Equity markets Still not cheap

Post on: 14 Май, 2015 No Comment

Still not cheap

Add this article to your reading list by clicking this button

IS THE American stockmarket cheap or expensive? The smart retort is compared with what? With cash yielding zero and some bond yields negative, equities may look much more promising than the alternatives. But given that equities can fall a lot when things turn rough, it seems reasonable to ask whether they are cheap or dear relative to their history.

The latest Credit Suisse Global Returns Investment Yearbook uses one approach; the discount rate. This measure is reverse-engineered from the markets. Theory suggests that an equity’s value should be equal to the sum of the future cashflows, discounted by the appropriate rate (ie, the discounted cashflow or DCF approach). The tricky bit is deciding on the right discount rate. But Credit Suisse simply takes forecasts of future cashflows, compares them with the current share price, and works out the implied discount rate. A high discount rate implies investor caution; a low rate implies optimism.

The table shows the range of discount rates for US industrial and service companies (so financials are excluded) going back to 1976.

Highest (90th percentile) 7.6

75th percentile 6.8

Median 5.6

25th percentile 4.6

Current rate 4.2

Lowest (10th percentile) 4.0

As you can see, the market is currently priced right at the expensive end, even of recent history. This does not mean that it is bound to crash right away. On average, the discount rate moves only 10 basis points (0.1%) in a year; moves of a percentage point or more (up or down) occurred only 20% of the time.

Still, such a valuation should give investors pause; the odds are that returns will be lower than average when the return is above average. Speaking at the Buttonwood gathering this week, Kyle Bass, the hedge fund manager. was expecting a return of around zero from US equities this year.

In addition, this measure confirms the signal sent by Robert Shiller’s cyclically-adjusted price-earnings ratio. which averages profits over 10 years to smooth out the cycle. The CAPE is currently at 26.5, not as high as it was in 2000 but well above the historic average. The same goes for the Q ratio, a measure of share prices relative to the replacement cost of net assets, championed by Andrew Smithers; the two ratios track each other closely as can be seen here .

There are many critics of CAPE who argue, for example, that accounting practices have changed so much that comparison with past profit measures are meaningless or that it fails to take account of the prevailing level of interest rates. It is true that neither CAPE nor the Q ratio are much use as short-term market indicators although Andrew Smithers has shown they are much better guides to the long-term than the historic or prospective p/e ratio that most strategists quote. And both ratios have the benefit of using all historic data rather than the shorter periods relied upon by most strategists who like to use prospective profit forecasts (data on such forecasts was not collected until the last 30 years or so).

At its heart, this debate revolves around the implications of low interest rates. Bulls use low rates to reduce the discount rate they apply to future earnings, thus increasing the present value of equities. But why are rates so low? It is because central banks are worried about growth. If they are right to be worried, then profits will not grow as quickly as before; bulls essentially lowered the discount rate but kept their cashflow forecasts unchanged.

Now perhaps investors think central banks are wrong in their growth fears, although this would be odd given the exaggerated faith they seem to have in the ability of Janet, Mario et al to manage the cycle. It would also be odd given that growth has been trending lower over time (see graph in earlier post ).

Or perhaps investors are going on recent experience, which has seen profits be very strong in relation to GDP (see graph from St Louis Fed ). This seems to be down to a combination of strong overseas profits and subdued wages. But the dollar is now strong and wages are picking up. And profit forecasts are being slashed. Below is a table, courtesy of Albert Edwards of SocGen, showing how estimates of Q1 2015 profits have dropped since April 2014.

Sector Apr 2014 est Jan 2015 est Current est

Cons disc 22.0 14.6 10.5

Cons staples 10.5 5.3 2.7

Energy 9.7 -32.2 -61.8

Financials 13.0 13.9 11.5

Health care 13.9 11.1 9.1

Industrials 16.6 11.5 6.7

Materials 23.0 17.0 0.6

Technology 15.0 10.2 6.2

Telecom 8.6 1.2 1.6

Utilities 3.5 -5.9 -5.9

S&P 500 14.0 5.3 -1.4

Note that the problem is not confined to energy; even tech forecasts have been slashed. Of course, forecasts are always revised down as the earnings season approaches, allowing companies to beat the forecasts on the day.

Nevertheless, we have a combination of cyclically-high profits, a downward trend in revisions and above-average valuations. That ought to be cause for concern.

Next

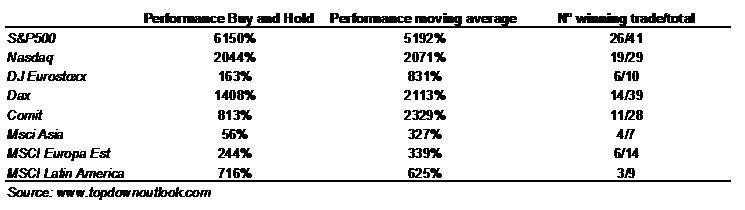

Mutual fund investing: A 25% chance of success