Economic Outlook 2015

Post on: 6 Май, 2015 No Comment

The U.S. Economic Outlook for 2015 will be significantly different depending on your vantage point. If you’re wealthy, 2015 will probably be another year of celebratory wealth creation.

If, on the other hand, you’re not, 2015 will feel an awful lot like 2014, 2013, 2012, 2011, 2010, and 2009. Wall Street and the U.S. government will tell you the economy is doing well, but it won’t feel like it.

In fact, according to a national survey, 70% of Americans believe the U.S. economy is permanently damaged, while 84% do not believe the economy has improved since the recession ended in 2009.

How Can this Be?

The stock market is, after all, the barometer for the country’s economic health. Since the markets bottomed in March 2009, the S&P 500 has climbed approximately 200%, the NYSE is up 165%, the NASDAQ is up more than 260%, and the Dow Jones Industrial Average has gained more than 165%.

With the major U.S. indices reaching uncharted territory almost daily, many have concluded that the U.S. economy has recovered. Unemployment levels have dropped to just 6.1% and inflation is in check. Further, the Federal Reserve is winding down its bond buying program and at the current rate, will wrap up its quantitative easing (QE) strategy this fall. Mission accomplished!

The fact of the matter is that the U.S. is doing spectacularly well. Well, Wall Street is.

Special: An Important Message from Michael Lombardi:

I’ve identified six time-proven indicators that now all point to a stock market crash in 2015. You can see my latest video, Six Time-Proven Indicators Now All Pointing to a 2015 Stock Market Crash, which spells out why we’re headed for a crash and what you can do to protect yourself and even profit from it, when you click here now.

Economic Background

The Great Recession in the U.S. started in December 2007 and lasted for 18 months. In late 2008, in an effort to help kick-start the economy, the Federal Reserve initiated its generous bond buying program (quantitative easing) and sent short-term interest rates tumbling to near zero. The low interest rate environment was supposed to encourage banks to lend more money to businesses and people.

This didn’t happen exactly like it was supposed to. Instead of making it easier to get money, America’s big banks tightened their lending rules, taking the opportunity to strategically invest the money themselves.

Granted, the banks were more than willing to lend to well-heeled Americans. Keeping interest rates artificially low has made it cheaper to borrow and is generally recognized as the fuel that’s been propelling the stock market increasingly higher.

Since the Federal Reserve enacted its quantitative easing strategy, the S&P 500 has soared more than 200% in value. During the same timeframe, the number of Americans receiving food stamps has essentially doubled to 46.23 million, or one-sixth of the American population.

As a broader measure, since the Great Recession began, the top one percent of earners have seen their incomes rise more than 30%, while the bottom 99% saw their earnings rise 0.4%. During the so-called recovery, the top one percent captured 95% of the total growth in the U.S.

Unfortunately, the widening gap has slowed the five-year recovery and contributed to Standard & Poor’s (S&P) cutting its growth estimates for the economy. Because (in part) of the income disparity, S&P estimates the economy will grow 2.5% annually for the next decade—down from a forecast five years ago of 2.8%.

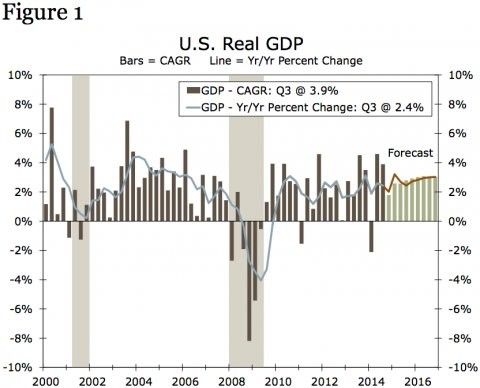

This is a little less optimistic than what the International Monetary Fund (IMF) has projected. In 2012, U.S. gross domestic product (GDP) growth was 2.8% and in 2013, it slowed to just 1.9%. In 2014, the IMF expects U.S. GDP growth to hit 2.8% and in 2015, it expects an even three percent.

Unemployment Analysis & Forecast

Again, the stock markets may be doing well, but the underlying fundamentals that hold the U.S. economy together are not. Yes, the jobless rate is down to 6.2% from nearly 10% four years ago, but that number is a little misleading.

