ETF Investing Guide OnePage Summary Of The Entire Guide

Post on: 18 Апрель, 2015 No Comment

Mutual Funds

- Actively managed mutual funds are generally a bad deal (Why You Shouldnt Buy Mutual Funds ). Research suggests they under-perform the market indexes by 2-3 percentage points per year in aggregate, adjusting for survivorship bias.

- Mutual fund ratings give you little useful information (Mutual Fund Ratings ), and if you switch into and out of mutual funds because of changes in ratings youll get hit with taxes and possibly large fees.

- The under-performance of mutual funds is not a surprise when you take a realistic (but cynical) look at the mutual fund business. Fund companies’ interests are not adequately aligned with investors’ interests. Fund companies are incented to spend heavily on advertising to grow assets under management, to highlight only their best performing funds, and to merge underperforming funds out of existence (How to Run a Mutual Fund Company ).

- Mutual funds are not a particularly effective way to build a diversified portfolio. Mutual fund managers vary the amount of cash they hold, so you don’t know your overall stock exposure. And they often stray from their style guidelines or have unconventional interpretations of those guidelines, making it hard to avoid sector and stock overlap in a portfolio that includes multiple funds (So You Thought Mutual Funds Help You Diversify? ).

- If you try to diversify by owning lots of mutual funds, you can end up with a portfolio that effectively resembles an index fund, but with higher expenses, more cash and unforeseen concentrations in individual stocks (So You Thought Mutual Funds Help You Diversify? ).

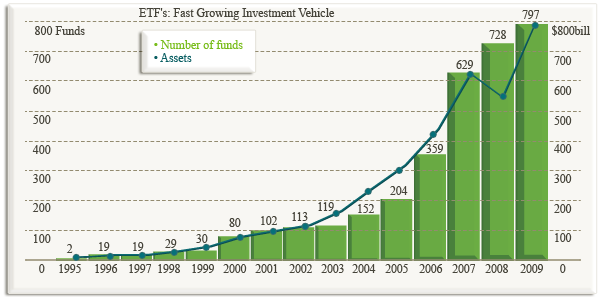

Index Funds and Exchange-Traded Funds (ETFs)

- Index funds provide the best combination of diversification and performance (Why Indexing Wins ).

- Exchange-traded funds (ETFs) are the cheapest and most convenient way for individuals to build and manage a portfolio of index funds, as long as the transaction fees to buy and sell the ETFs represent a small percentage of the amounts you are investing (The 7 Advantages of ETFs Over Index Mutual Funds ).

- A (model) portfolio of index ETFs has annual expenses roughly 18% less than a similar portfolio of Vanguard index mutual funds (ETF Investing Guide: ETFs Are Cheaper Than Index Mutual Funds ).

- ETFs are more tax efficient than index mutual funds, and easier to manage for tax-loss selling (The 7 Advantages of ETFs Over Index Mutual Funds ).

- Asset allocation and portfolio rebalancing are easier with ETFs than with index mutual funds (The 7 Advantages of ETFs Over Index Mutual Funds ).

- ETFs are particularly attractive in combination with ultra-low cost online trading (The Single (But Serious) Disadvantage of ETFs ).

- ETFs don’t make sense if you want to invest small amounts regularly (The Single (But Serious) Disadvantage of ETFs ). In that case, the cost of buying the ETFs — even in an online brokerage account — outweigh the advantages of ETFs compared to index mutual funds.

Building an ETF Portfolio

More from this section