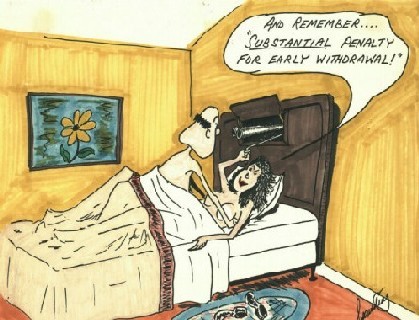

Early Withdrawal Penalties

Post on: 29 Июнь, 2015 No Comment

The economy is tough right now. Gas and food prices are going through the roof, energy and housing prices are rising, and many people are struggling to make ends meet.

When times are tough, making early withdrawals from your retirement funds can seem like a quick source of cash. It is. But it can be an extremely expensive source of quick cash. Many people dont realize that making early retirement withdrawals can hit you four times at once!

Taxes

The first thing that is going to get you is the taxes. Qualified retirement plans such as IRAs and 401(k) plans (and others) have some nice tax advantages. When you make an investment into a Traditional retirement plan such as a Traditional IRA or Traditional 401(k), the money is not taxed until you withdraw it. This is designed to allow you to invest more money upfront and give you years of tax free growth. When you withdraw that money early, you lose that tax advantage and must pay the taxes immediately.

Early Withdrawal Penalties

Early distributions from an IRA, 401(k), 403(b) or other qualified retirement plan are subject to a 10% early withdrawal penalty. That means not only are your withdrawals taxed, but an additional 10% is taken from the withdrawal to pay the penalty. Double-whammy!

Less Money for Future Growth

Compound interest is the most important thing you have working for your retirement. The more time that compound interest works in your favor, the more money you will have when you retire. Here is a nice illustrated example of how much compound interest can work in your favor.

Possible Market Losses

If your retirement account holdings have depreciated, not only will you have to pay taxes and early distribution penalties, but you may be paying them on less money than what you originally invested. Overall, the markets have not done very well the last year or so, and it is possible that some of your investments have lost money. Leaving the money in your investments gives them time to appreciate and not only regain their previous value, but hopefully appreciate beyond your original investment.

Stay the course. If at all possible, try to avoid withdrawing your retirement funds for short term needs. There may be other ways to get the funds you need, such as working overtime, taking a part time job, or raising funds by having a yard sale or selling unneeded items on eBay.