Other gauges have become harder to assess and may reflect persistent weakness, including the number of people jobless for more than six months, the millions who are working part-time but want full-time jobs, and stagnant wages. On top of that, the underemployment rate (U-6) remains at an eye-watering 12.6%. (Source: “The Employment Situation July 2014 ,” Bureau of Labor Statistics web site, August 1, 2014.)

For those who have jobs, they’re making less than they did before the Great Recession. Wages for workers at every pay level, save for the bottom 10%, declined from the second half of 2013 through to the second half of 2014. And there’s no indication wages will increase.

For 70% of the workforce, inflation-adjusted hourly wages are still lower than they were in 2007. Over the same period, inflation (CPI) has risen 15%. The best time to be a worker in America was in the late 1990s, when wage growth was broad-based and strongest for the lowest income earners.

Even U.S. housing, the bright spot in the U.S. economy, isn’t as robust as many think. The Case-Shiller Home Price Index may be up 25% since the beginning of 2012, but it still needs to climb an additional 20% just to break even with its pre-recession levels.

Real Estate Analysis

And despite the ultra-low interest rates, first-time home buyers are being priced out by all-cash purchases. As a result, the number of first-time home buyers getting onto the property ladder is lagging, accounting for just 28% of all purchases. The 30-year average, and a number that economists consider to be healthy, is 40%.

The National Association of Realtors also notes that nearly half of Americans said student loan debt is a huge obstacle to buying a home. First-time home buyers are an important part of the U.S. economy, and if they don’t buy homes, they can’t pay for upgrades, renovations, new appliances, or furniture. If they aren’t buying, construction companies aren’t building or employing as many people either. And that adds up. (Source: Gaffney, J. “CFPB director: Student loans are killing the drive to buy homes ,” HousingWire web site, May 19, 2014.)

Historically, residential investment (construction, remodeling, etc.) has averaged around five percent of U.S. GDP. Housing services, which includes gross rent, utility payments, and imputed rent (an estimate of how much it would cost to rent owner-occupied units), averages between 12% and 13%—for a combined total of 17% to 18%. (Source: “Housing’s Contribution to Gross Domestic Product (GDP),” National Association of Home Builders web site, last accessed September 3, 2014.)

Analysis for Investors

Despite the obvious economic warning signs, investors are not yet ready to throw in the towel. And they continue to be increasingly optimistic toward a stock market that many believe is both overvalued and ripe for a correction.

But it appears as though investors don’t care if the markets are overvalued so long as it keeps going up. While bearish indicators continue to surface on a regular basis, there’s no reason to think the markets are going to correct in the near term.

To appease shareholders, companies are going to continue to financially engineer their earnings. While using cost-cutting measures and cash to repurchase shares and increase dividend payouts is a short-term investment strategy used to boost earnings and support stock prices, more and more investors seem content with this strategy.

Eventually, companies will need to report sustainable revenue growth. It’s going to be difficult for a country that relies on consumer spending to drive roughly 70% of its GDP to run at full steam when the vast majority of the population is struggling.

Economic Factors

Economic factors outside the U.S. will also have a serious impact on the U.S. economy in 2015. Russia, one of the world’s biggest economies, is on the brink of a recession as a result of sanctions related to ongoing conflict in Ukraine. Russia’s economic ministry halved its 2015 GDP forecast from two percent to one percent.

This past summer, it was reported that Italy, the third-largest economy in the eurozone, had fallen back into recession. Germany, the region’s largest economy, is grinding down and France, the second-biggest economy in the eurozone, is also in a precarious position.

In the second quarter of 2014, Germany reported a decline in its GDP—this represents the first decline since the first quarter of 2013. In August, the ZEW Indicator of Economic Sentiment (a survey on the health of the German economy) posted a massive decline, collapsing 18.5 points to a lowly 8.6 points. Having been declining for more than half a year, the index is now at its lowest level since 2012. This does not bode well as we head into 2015. (Source: “ZEW Indicator of Economic Sentiment Economic Expectations Decline Significantly ,” ZEW web site, August 12, 2014.)

