EBITDA vs cash flows from operations vs free cash flows Wall Street Prep

Post on: 3 Июль, 2015 No Comment

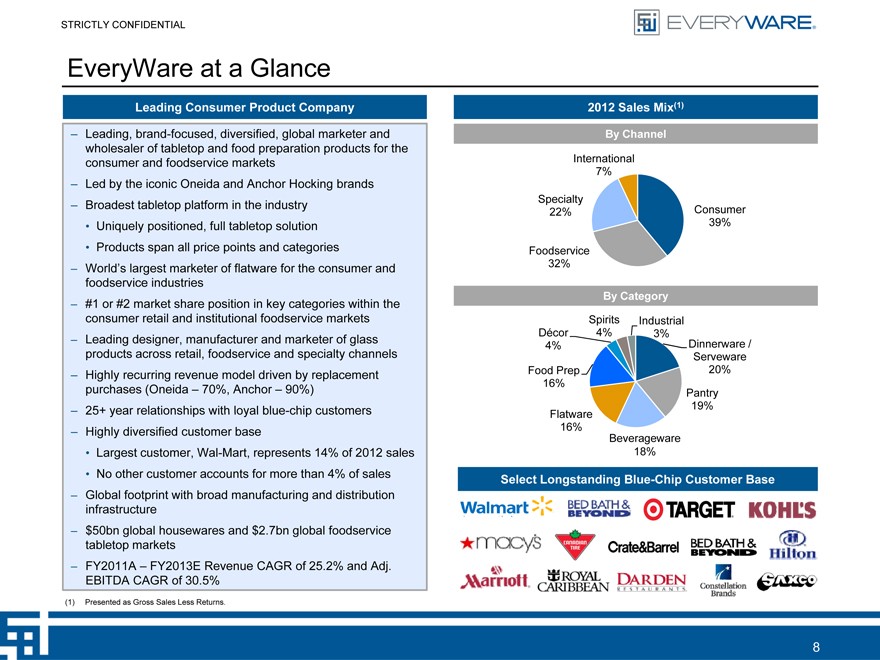

Constant Contacts EBITDA

EBITDA is often used as a proxy for cash flows, but many investment banking analysts and associates struggle with fully grasping how the differences between EBITDA, cash from operations, free cash flows, and other profitability metrics impact when they should be used in valuation. In this blog post I will try to address some of these topics.

Cash from operations (CFO) as a measure of profitability

First, lets look at cash from operations (CFO). The main advantage of CFO is that tells you exactly how much cash a company generated from operating activities during a period. Starting with net income, it adds back noncash items like D&A and captures changes from working capital. Here is Wal Marts CFO .

This is an extremely important metric, so much so that you might wonder whats the point of even looking at accounting profits (like Net Income or EBIT, or to some extent EBITDA) in the first place. I wrote a blog post about this recently here. but to summarize: accounting profits are an important complement to cash flows.

Imagine if you only looked at cash from operations for Boeing after it secured a major contract with an airliner: While its CFO may be very low as it ramps up working capital investments, Boeings operating profits show a much more accurate picture of profitability (since the accrual method used for calculating net income matches revenues with costs).

Of course, we should not rely solely on accrual based accounting either and must always have a handle on cash flows: Since accrual accounting depends on managements judgement and estimates, the income statement is very sensitive to earnings manipulation and shenanigans. Two identical companies can have very different looking income statements if the two companies make different (often arbitrary) deprecation assumptions, revenue recognition, and other assumptions.

So, the benefits of CFO are that it is objective. It is harder to manipulate CFO than accounting profits (although not impossible since companies still have some leeway in whether they classify certain items investing, financing, or operating activities, thereby opening the door for messing with CFO). The primary downside is the flip side of that coin namely, you dont get an accurate picture of ongoing profitability.

Free cash flows vs operating cash flows

Now lets talk about the other cash flow metric you were asked to compare free cash flows. FCF actually has two popular definitions

- FCF to the firm (FCFF): EBIT*(1-t)+D&A +/- WC changes Capital expenditures

- FCF to equity (FCFE): Net income + D&A +/- WC changes Capital expenditures +/- inflows/outflows from debt

Lets discuss FCFF, since thats probably the one investment bankers use most often (unless it is a FIG banker in which case she will be most familiar with FCFE).

FCFF adjusts CFO to exclude any cash outflows from interest expense, ignores the tax benefit of interest expense, and subtracts capital expenditures from CFO. This is the cash flow figure that is used to calculate cash flows in a DCF. It represents cash during a given period available for distribution to all providers of capital.

The advantage over CFO is that it accounts for required investments in the business like capex (which CFO ignores) and it also takes the perspective of all providers of capital instead of just equity owners. In other words, it identifies how much cash the company can distribute to providers of capital, regardless of the companys capital structure.

EBITDA, for better or for worse, is a mixture of CFO, FCF, and accrual accounting. First, lets get the definition right: Many companies and industries have their own convention for calculating of EBITDA, (they may exclude non recurring items, stock based compensation, non cash items (other than D&A) and rent expense. For our purposes, lets assume were just talking about EBIT + D&A. Now lets discuss the pros and cons:

1. EBITDA it takes an enterprise perspective (whereas net income, like CFO is an equity measure of profit because payments to lenders have been partially accounted for via interest expense). This is beneficial because investors comparing companies and performance over time are interested in operating performance of the enterprise irrespective of its capital structure.

2. EBITDA is a hybrid accounting/cash flow metric because it starts with EBIT which represents accounting operating profit, but then makes one non cash adjustment D&A but ignores other adjustments you would typically see on CFO, like changes in working capital. See how Constant Contacts (CTCT) calculates its EBITDA and compare to its CFO and FCF

The bottom line result is that you have a metric that somewhat shows you accounting profits (with the benefit of it showing you ongoing profitability and the cost of being manipulatable) but at the same time adjusts for one major noncash item the D&A which gets you a little closer to actual cash. So it tries to get you the best of both worlds (the flip-side is it retains the problems of both as well).

Case in point: say you are comparing EBITDAs for two identical capital-intensive businesses by adding back D&A, EBITDA prevents different useful life estimates from affecting the comparison. On the other hand, any differences in revenue recognition assumptions by management would still skew the picture. Where EBITDA also falls short (compared to FCF) is that if one of the two capital-intensive businesses are investing heavily in new capital expenditures that are expected to generate higher future ROICs (and thus justify higher current valuations), EBITDA, which does not subtract capital expenditures, completely ignores that, and you may be left incorrectly assuming that the higher ROIC company is overvalued

3. It is easy to calculate: Perhaps the biggest advantage of EBITDA might very well be that it is used widely and it is easy to calculate. Take operating profit (reported on the income statement) and add back D&A and you have your EBITDA. Further, when comparing forecasts for EBITDA, CFO, FCF (as opposed to calculating historical or LTM figures), both CFO and FCF requires an analyst to make far more explicit assumptions about line items that are challenging to predict accurately, like deferred taxes, working capital, etc.

Lastly, EBITDA is used everywhere from valuation multiples to formulating covenants in credit agreements, so it is the de facto metric in many instances for better or for worse.