ETF Funds Mergers Acquisition

Post on: 6 Июнь, 2015 No Comment

Recent Posts:

Merger ETF is Your Best Way to Play Acquisition Surge

Mergers and acquisitions, more commonly referred to as M&A, are the hot topic on Wall Street. Last week we saw a surge in deal activity led by semiconductor giant Intel (NASDAQ: INTC ) and its $7.67 billion all cash bid for PC security software maker McAfee (NYSE: MFE ). We also saw mining behemoth BHP Billiton (BHP ) make an unsolicited (and unwelcome) offer for agricultural chemical firm Potash Corp. of Saskatchewan (NYSE: POT ). Today we received news of even more M&A action, as PC maker Hewlett-Packard (NYSE: HPQ ) made a $1.6 billion bid for data-storage firm 3PAR (NYSE: PAR ), a +30% premium over last week’s offer from Dell (NASDAQ: DELL )

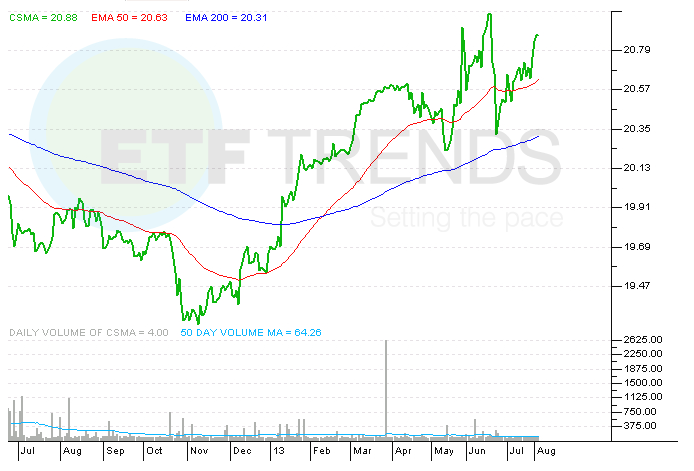

It should come as no surprise that we are finally starting to see a flurry of high-profile, high-dollar deals. After all, corporations have been hoarding trillions in cash since the beginning of the recession, and now they’re finally starting to see opportunities to put that cash to work. Yet short of knowing someone on the inside of a specific company’s board of directors, how can individual investors get in on what’s likely to be a summer surge in M&A activity? The easiest way is via MNA, or The IQ Merger Arbitrage ETF (MNA).

This exchange-traded fund is sort of a retail version of a hedge fund that gives investors exposure to the price disparities generated when companies engage in M&A activity. According to issuer IndexIQ, MNA is designed to give investors exposure to global corporate merger and acquisition activity. But how, exactly, does it achieve this?

The company says MNA’s capital appreciation comes from investing in companies “for which there has been a public announcement of a takeover by an acquirer, a strategy generally known as ‘merger arbitrage.’ This strategy generally seeks to take advantage of the price differential, where it exists, between the current trading price of a stock and the price of that stock at the time the deal is completed.”

In other words, MNA’s management will buy into stocks below the target price of a prospective M&A deal. If the deal closes at or above the target price, MNA will realize the gains, and investors in the fund also will realize the gains.

So, what do you get when you buy MNA? As of Aug. 20, the fund’s top holdings include cash (18.9%) in order to buy into new prospective deals; oil and gas exploration firm Smith International (NYSE: SII ), (10.43%), a company bought out by industry leader Schlumberger (NYSE: SLB ) in February; telecom firm Qwest Communications (NYSE: Q), (8.26%), which will be acquired in 2011 by CenturyLink (NYSE: CTL ), and human resources firm Hewitt Associates Inc. (NYSE: HEW ), (7.20%), which will be acquired by consulting giant Aon Corp. (NYSE: AON ).

Until the issuance of MNA in November 2009, this merger arbitrage strategy wasn’t available to ETF investors. Now, however, with M&A activity on the march, this could just be the right time to bet on MNA.

As of this writing, Jim Woods did not own a position in any of the stocks named here.

5 Small Cap Stocks to Buy Now. Small, innovative companies are watching their earnings explode and they are the next ten-baggers. Investing pro Louis Navellier reveals his secrets to identifying these small cap innovators, plus five of his favorite small cap stocks download your FREE profit guide here.