Escrow and Closing in Buying or Selling a Home

Post on: 10 Сентябрь, 2015 No Comment

Talk to a Local Residential Real Estate — Buy / Sell Attorney

Now that you’ve agreed to buy the house you’ve been looking for, or maybe you’ve just accepted a buyer’s offer for your home, there’s still some work to do. Mainly, it’s a lot of paperwork on the details of the deal, like transferring the deed to the buyer and paying the seller.

It’s a critical time in the deal, and it can be complicated. But, typically, you’re not alone at this time. A realtor and escrow agent are probably involved, and they’ll take care of a lot of these details. But, if you’re trying to handle the deal by yourself, you need to be certain that nothing is overlooked.

Escrow

Usually, the contract for sale includes a provision for escrow, which is simply when something is given to a third party (an escrow agent or escrow company) to hold until a certain event takes place, and then the thing is delivered to another party. Escrow instructions tell the agent how to hold and care for the items given to him or her. In a real estate transaction, the instructions are written by the buyer, seller, or lender- the bank financing the deal.

When buying and selling a home, an escrow agent usually does some or all of the following:

- Hold the buyer’sdown payment until the closing

- Hold the money that the bank has loaned the buyer

- Obtain and hold a deed from the seller transferring the property to the buyer, and arranges for the deed to be recorded in the appropriate county office or agency at closing

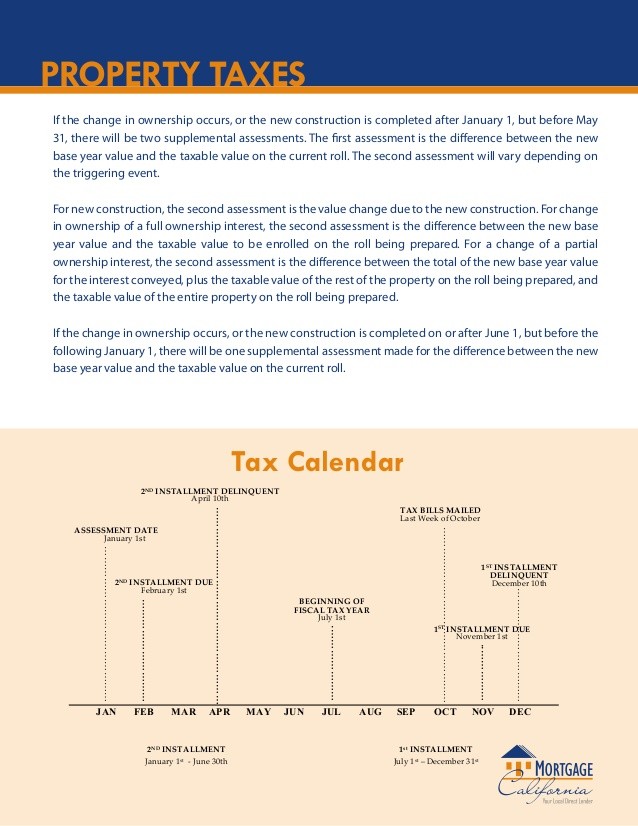

- Figures the amounts owed by both the buyer and seller (at the time of the sale closing) for things like property taxes

So, for example, in a simple sales/purchase transaction, an escrow agent might be instructed: to pay the seller the buyer’s down payment, together with the money deposited with the agent by the buyer’s bank, once the seller has delivered clear title to the home, that is, a title search shows that no one else claims to own the home and there are no liens against it, such as a lien for unpaid property taxes.

An escrow agent is not an attorney. and so he or she can’t tell you how the deal is progressing or advise you as to whether your transaction is being handled correctly. So, it’s critical that you understand the ins-and-outs of a real estate deal, or get some help from an experienced real estate law attorney.

Once the escrow agent performs the duties he or she was instructed to do, escrow is considered closed.

Closing

Closing the sale/purchase is closely related and connected to closing the escrow: it’s when the deal is completed and both parties get what they bargained for, money for the seller and a home for the buyer.

Most likely, the sales contract contains a closing date, which is when the final papers are signed and money changes hand. It’s the date the buyer becomes the owner of the home. For the closing to proceed, all issues regarding matters such as financing and insurance will need to have been resolved.

The closing date, however, does not necessarily mean that you can move in or the seller has to leave on that date. The sales contract should state when the buyer is to take possession of the property. Typically, the buyer takes possession at closing, but the parties can also negotiate for situations such as the seller remaining in the home for a period of time, pending the closing of a home purchase or the completion of construction of a new home. Protections for the buyer may be reflected in an escrow arrangement, such as money held in escrow to be paid to the buyer if the seller remains in the home longer than agreed.

Usually, payment of the purchase price must be in cash or a cashier’s check, unless the contract provides otherwise. In almost all circumstances, an escrow agent will deliver funds by certified check.

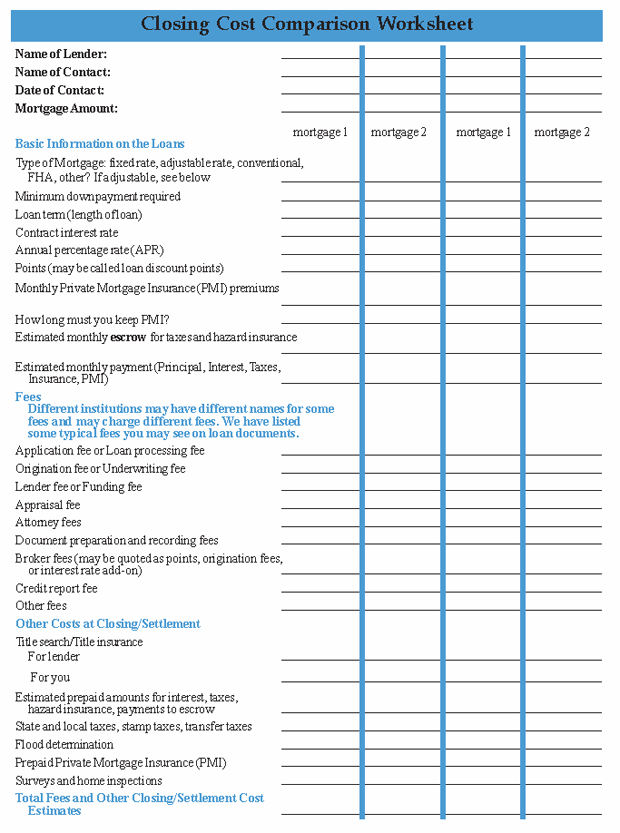

In addition, if you, the buyer, has taken a mortgage to finance the purchase, you must be given certain disclosure statements as required by the Real Estate Settlement Procedures Act (RESPA). which is a federal law designed to provide advance disclosure of closing or settlement costs and reduce the amounts buyers are required to deposit in escrow accounts for payment of taxes and insurance, which are usually required by the bank giving you a mortgage. At closing, you should get:

- A statement that shows the actual closing costs of the loan transaction, and;

- A statement that itemizes the estimated taxes, insurance premiums and other charges anticipated to be paid from the escrow account during the first 12 months of the mortgage

Questions for Your Attorney

- How much will it cost for you to represent me at closing?

- A seller won’t sell me his house unless I agree to use an escrow company for the closing and pay for it. How are such arrangements customarily handled in my area?

- What should I do if I don’t get the proper disclosure statements at closing?

- How long will a closing take?

- If I can’t make the closing date, can the seller cancel the deal?