Efficient Market Hypothesis And Market Efficiency Finance Essay

Post on: 6 Май, 2015 No Comment

Market efficiency is a situation wherein present prices reveal all the openly accessible information regarding the security. The essential thought in market efficiency is that competition will direct all information into the price speedily (Cutler, et al, 1989). In the monetary market, the utmost price that depositor is ready to give for a financial asset is really the existing worth of upcoming cash expenses that discounted at a higher rate to balance for the improbability in the cash flow projections. Efficient market appears when new information is rapidly integrated into the price in order to turn the price into information (Malkiel, 1973). Under this status the existing market value in any of the monetary market shall be the top unprejudiced guess of the appeal of any deal (Roll, 1988).

The efficient market hypothesis was primarily introduced by French mathematician Louis Bachelier in 1900 and he stated that the value of a stock reveals the open information accessible on that stock at a specified occasion (Seyhun, 1998).The Efficient Market Hypothesis is a notorious theory that tells that security prices reveal all accessible information, creating it ineffective to select stocks. The rationale following this is that the informed motivated experts that work in the financial markets supposedly create a competent structure for conveying every security with sufficient value, specified by the accessible information (Roll, 1997).

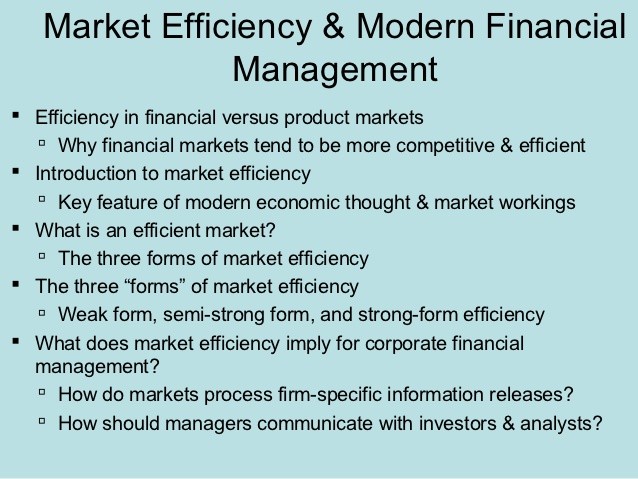

There are of two types of efficient capital market named as: Operationally or Internally Efficient wherein a shareholder can do dealings as economically as likely and Pricing or Externally Efficient in which an shareholder be able to suppose that stock prices always reveal all accessible information that is applicable to the assessment of the stocks (La Porta, et al, 1997).

A capital market is supposed to be efficient if the equilibrium values to perform as if all shareholders understand the information accessible and security prices respond quickly and in an impartial style to the fresh information (Fama, 1970). In the United States, consistent information concerning firms is comparatively economical to get and trading securities is inexpensive. For those causes, U.S. security markets are considered to be comparatively competent (Gosnell, et al, 1996). The traditional statements of the Efficient Markets Hypothesis are to be seen in Roberts (1967) and Fama (1970) (Fama and Kenneth, 1995). Fama recognized three separate stages upon which a market will really be competent. Weak-form efficiency- It requires that Technical analysis will not be possible to build extra earnings. To check for weak-form efficiency it is adequate to employ statistical analysis on time series data of values. The weak form has currently been commonly admitted in the business, wherever only some investment managers still follow technical trading policy (Haugen and Baker, 1996). Semi-strong form efficiency — It states that Fundamental analysis may not be capable to make surplus profits. To check for semi-strong-form efficiency, the alterations to formerly unfamiliar reports might be of a sensible range and must be on the spot (Jensen, 1969). The best part of researches conducted has assisted the Semi-strong type of the EMH. Thus, as there shall be theoretical exceptions to the semi strong form, from a sensible investment perspective, it still holds.

