Earnings Manipulation Detection and The MModel

Post on: 30 Апрель, 2015 No Comment

Earnings Manipulation Detection and The M-Model

Management quality is one of the most important elements in choosing an investment; management is incentivized to hit the target and increase long-term earnings, in reality, this does not necessarily mean long-term value would be created. The first step in any successful public equity investment strategy is to determine whether reported earnings are trustworthy.

Benford’s Law and Beneish’s M-Model

People who have mathematics background may recall the Benford’s Law which states that in listings, tables of statistics, the digit 1 tends to occur with a probability of

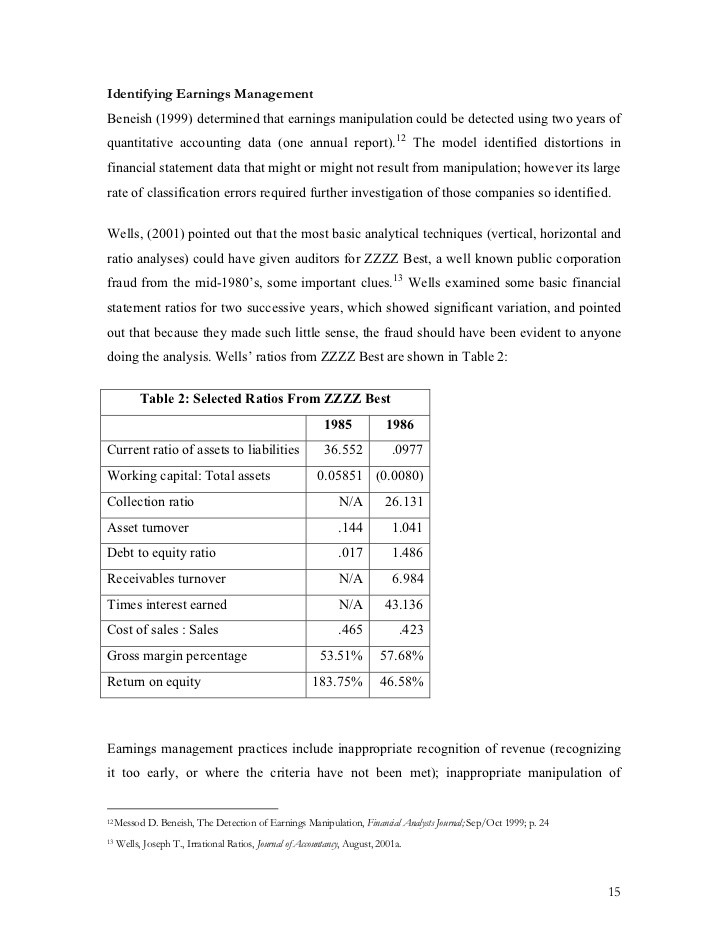

30%, much greater than one out of nine. In 1972, Hal Varian suggested that the Benford’s Law be used to detect possible fraud in lists of socio-economic data submitted in support of public planning decisions. Subsequently, in 1999, Mr. Messod D. Beneish introduced the “M-Model” to distinguish manipulated earnings reporting, where he defined earnings manipulation as an instance where management violated Generally Accepted Accounting Principles (GAAP) in order to improve the firm’s operating and financial performance. The major finding is that there is a systematic relation between the probability of manipulation and financial statement information. Along with the variables mentioned by other scholars in some previous research, Mr. Beneish categorized the variables as “manipulation signals” and “motivation signals.” To be specific, the eight variables are:

- Days Sales in Receivables Index (DSRI) – the ratio of days sales in receivable in the first year in which earnings manipulation is uncovered to the corresponding measure in year t-1

- Gross Margin Index (GMI) – the ratio of the gross margin in year t-1 to the gross margin in year t

- Asset Quality Index (AQI) – the ratio of non-current assets other than property plant and equipment (PPE) to total assets

- Sales Growth Index (SGI) – the ratio of sales in year t to sales in year t-1.

- Depreciation Index (DEPI) – the ratio of the rate of depreciation in year t-1 vs. the corresponding rate in year t

- Sales General and Administrative Expenses Index (SGAI) – the ratio of SG&A to sales in year t relative to the corresponding measure in year t-1

- Leverage Index (LVGI) – the ratio of total debt to total assets in year t relative to the corresponding ratio in year t-1

- Total Accruals to Total Assets (TATA) the change in working capital (current assets – current liabilities) other than cash less depreciation.

Then,

Score M-Model = -4.84 + 0.92 (DSRI) + 0.404 (AQI) + 0.115 (DEPI) + 4.679 (TATA) + 0.528 (GMI) + 0.892 (SGI) – 0.172 (SGAI) – 0.327 (LEVI)

The M-Model is easily implemented in that data can be extracted from annual reports, although the results require further investigation to determine that whether the distortions are from earnings manipulation. The negatives are: 1) it cannot be applied to private-held companies; 2) data used in Mr. Beneish’s tests are all earnings overstatement samples, which means, it cannot be used to study firms that report understated earnings; 3) it misses changes in the financial markets.

In February of 2012, with the assistance from Charles M.C. Lee, and D. Craig Nichols, Mr. Beneish found that firms with a higher probability of manipulation gain lower returns in every decile portfolio, sorted by size, BtM, momentum, accruals, and short-interest, which again, supports the investment approach that a comprehensive fundamentals-based analysis framework is the key in investment selection.

Other Red Flags

There are also simple metrics and easy processes for investors to detect earnings manipulations, to list a few:

- Cash flow on Capex can be used to screen for companies that have more than ample cash to fund capital spending needs.

- Capex on PP&E provides a measure of capital intensity.

- Free Cash Flow on Debt Ratio can be combined well with profitability, valuations, and price momentum factors.

- Companies that are active in acquiring assets are prime candidates for asset impairment.

- A noticeable rise in either receivables or days sales outstanding could be a sign that a company is inappropriately extending credit to customers

- Overvalued inventories issue could force management to take large write-downs in the following reporting period.

- Deferred tax assets issue is related to that FASB requires companies to write down the value of tax credits to the valuation level it thinks is more likely to be used in the future, which will eventually boost the company’s income tax liability and reduce its earnings.

References:

- Fraud Detection and Expected Returns by Messod D. Beneish, Charles M.C. Lee, and D. Craig Nichols, February 2, 2012

- The Detection of Earnings Manipulation by Messod D. Beneish, June 1999