced by another ETF giving a total of 12 trades).

To avoid others copying our model we wont divulge our ETF rotation methodology which is based on a combination of research, back-testing and live trading.

Of course past performance can’t predict future results. But our ETF Rotation model is based on international best practice in momentum investing.

Attractions and risks

An ETF Rotation strategy has both attractions and risks.

Its main appeal is that momentum investing beats other investment styles such as buy and hold, growth or value (see

font-family:Calibri,sans-serif;mso-ascii-theme-font:minor-latin;mso-fareast-font-family:

Calibri;mso-fareast-theme-font:minor-latin;mso-hansi-theme-font:minor-latin;

mso-bidi-font-family:Times New Roman;mso-bidi-theme-font:minor-bidi;

mso-ansi-language:EN-AU;mso-fareast-language:EN-US;mso-bidi-language:AR-SA> www.aqrindex.com/resources/docs/PDF/News/News_Case_for_Momentum.pdf and mso-ascii-theme-font:minor-latin;mso-fareast-font-family:Calibri;mso-fareast-theme-font:

minor-latin;mso-hansi-theme-font:minor-latin;mso-bidi-font-family:Times New Roman;

mso-bidi-theme-font:minor-bidi;mso-ansi-language:EN-AU;mso-fareast-language:

Also back-testing shows it has less downside risk than buying and holding a portfolio of comparable ETFs. Finally, the strategy does not take a lot of time since it involves on average only 6 ETF switches a year (i.e. 6 buy and 6 sell trades); about one ETF switch every two months.

Its main risks is that like all trading strategies it can involve losses and opportunity costs, but these are usually small. For instance the maximum drawdown (i.e. loss) on any trade over the period back-tested was 4.9%.

Finally, we dont recommend that adopt the Rotation strategy as a substitute for MarketTiming s Share and Gold strategies which are timed on a daily rather than a weekly basis and have tighter stop loss limits; two features that reduce their risk relative to the Rotation Strategy. Note, however, that the Rotation strategy, based on back-tests, is still less risky than buying and holding an indexed share fund indefinitely.

MarketTiming discloses the results of its Rotation Strategy as well as its Share and Gold Strategies each half year.

How to Trade

You can use your own online broking platform to trade the Rotation Strategy ETFs which appear in MarketTiming s Weekly Update bulletin received by all clients. Alternatively you can use an auto-trade service that automatically applies MarketTiming signals for any of our ETF trading Strategies. Question 4b under the FAQs section of the MarketTiming website menu explains how to open a personal broking account that automatically applies MarketTiming signals to ETFs for minimal cost.