Strong-form efficiency – the prices of the shares discloses all the details and no one shall obtain further earnings. To check for strong form efficiency, a market desires to survive where shareholders cannot constantly receive more profits over an extended phase of time. The Strong structure of the EMH has been as fine as set free (Lo and Craig, 1999). As at an instance when insider trading was far more common it may have held correct, this is surely no longer the case. The obvious hope to efficient markets might arise in investment bubbles and collapses when values attain stages that cannot be clarified by sensible assessment techniques (Seyhun, 1986). The Efficient Market Hypothesis tells that at any specified occasion, security values completely reveal all obtainable information. The offers of the efficient market hypothesis are in actual fact thoughtful (Malkiel, 1977). Arguments amongst Supporters and Opponents of Efficient Market Hypothesis. The Proponents of EMH like Fama and French [1995] sustain that such certainty which arrives from time-varying equilibrium anticipated profits made by normal pricing in a competent market which balances for the stage of risk accepted. The Opponents of EMH like La Porta, Lakonishok, Shliefer, and Vishny [1997] dispute that the certainty of stock returns mirrors the emotional aspects, social activities, noise trading, and approaches of illogical depositors in a speculative market.

The EMH turn into controversial following the discovery of some anomalies in the capital markets and the well-known amongst them are the ‘small firm’ effect, the January effect and the mean reversion. The ‘small firm’ effect- Banz (1981), in a key study of long-standing outcomes on US shares, was the primary to steadily file the known thing anecdotally for a few years –specifically, that shares in companies with little market capitalizations be likely to convey high returns than those of bigger companies (Malkiel, 2005).

The January effect- subsequent from the ‘small firm’ effect, it was also viewed that almost all of the net outperformance by little cap stocks was attained in consecutive Januarys. This was a noticeable tendency that in EMH must have been arbitraged away. Mean reversion- This is the name specified to the tendency of markets, divisions or individual shares subsequent to a phase of constant under-or out-performance to relapse to a continuing average by means of an equivalent phase of out- or under-performance (Patell and Wolfson, 1984). Supporters of the EMH dispute that the only people who attain better profits from lively administration are the managers itself. They state that if top finance managers may not constantly direct to beat the market, then the standard depositor has small expect of pulling off an improved outcome. If the investor can’t beat the market, the alternative left is to join it by investing in an index or exchange traded fund that trails or reflects the performance of the market.

Opponents of the EMH emphasize instances as the market is not forever competent and as brilliant openings can and do present themselves for the wise depositor. They point to finance managers who have constantly beaten the market in extensive time, traders left to the Caribbean with millions exploited from years of flourishing bets, and hedge fund managers who draw in further than a billion dollars in yearly trading income (Damodaran, 2006). Behavioural economists propose that illogical behavior is improbable to attain proficient monetary markets. Supporters of the EMH have reacted to the opinions by behavioural scientists by opposing that as behavioural prejudices do subsist, their survival is brief and their significance least, due to the market forces that will arbitrage away such openings (De Bondtm and Thaler, 1985). Supporters of the Efficient Market Hypothesis happily indicate that through their estimate no depositor in history has forever twisted in a statistically important outperformance of the market averages over an extended time. Other opinions not in favor of are that individual market contestants may have conflicting causes for market incompetence, for instance the slow absorption of market information, the unstable power of a few market competitors among the subsistence of complicated professional depositors.

EMH states that a stock’s price characterize an total of the chances of all upcoming results for the company, based on the finest information accessible at the occasion, will that information turns out to have been exact is not something necessary by EMH. The implications of the competent market hypothesis are really reflective, persons that purchase and put up for sale securities, perform so in the supposition that the securities they are buying are valued above the price that they are paying, as securities that they are selling are valued below the selling price (Nasir and Mohamad, 1993).

For an efficient market, there should have the following particulars:

Every information is accessible to the entire members and every one of members is monetarily balanced, for instance they favor more cash to less cash, other things being equivalent. Every member can and do immediately assess all accessible significant information and decide the present fair price of each security. Latest information makes costs to instantly “gap” to the new fair price, restricting everyone from gaining a surplus market return by trading at intermediary price throughout the conversion (Keller and Warrack, 2000).

Conclusion

Certainly, the studies focused on EMH have created a precious contribution to our knowledge about the securities market. Yet, there appears to be raising disapproval with the hypothesis. A restricted investigation of the current literature explains that disapproval of EMH has been increased in current years. As it is correct that the market reacts to latest information, it is currently clear that information is not the only variable influencing security assessment. Current years have seen researchers who have offered idea provoking, theoretical arguments and supporting observed proof to illustrate that security prices might diverge from their equilibrium prices owing to emotional factors, fashions, and noise trading.