Energy Stocks for 2009

Post on: 16 Март, 2015 No Comment

When Bad News is Good News

Comments ( )

By Chris Nelder

Wednesday, January 7th, 2009

When is bad news good news?

When the bad news is that commodity prices have gotten too low to keep producers in business.

As I have written for the last many weeks, oil has descended too far below the production cost to sustain future supply. The same is true for much of the commodity complex. With the global credit markets still tight fisted, the marginal producers of oil, gas, and metalsthat is, the ones who have either new or extremely difficult and expensive projectsare unable to raise the capital needed to continue. This is crushing new supply and lending pricing power to the more established producers with cash on their balance sheets. The problem is particularly acute for miners, who find it impossible to continue operating at a loss.

That means that prices have to bottom as, indeed, it seems they have.

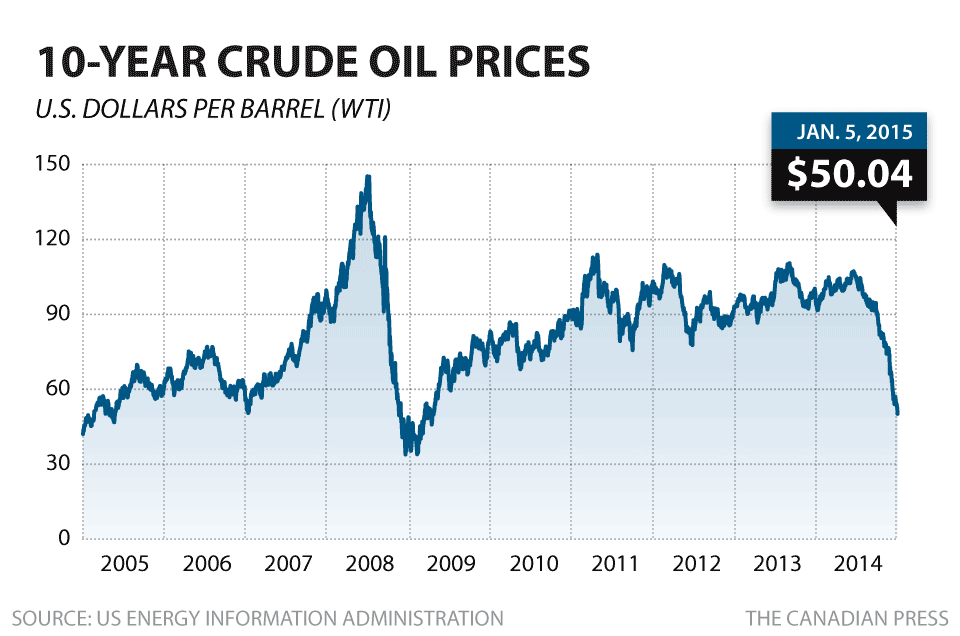

From a low of $35.35 on December 24, crude oil rebounded sharply to cross the $50 mark yesterday, before settling at $49.15 (NYMEX Feb 2009 Light Sweet Crude), a level not seen since December 1.

NYMEX Feb ’09 Light Crude Oil. Source

That’s a 39% gain. This is precisely the signal I have been waiting for, that traders may have recognized an overcorrection and started buying again.

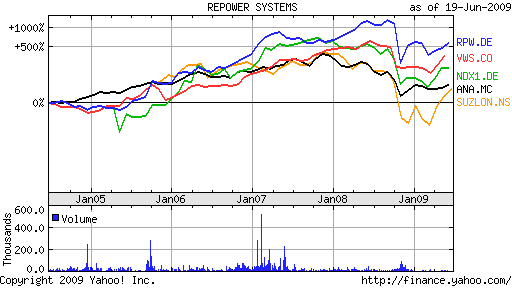

The continued contango of the crude futures curve is certainly giving them some confidence, with contracts pricing oil at over $80 by 2011:

NYMEX Crude Oil futures curve. Source

Traders clearly do not think that oil is going anywhere but up from here. A recent Bloomberg survey of 30 analysts gave a median fourth-quarter estimate of $70 for black gold.

One driver of oil’s rise is that OPEC members are apparently honoring their recently announced production cuts. Combined with geopolitical concerns like Russia’s annual stick-up of Ukraine and Europe, forcing them to pay much higher natural gas prices in the cold of winter, and Iran’s threat to withhold oil shipments to Israel’s allies over the recent conflict in Gaza, there is plenty of tension to drive oil higher.

And that’s not to mention the growing concern over peak oilthe depletion of some of the world’s best and most productive oil fields.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the newsletter below.

Enter your email: