Economists agree Stimulus created nearly 3 million jobs

Post on: 16 Март, 2015 No Comment

Quick Degree Finder

By David J. Lynch, USA TODAY

Amid mounting signs that the economic recovery is faltering, one potential remedy seems out of the question: a booster shot of government spending.

The White House says the multiyear $814 billion stimulus program passed by Congress in 2009 boosted employment by 2.5 million to 3.6 million jobs and raised the nation’s annual economic output by almost $400 billion. A recent study by two prominent economists generally agrees, crediting the pump-priming with averting what could have been called Great Depression 2.0.

We have played our policy hand. Now we’ve got to hope it’s good enough, said Mark Zandi, chief economist for Moody’s Analytics and co-author of the recent study.

Controversy has dogged the stimulus program since its debut. Formally known as the American Recovery and Reinvestment Plan, the spending effort was designed to fill the hole in the economy left after the housing and credit bubbles imploded. The program was proposed by the president and enacted by Congress at the depths of the post-Lehman-Bros. financial collapse, when the economy was shrinking at an annual rate of 6% and losing 750,000 jobs a month.

Politically, the Recovery Act which is divided among tax cuts, financial aid for cash-strapped state governments, emergency unemployment assistance and spending on roads, bridges and other infrastructure has taken fire from the left and the right.

Liberal economists such as New York Times columnist Paul Krugman complained that the massive program should have been larger and was marred by the inclusion of excessive tax cuts that would have a less-immediate impact on job creation. Republicans derided the legislation as wasteful spending that would add to ballooning government debt.

Eighteen months later, the consensus among economists is that the stimulus worked in staving off a rerun of the 1930s. But the spending’s impact was dwarfed by other crisis-fighting tools deployed by the Bush and Obama administrations, including costly efforts to stabilize crippled banks and the Fed’s unconventional monetary policy.

I think it was important for confidence. But fiscal stimulus was the least important of the three planks of the government’s strategy, said Harvard University ‘s Kenneth Rogoff. former chief economist of the International Monetary Fund .

Counting jobs

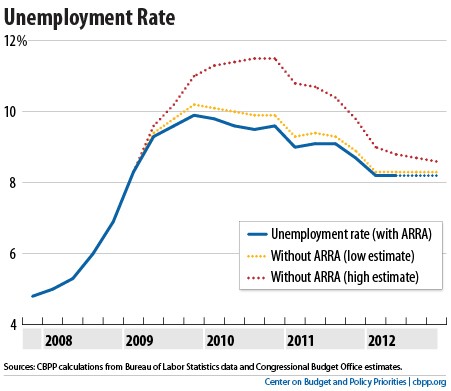

Christina Romer, the outgoing head of the president’s Council of Economic Advisers. never really recovered politically from her January 2009 forecast that the stimulus would keep the unemployment rate below 8%. In fact, by the time Obama signed the Recovery Act into law on Feb. 17, 2009, it already had breached that level. (The original administration forecast was prepared using data from late 2008 before the already-wounded economy deteriorated even more dramatically.) The unemployment rate hit 10.1% in October 2009 and stands at 9.5% today.

Republican leaders such as Rep. Eric Cantor of Virginia say that proves the stimulus a failure. But Romer last month told the Joint Economic Committee that the stimulus helped to turn the economy from free fall to recovery.

It’s no surprise that the administration would proclaim its own policies a success. But its verdict is backed by economists at Goldman Sachs. IHS Global Insight. JPMorgan Chase and Macroeconomic Advisers, who say the stimulus boosted gross domestic product by 2.1% to 2.7%.

It’s impossible to determine precisely how many jobs or how much growth the stimulus program caused. In a nearly $14 trillion economy, economists can’t go employer to employer counting new hires. And there are too many moving parts to confidently link any single factor with individual hiring decisions. Roughly one-third of the stimulus, for example, came in the form of tax cuts, which are designed to boost demand for a wide array of products and eventually result in related hiring.

But to estimate the answers to such questions, economists rely on models based on historical relationships between various policies and real-world results. Earlier this month, Zandi and co-author Alan Blinder. former vice chairman of the Federal Reserve. released the most detailed assessment of the government’s efforts to combat the so-called Great Recession. Neither economist is regarded as a partisan firebrand. Zandi, for example, backed John McCain in the 2008 presidential campaign and has advised members of both parties.

