Equity Valuation Class Riskfree Rate and Risk Premiums Fat Pitch Financials

Post on: 28 Май, 2015 No Comment

We are now on session three of Equity Instruments. This session continues the discussion of the discounted cash flows valuation model.

Professor Damodaran explains that cash flows to equity are cash flows after debt payments and that cash flows to firm are cash flows before debt payments. When valuing a company using cash flows to firm, one needs to use the cost of capital when discounting the cash flows and then you need to subtract out debt.

The most important part of this discussion is Damodarans recommendation to pick an approach and stick with it. Dont mix and match. I must admit that in the past Ive gotten confused and probably mixed and match components of valuing stocks by discounting cash flows to equity and valuing stocks by discounting cash flows to firm. The professor point out three main mistakes that you need to watch out for, which include:

- Discounting cash flows to equity at the cost of capital to get equity value

- Discounting cash flows to firm at cost of equity to get firm value

- Discounting cash flows to firm at cost of equity, forget to subtract out debt, and get too high a value for equity

Make sure that you dont make any of these mistakes the next time you try to value a stock. When you see net income being used to value a company, you can tell that what is being discounted is the cash flows to equity and that the cost of equity should be used for the discounting. These distinctions are important because the cost of debt is cheaper than equity.

Professor Damodaran breaks down discounted cash flows (DCF) valuation into 5 steps on slide 11 of the course presentation. This a very important slide that I recommend you review it. DCF boils down to:

- Getting the current cash flows.

- Getting the growth rate for those cash flows in the near term.

- Determining when the company will enter stable growth

- Choose a discount rate to apply to the cash flows

The dividend discount model is the most basic DCF model. This model strictly looks at the flows of cash flows to equity in terms of dividends paid to shareholders. This method was detailed in 1938 by John Burr Williams in his classic book, The Theory of Investment Value .

There are several problems with this dividend discount technique. It is not a problem if a company is not able to pay a dividend right now, but if the company will be unable to pay a dividend in the future this method breaks down. Companies that payout dividends that are different than what they can afford to payout are a real problem under this method.

The dividend discount model often will result in too low a value since cash flows left over after paying dividends are considered burned up. One way around this drawback is to focus on what a company could have paid out in dividends. You just replace actual dividends with potential dividends. This then basically becomes the cash flows to equity model.

The other DCF approach looks at cash flow to the firms. This is predebt cash flows. All you value is operating income. Then you add back other assets like cash and subtract out the debt. This is basically the method I often use when I value stocks by discounting future free cash flows (operating cash flows minus capital expenditures).

After briefly reviewing the main valuation models, the course shifts gear into looking at DCF inputs. The rest of this session focuses on the discount rate. Professor Damodaran admits that discount rates are not as critical as getting the cash flows right and the growth rates of those cash flows. I tend to give very little attention to discount rates when I value a company. However, I am curious as to how the professionals determine discount rates.

The professor makes a few points about cash flows. First you pick the currency that will be used for both cash flows and for determining the discount rate. Also, if you do your cash flows in nominal terms, then your discount rate needs to be in nominal terms. Nominal simply means that the rates havent been adjusted for inflation. For the most part, you will likely use nominal rates because they are the easiest to get directly.

Damodaran thinks its irrelevant to think in terms of how much risk we individually see in a company when valuing it. I dont agree with that point. If institutional investors do not see much risk in a particular company, but my own research of a company results in me seeing lots of risk and Im right about that risk, then my individual view on risk is indeed important.

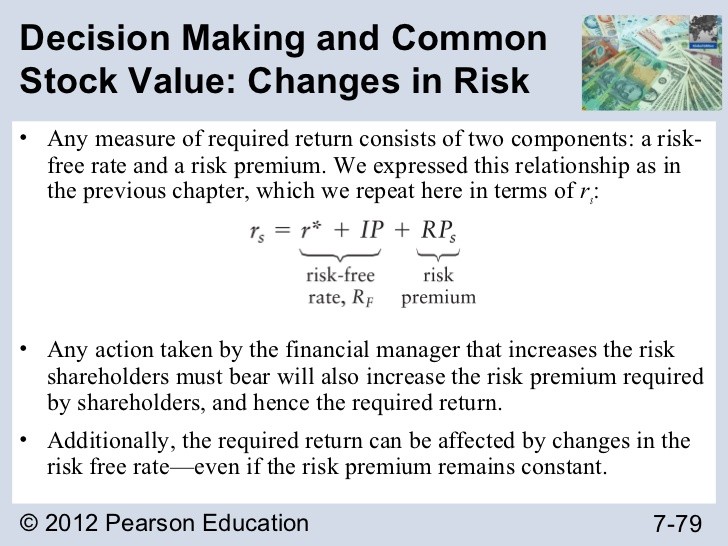

Professor Damodaran also briefly discussed the major ways the costs of equity is determined. The models include CAPM, Arbitrage Pricing Model (APM), multi factor, and the proxy model. The CAPM method is made up of three factors:

- Beta Risk in the stock that cannot be diversified away

- Risk free rate The average rate on risk free securities

- Risk premium

I personally do not think it is worth spending too much effort on determining the cost of equity for discounting future cash flows. Id rather assume a constant discount rate for all equities and then adjust my margin of safety to address company specific risk. Max left a comment in the previous lesson that also questions estimating cost of capital using betas and country risk premiums.

I did find the discussion of the risk free rate to be of interest. The risk free rate should have no default risk. This excludes corporate bonds, so we are really looking at government bonds. However, not all government bonds are risk free.

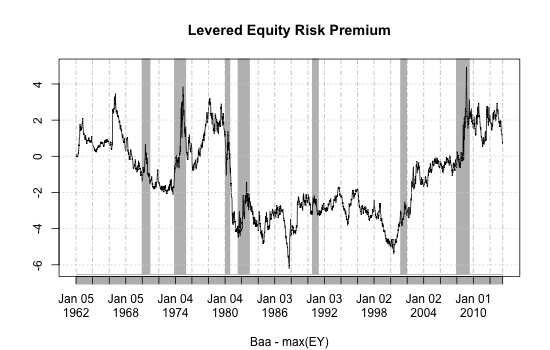

In addition, the risk free rate should have no reinvestment risk associated. This reinvestment risk comes from the potential that when for example a six month T-bill needs to be reinvested, there is the real risk that interest rates on T-bills could drop. Professor Damodaran recommends that we should match up cash flow lengths to the length of bonds used to determine the risk free rate. I tend to use the 10 year U.S. Treasury Note for my risk free rate. Basically for equity valuation, the risk free rate should be derived from long term securities that are default free and match the currency of cash flows. The U.S. geometric average risk free rate from 1994-2004 is 4.51%. Professor Damodaran mentions that using the U.S. rate for risk premium could be biased since the U.S. equity market was the most successful in the twentieth century. A lower risk premium of 4% over a range of countries may be more appropriate (see slide 28).

The final part of this class looked at estimating the risk free rate using various techniques for other countries, especially emerging markets. Im not sure why using the average global rate would not be more appropriate since using a country specific rate for an emerging country might be downwardly biased.

Please share your comments and questions on this class session in the comments section below.