France, the second-biggest economy in the eurozone, is in a worse spot economically—and a recession may just be around the corner. In 2013, France’s GDP rang in at just 0.4%. During the first half of 2014, France’s GDP came in at zero. In addition to a stagnant economy, France faces record unemployment and a growing deficit. On top of that, Prime Minister Manuel Valls warned the autumn months would continue to be difficult. (Source: “In Q2 2014, French GDP held steady ,” National Institute of Statistics and Economic Studies web site, August 14, 2014.)

What Will Happen in 2015?

It doesn’t look like 2015 will be a prosperous year for the eurozone, especially when you consider its three biggest economies are in jeopardy. Why should we, as Americans, be worried about the eurozone economy?

Approximately 40% of the public companies that make up the S&P 500 derive sales from Europe. If the eurozone faces a sustained economic slowdown, the corporate earnings of American companies will suffer. As a result, America won’t be able to skirt the consequences of an economic slowdown in the eurozone because the U.S. economy itself remains weak.

After all, it’s been the lethargic U.S. economy that has necessitated near-zero interest rates for six years. And there is serious doubt as to whether or not the U.S. economy can sustain higher rates. With that in mind, it’s difficult to imagine the U.S. could weather a global economic slowdown unscathed.

That doesn’t mean the stock market won’t continue to do well; it all depends on when the Federal Reserve decides to start increasing interest rates. Initially, the Federal Reserve said it wouldn’t raise interest rates until the U.S. economy was on sustainable economic footing. Many take that to mean a jobless rate of 6.5% and inflation of 2.5%. The unemployment rate is already below the 6.5% target and U.S. inflation is near 1.5%.

At the same time, there is more to the U.S. economy than those two indicators. It’s quite possible the U.S. economy will hit those targets in early 2015 and the Fed chooses not to raise interest rates because it believes there is too much uncertainty.

The Federal Reserve will announce on March 18, 2015 whether or not it will raise interest rates from zero. If the Federal Reserve decides the economy is on the right path and raises interest rates sooner than expected, it’s quite possible the stock market will go through a short-term correction. An increase of 50 basis points could shock the system and negatively impact the broader economy—making it more difficult for people and businesses to borrow and lend.

If this were to happen, investors might want to consider banking stocks and growth stocks. Over the remainder of the year, the Federal Reserve would monitor how the economy is doing and decide whether or not to move interest rates higher…or lower.

Maintaining the current ultra-low levels would signal there is still work to be done and that rates will probably not rise until later in 2015—possibly October. If this happens, investors will, in all probability, remain bullish, sending the stock markets higher over the coming seven months.

Waiting to announce an interest rate hike until October 2015 would allow the U.S. economy more time to set itself on a more stable, sustainable course. It would also allow the U.S. economy time to better understand or assess where the global economy is heading.

Because an interest rate hike in October 2015 would be expected, it would come as less of a shock. As a result, the major U.S. stock indices would be prepared to absorb the expected hike.

What kind of companies thrive on higher interest rates? Few are looking forward to interest rate hikes more than banks. America’s big banks have been the biggest winners of the Great Recession and quantitative easing. When the U.S. financial system was on the brink of collapse, the Federal Reserve and the U.S. government stepped in and bailed out America’s big banks. The six biggest banks were given $160 billion and they borrowed as much as $460 billion; they profited from cheap, taxpayer-funded dollars.

And America’s big banks did well. JPMorgan Chase & Co. (NYSE/JPM) has seen its share price climb almost 350%, Morgan Stanley (NYSE/MS) has seen its share price increase more than 450%, Bank of America Corporation ’s (NYSE/BAC) share price is up more than 500% since early 2009, and Wells Fargo & Company (NYSE/WFC) has seen its share price climb more than 625%.

Even in the low interest rate environment, America’s big banks have made a lot of money. But low interest rates mean there is a limit to what banks can charge. With the country’s banking industry on strong financial footing, America’s big banks want interest rates to climb.

When interest rates do start to increase, lending institutions will raise the amount they charge for the loans faster than what they pay on deposits. For America’s big banks, these higher rates will translate into higher profits.