Equity Valuation Class Cost of Capital Fat Pitch Financials

Post on: 7 Май, 2015 No Comment

Last weeks equity valuation class session ended on bottom up betas. This weeks lecture is session 5 and it covers the following topics:

- Bottom up betas

- Cost of debt

- Weights for cost of capital

- Dealing with hybrids

Before I get started, I wanted to mention that Professor Aswath Damodaran left a comment on a previous post. He has offered to respond to our questions if we get stuck on a topic. Ill gather up any questions we cant resolve on our own and email them to the good professor.

Session 5 picks up on slide 55 of the Discounted Cashflow Valuation slide presentation. The discussion starts with how ideally betas should be for the business that a firm is in and then adjusted for operating leverage. To adjust for operating leverage, you need to know the breakdown of fixed and variable costs. However, it is not always easy to get information on fixed and variable costs. Therefore, the conventional approach is to adjusting betas for financial leverage using the debt to equity ratio, because it is much more straight forward. One think to keep in mind is that debt can have some market risk and impact beta.

Bottom-Up Betas

Slide 58 provides a schematic overview of how a bottom-up beta is calculated. The following steps are taken when calculating bottom-up betas:

- Adjust for the business lines that the company as in.

- Get unlevered beta for those businesses.

- Estimate the proportion of value the firm derives from each of the businesses.

- Develop weighted average for the betas.

- Adjust for debt to equity ratio to get the levered beta for the firm.

The professor mentions that you probably should adjust for cash. You can assume the beta of cash is zero. Damodaran believes we should strive to use alternatives to regression betas. I cant say I disagree.

Here are some of the benefits to using bottom-up betas:

- Standard error is lower for bottom-up beta.

- Can be adjusted to business mix and financial leverage.

- You can do it even without historical stock prices.

Professor Damodaran applied the bottom-up beta to SAP (SAP) as an example. If you are interested in doing your own bottom-up betas, I recommend you study this portion of the lecture. I found it interesting that since SAPs software and consulting businesses have different margins, the weighting for the betas from each of these business lines should not be based solely on the proportion of revenues generated from each of the businesses.

On Damodarans website there is a table of unlevered betas by industry . If you navigate to his main financial data webpage, you can also find unlevered betas by industry for various countries.

If you have a fairly unique company you are struggling to develop a bottom-up beta, try expanding your universe for comparables or even go up or down the supply chain. When searching for comparables you should ask whether the company you are looking at goes down when the comparable goes down. Look at the correlation between revenues over time.

Cost of Debt

Cost of Debt = rate at which you can borrow money today for the long term.

Professor Damodaran discusses a little debate his students are having between using the 30 year bond and 10 year bond for the risk free rate. The difference is inconsequential. What you really want is to match the historical period selected to the equity risk premium for that time period. The 30 year bond usually has a higher interest rate but the equity risk premium should be lower. The equity risk premium is around 4.81 instead for 30 years.

You can be a risky company that can issue a safe bond by backing it with you best assets. This is something you should watch out for according to Professor Damodaran. Instead you should look at the companys debt rating for cost of debt. I usually get this from Moodys or S&P. If a companys debt is not rated, you can create a synthetic ratio using the following formula:

Interest Coverage Ratio = EBIT/Interest Expense

Then you can convert that ratio into a rating by looking up companies with ratings and looking at their interest coverage ratio. BondsOnline provides a snapshot of default spreads in any one point in time for a fee. The default spread changes over time, so you might need to look this up about once a year. Primarily, you want to adjust for country default spread. Being in an emerging market pushes up your cost of debt.

The next topic gets into adjusting for subsidies, primarily subsidized interest rates. Should cost of subsidized debt be used when subsidies are? It is safer to consider subsidies separately. You could instead value the subsidy separately. You need to consider what the cost of getting the subsidy is, such as higher operating costs for locating in areas with less skilled labor pools. You also need to consider how long the subsidy will potentially last.

Weights for Cost of Capital

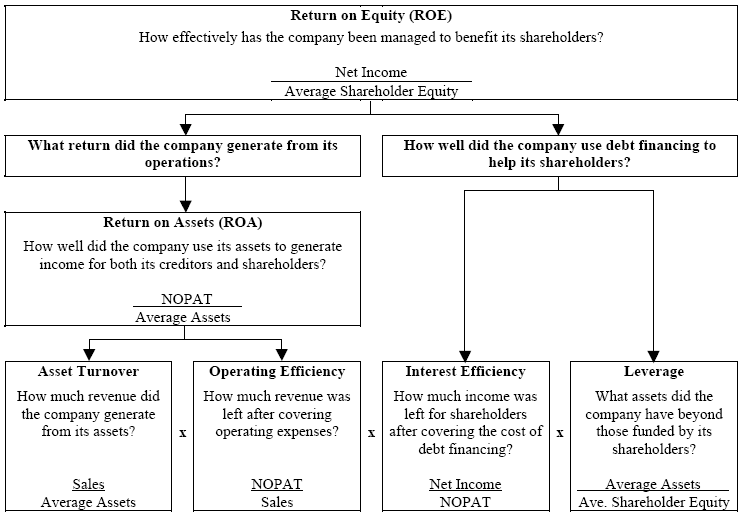

According to Damodaran, weights should always be based on market value. Why do we use market value weights to get the cost of capital?

- To be consistent with what you have to pay at the prevailing market prices.

- It is a hypothetical acquisition valuation.

- That is what you have to pay today to buy the company.

One thing to keep in mind, the market value of equity cannot fall below zero. There is a short cut for making currency adjustment on slide 72. You just take the difference between T-bills and TIPS rates to get the expected rate of inflation. Then you need the ratio of the inflation rate in the foreign currency to the inflation rate in dollars.

Dealing with Hybrids

Hybrids include convertible bonds and similarly preferred stock. Damodaran recommends trying to stay with the costs of debt and equity. You just break about the equity like portion from the debt like portion of the convertible bond.

In summary:

Cost of Capital = Cost of Equity (Equity/(Debt + Equity)) + Cost of Borrowing (1-t) (Debt/(Debt + Equity))

The next class will finally get into looking at cash flows from:

- Dividends

- Free Cash flows to equity

- Free cash flows to the firm

Be careful not to fall into accounting definitions of these numbers:

- Operating income = revenue true operating expenses

- Capital expenses = investment in long term assets

- Working capital = investment in short term assets

I hope I havent lost all of you with all this talk about CAPM and betas. Im looking forward to the next few lectures a lot more than I have to the past two. We will be moving into the more useful and practical topics regarding cash flows.