Effects of Stock Dividends Help for Stock Dividends

Post on: 2 Май, 2015 No Comment

To extract some good amount of profit from the share market it is very important to understand the different characteristics of shares. The term stock in terms of share market can be said to be the aggregate or a number of shares taken together and dividends can be simply said to be the profit or the excess amount the one gets in return as a result of investing in a particular category of shares. Therefore stock dividends can be expressed as the accumulated or the total dividends earned due to investment in shares. Get latest updates on the related subject in Accounting homework help and assignment help at transtutors.com .

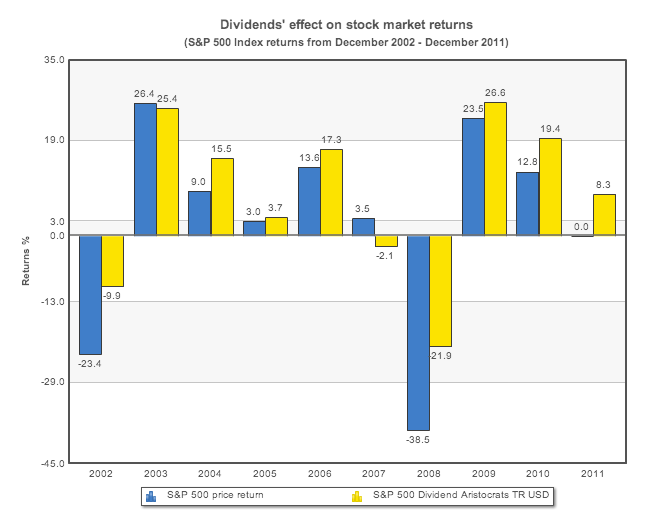

Effects of stock dividends are very acutely dependent on the choice of type of shares. To obtain a fair value form the different stock options it is very crucial to know about the variables such as the prices of underlining stock, volatility . time, the different interest rates and the amount of dividend that can be pulled out from the investment. Effects of stock dividends are greatly dependent on the price of stock, time and its volatility. Therefore these three factors attract the greatest amount of attention. But one should not forget the other factors such as dividends and the rates of interest, as these also are equally important. It is also important to understand the effects of stock dividends created by dividends and interest rates.

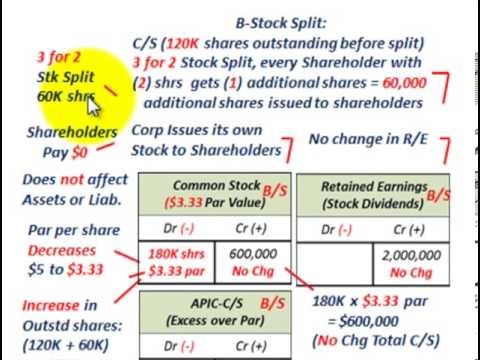

One should also know that the outstanding shares are enhanced by the stock dividends which in turn are visible as effects of stock dividends. This feature also reduces the equity per share . The effects of stock dividends can also be some in some other aspects. The cash dividends hugely effect the price options as a result of their effect on the underlying stock price. This happens because the different stock prices are expected to drop by the amount of the dividends on the respected date. All such methods are covered inAccounting homework help and assignment help at transtutors.com .

The effects of stock dividends are also dependent on the very important dividend decision. The dividend decision is a decision taken by the directors of the company. This in turn is related to the amount and equally important timing of the cash payments made to the respected stockholders of a company. This decision happens to be important for the company as it highly influences the stock capital and stock price. It also influences and determines the amount of tax that a stockholder of a particular company must pay.

The dividend paid should be considered while calculating the price of options and predicting the probable loss or gain during determining the position. Another factor that influences the variable effects of stock dividends is the change in the manner of taxation or a change in the tax slab. Factors such as inflation and recession also hit hard on your dividends. But if one can properly understand the conditions of the share market one can also extract profits out of his or her investment.

In a nut shell the effects of stock dividends greatly change according to the prevailing conditions of the stock or share market one must also invest wisely keeping in mind the effects of stock dividend which can be both gainful and harmful as told earlier above.

Our team assists you with the email-based homework help assistance, which offers the brilliant insights and simulations to help the make subject practical and pertinent for any assignment help.

Transtutors.com provides timely homework help at reasonable charges with detailed answers to your Accounting questions so that you get to understand your assignments or homework better apart from having the answers. Our tutors are remarkably qualified and have years of experience providing Effects of stock dividends homework help or assignment help.

Related Questions

Copper Inc. accounts for its investment in Ridge Corporation using the fair value method. Copper bought 3,000 shares (5%) of Ridges outstanding common stock for $28 per share on January 1, 2014. Ridge earned $3 per share.

Tags : Accounting, Cost Management, Process Costing, College ask similar question

Cool Sky Company reports the following costing data on its product for its first year of operations. During this first year, the company produced 40,000 units and sold 32,000 units at a price of $120 per unit. .

Tags : Accounting, Cost Management, Process Costing, College ask similar question

Cook Company estimates that 397,900 direct labor hours will be worked during the coming year, 2014, in the Packaging Department. On this basis, the budgeted manufacturing overhead cost data, are computed for the year.

Tags : Accounting, Cost Management, Process Costing, College ask similar question

Cook Company estimates that 373,000 direct labor hours will be worked during the coming year, 2014, in the Packaging Department. On this basis, the budgeted manufacturing overhead cost data, are computed for the year.

Tags : Accounting, Cost Management, Process Costing, College ask similar question

Conversion — personal use to business use Alice starts a taxi service and decide to use her peronal car as the first taxi in her new business. the car will be used solely for business purposes. the car had an orginal cost of.

Tags : Accounting, Cost Management, Process Costing, College ask similar question

The controller for Traditional Manufacturing Inc. performed a trend analysis of the unit manufacturing costs of product T-2 for the month of March. Two patterns emerged; there was a gradual upward trend in the unit costs over.

Tags : Accounting, Cost Management, Process Costing, College ask similar question

The controller of Ferrence Company estimates the amount of materials handling overhead cost that should be allocated to the companys two products using the data that are given below: Wall Mirrors Specialty Windows.

Tags : Accounting, Cost Management, Process Costing, College ask similar question

Control Alt Design acquired 30% of the outstanding common stock of Walter Company on January 1, 2012, by paying $800,000 for the 45,000 shares. Walter declared and paid $0.30 per share cash dividends on March 15, June 15.

Tags : Accounting, Cost Management, Process Costing, College ask similar question

Contribution Margin, Unit Amounts, Break-Even Units Information on four independent companies follows. Calculate the correct amount for each answer blank. Round your answers for per unit amounts to the nearest cent. When.

Tags : Accounting, Cost Management, Process Costing, College ask similar question

Contribution Margin Ratio, Variable Cost Ratio, Break-Even Sales Revenue The controller of Pelley Company prepared the following projected income statement: Required: 1. Calculate the contribution margin ratio. % 2. C

Tags : Accounting, Cost Management, Process Costing, College ask similar question