Enterprise Property Company LLC Investment Strategy

Post on: 16 Март, 2015 No Comment

Investment Strategy

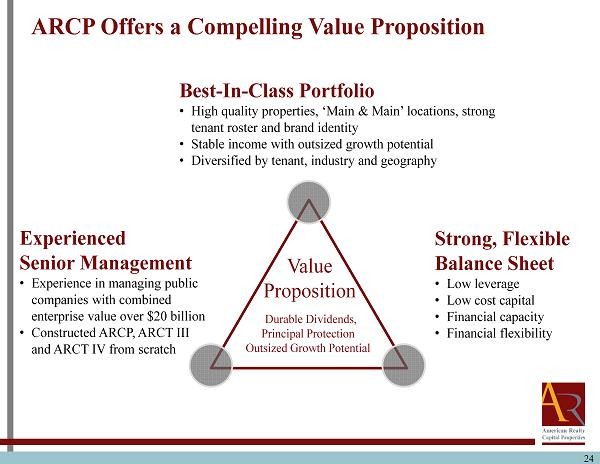

Targeted properties are those that offer an opportunity to add value through refurbishment, financial restructuring, re-leasing and hands-on professional management. Concentration is on properties priced between $1 to $10 million dollars. This is a niche market that is “under the radar” of the institutional buyer and beyond the sophistication of most passive investors. Currently, Enterprise Property, LLC is acquiring multi-tenant industrial and office properties because of their potential for high returns and the greater stability offered by multiple tenant real estate.

Investment Criteria

- The fundamental criteria in all Enterprise Property, LLC acquisitions are:

- Purchase at or below replacement cost

- Appeal to a broad resale market

- Acquisitions between $1 and $10 million dollars

- Positive financial leverage with the rate of return greater than the debt interest rate

- Multi-tenant properties with stable income

- Short term leases that can be adjusted to market rent

- Value-added acquisitions with rehabilitation and development opportunities

- Properties located near major transportation corridors

- Properties with access to significant labor markets

- Return potential maximized within five years

Financing Strategy

The equity requirement from the investors will normally be in the range of 25% to 30% of the purchase price, depending upon the source of the financing. Currently, financing is available from Wall Street conduit lenders on terms more favorable than traditional sources. Often seller financed interim loans are available to finance a project during the refurbishment period.

Our objective is to structure financing that provides “positive leverage”. That is, the return before paying debt service is higher than the interest rate paid for the debt. This has the impact of increasing our return on invested equity as we improve a property and bring the rents to market rates, thus maximizing the economic value of the property.

Profit Structure

Profit sharing is based on the performance of the specific investment. The investor will receive a specified share of the proceeds after the return of his capital investment. The investor will also receive a preferred return on investment. Should there be a refinancing or a property sale, proceeds will go first to the investor to pay any balance due on the investor’s preferred return, then to repay the investor’s capital investment and then toward the investor’s share in the excess over the cumulative preferred return.

Legal Structure

A Limited Liability Company (LLC) will be typically used for each investment. Enterprise Property, LLC or its principals serve as managing members of the LLC. This structure benefits the investor by providing the legal protection of a corporation without any additional corporate tax liability. The cash flow and tax benefits are passed directly through to the investors. Each investor receives a K-1 form for tax reporting purposes each year.

Summary

Enterprise Property, LLC ’s private investment placements provide an investor the opportunity to participate in institutional grade real estate investments that are structured to take maximum advantage of today’s strong real estate market with the cash flow priority of a cumulative preferred return and the hands-on management of seasoned professionals.