Their conclusion: The fiscal stimulus created 2.7 million jobs and added $460 billion to gross domestic product. Unemployment would be 11% today if the stimulus hadn’t been passed and 16.5% if neither the fiscal stimulus nor the banks’ rescue had been enacted, according to Zandi and Blinder. It’s pretty hard to deny that it had a measurable impact, Zandi said.

As of Aug. 13, almost 64% of the program’s original $787 billion had been spent. (The Congressional Budget Office. which is among those concluding that the program had a broadly positive economic result, currently projects the Recovery Act’s total cost to be $814 billion. Including an earlier Bush administration tax rebate and some unrelated programs, total stimulus spending will reach about $1 trillion over several years.)

Stimulus outlays first topped $100 billion in the third quarter of 2009, which is when the economy resumed growing after the recession that started in 2007. Likewise, personal consumption spending began to increase in the third quarter after four consecutive quarterly declines. To Zandi, those facts buttress his model’s conclusion that the program resuscitated a moribund economy.

Not everyone is convinced. I can’t find in my analysis that the 2009 stimulus package had much effect at all, says economist John Taylor of Stanford University .

Taylor, who served as undersecretary of the Treasury under former president George W. Bush. says the recovery that began last year stemmed from a pickup in business investment unrelated to government spending. He dismissed the Zandi-Blinder conclusions as divorced from what is actually occurring in the economy and reflecting built-in assumptions about the impact of government spending.

At issue is the so-called multiplier effect of government spending. Economists such as Taylor who are skeptical of government’s pump-priming role argue that for every additional $1 of government spending, GDP increases by less than $1. Those whose models back the stimulus generally assume that $1 in government spending adds more than $1 to total output via the multiplier effect. If you crank up government spending, it will create jobs, says Sung Won Sohn. an economist at California State University.

The actual multiplier changes depending upon the condition of the economy. Over the course of the business cycle, the average multiplier is less than 1, Zandi acknowledged. If unemployment is low and the government borrows money for stimulus projects thus crowding out some private companies seeking to borrow money the net result can be muted. But with unemployment high and the government able to borrow money for 10 years at historically low 2.5% rates, Uncle Sam’s borrowing doesn’t come at the expense of the private sector and the stimulus is a bigger net positive, he says.

Ultimately, people have to use their judgment here, says Taylor. There’s a difficulty of knowing what would have happened otherwise.

Facing congressional elections in less than 90 days, administration officials say they know what would have happened: The ailing economy would be in worse shape if not for the stimulus. But even some of those directly benefiting from the stimulus remain dissatisfied amid the economy’s myriad woes.

When the president conducted an Aug. 18 town hall meeting in Columbus, Ohio, one questioner said he worked for a company that the stimulus funds were helping.

It’s keeping me and my crews afloat for a while. But what we really need is a stronger housing market here in Columbus. We need to be building new roads and making houses affordable for people. They need to get out there buying. They need to be able to get the loans. And what’s up with that? the unidentified man asked, according to a White House transcript.

Lack of appetite

The economy expanded for four consecutive quarters after the stimulus spending accelerated. But in recent weeks, in the aftermath of the European debt crisis, what once had seemed like steady if modest growth has noticeably weakened. In the week ended Aug. 14, new jobless claims breached the 500,000 barrier for the first time since November. They fell the following week to 473,000, but the four-week moving average remains at the highest level in nine months. Meanwhile, sales of existing homes in July fell 27% from the previous month, reaching their lowest level in 15 years, and durable goods orders disappointed.

The recovery in the U.S. appears to have come to a complete halt, says John Higgins of Capital Economics .

Among investors, fears of a second recession or double dip are rising as stimulus spending gradually tapers off. Some analysts such as David Rosenberg of Gluskin Sheff in Toronto say that the first downturn, which began in December 2007, never really ended. This is a depression, and not just some garden-variety recession, he wrote clients.

The administration has proposed some modest additional spending measures, such as a plan to aid small business that is stalled in Congress. With about one-third of the original stimulus money yet to be spent, and rising political angst over the public debt, there are no plans for a major new initiative. If the economy requires any additional impetus, it will likely come from the Federal Reserve, where Chairman Ben Bernanke has signaled a willingness to expand unconventional efforts to increase the money supply.

Small-scale efforts to support demand are warranted, Zandi says. But as the economy struggles to work off the excess debt clogging household and bank balance sheets, time may be the most important salve. Policymakers should remain aggressive, he said. But I don’t think there’s any political appetite for a big stimulus plan.