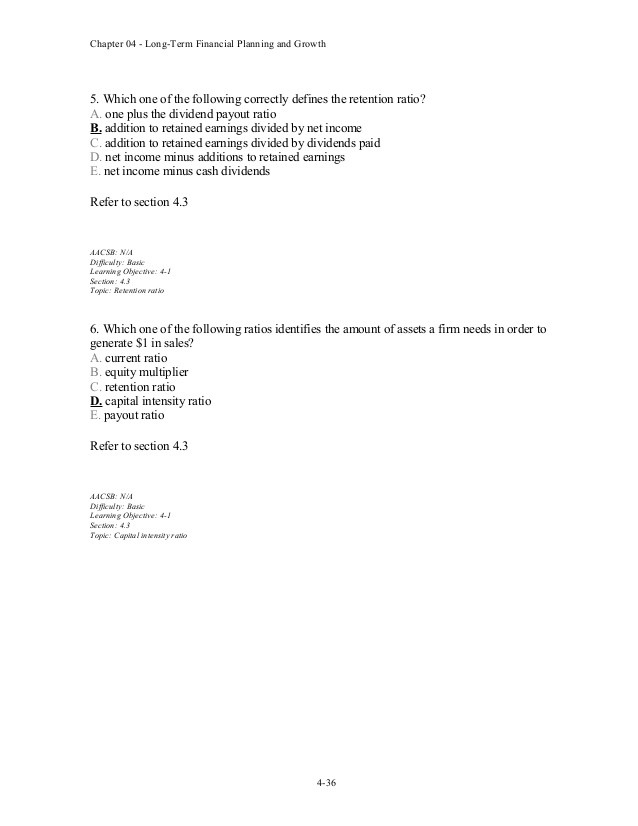

Earnings Retention Ratio

Post on: 16 Март, 2015 No Comment

Definition of Earnings Retention Ratio

Earning Retention Ratio is also called as Plowback Ratio. As per definition, Earning Retention Ratio or Plowback Ratio is the ratio that measures the amount of earnings retained after dividends have been paid out to the shareholders. The prime idea behind earnings retention ratio is that the more the company retains the faster it has chances of growing as a business. This is also known as retention rate or retention ratio. There is always a conflict when it comes to calculation of Earnings retention ratio, the managers of the company want a higher earnings retention ratio or plowback ratio, while the shareholders of the company would think otherwise, as the higher the plowback ratio the uncertain their control over their shares and finances are.

Formula to calculate Earnings Retention Ratio or Plowback ratio

This ratio shows the amount that has been retained back into the business for the growth of the business and not being paid out as dividends. The formula is

= Plowed back gross profits / total gross profits

= Total Gross Profits Payout ratio

= (Total Net Profit / Number of Total share) — (Dividend / Share)

The investors prefer to have a higher retention ratio in a fast growing business, and lower retention ratio in a slower growing business.

Advantages of the Earnings Retention Ratio

- One of the greatest advantage of Earnings Retention Ratio or the plowback ratio is that is a very easy formula to understand and decipher.

- There are actually plenty of ways that you can calculate the Earnings Retention Ratio as there are plenty of formulas you can use.

Disadvantages of the Earnings Retention Ratio