ETF Expert Best ETFs To Diversify Your Portfolio

Post on: 5 Апрель, 2015 No Comment

ETF Expert: Best ETFs To Diversify Your Portfolio

Herbert Mayo is a professor of finance and international business at the College of New Jersey. You probably havent seen him on CNBC.

Nevertheless, Mr. Mayo and several of his students embarked on an ambitious project. As reported by the good folks at Index Universe. Mayos team set out to uncover ETFs that show minimal correlations to one another.

Indeed, I have addressed the criticality of non-correlating assets to diversification time and time again. Here is a small sample of features on diversification that I have written in the past:

1. At the very start of the bear market, on 10/8/2007, I wrote, Foreign Fixed Income: True Diversification Has Finally Arrived . The SPDR Lehman International Treasury Bond ETF (BWX) has earned nearly 8% since the bears inception.

2. I also spoke about the importance of commodities to a truly diversified portfolio earlier in 2007 with, Total Commodity ETN: Low Correlation, High Sleep Factor . The iShares Dow Jones-AIG Commodity Index ETN (DJP) provided plenty of sleepless nights due to the commodity bust; nevertheless, commodities travel an independent path from stock assets, making them worthy considerations for a genuinely diversified pie.

3. What about currencies? They too can provide the non-correlating element that helps diversify your holdings. In 3 ETFs That Will Keep Your Ship Afloat , Here I addressed the potential for the CurrencyShares Swiss Franc Trust (FXF).

There are several major problems with Mr. Mayos endeavor, which he freely admits. One, many of the ETFs havent been around more than a year or two. Whats more, many of those ETFs have only been studied during the period of bear market decline. It follows that the results can hardly produce statistically relevant interpretations.

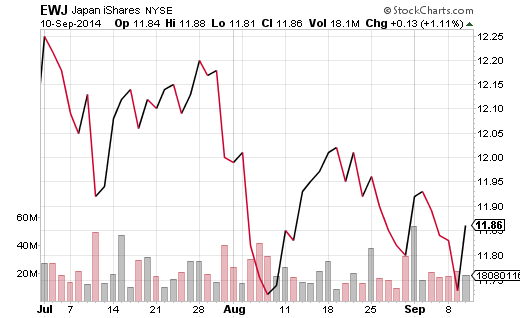

Noting the limitations, however, I think the results are still worthy of common sense validity. For example, most developed market indexes move in the near identical direction to one another; this includes the large-cap S&P 500 SPDR Trust (SPY), the iShares S&P Small Cap 600 (ITJ), the iShares Global 100 (IOO) and Japans MSCI Kokusai Index (TOK).

In contrast, natural resources stocks in the iShares Natural Resources Fund (IGE), energy partnerships in the Alerian MLP ETN (BSR) and emerging market stocks in the iShares MSCI Emerging Market Index Fund (EEM) had much smaller relationships (i.e. correlations) to the developed stock funds mentioned above.

Similarly, currency ETFs and precious metal ETFs had the smallest relationships to broad market develop stock funds. You might say, currency ETF and precious metal ETFs had virtually no relationship with stock assets and that goes to the heart of a diversified mix of investments.

More specifically, the Japanese Yen Trust (FXY) had an inverse relationship with the Dow Jones Total US Index Fund (IYY). Meanwhile, the Powershares Precious Metals Fund (DBP) had no correlation with the iShares S&P Global 100 (IOO).

The results have somewhat obvious implications; that is, if you wish to reduce risk through diversification, you need a mix of low-correlating assets. In addition to developed market funds like the SPDR S&P 500 Trust (SPY), one might include currency ETFs like the Yen Trust (FXY) and the Swiss Franc Trust (FXF). One might also include emerging market funds like the iShares Emerging Market Fund (EEM). One might even consider gold/silver via the Powershares Precious Metals Fund (DBP).

Keep in mind, diversification is only one way to reduce risk while optimizing overall return. After all, there are times when all assets decline in unison, as they did in late 2008. You need to know how to use stop-loss orders to raise cash in times of extreme bearish pressure across the board.

If youd like to learn more about ETF investing then tune into In the Money With Gary Gordon. You can listen to the show live or via podcast or on your iPod .

Disclosure Statement: ETF Expert  is a web log (blog) that makes the world of ETFs easier to understand. Pacific Park Financial, Inc.. a Registered Investment Adviser with the SEC, may hold positions in the ETFs, mutual funds and/or index funds mentioned above. Investors who are interested in money management services may visit the Pacific Park Financial, Inc. web site.

Share this post: