Dynamic Risk Management

Post on: 27 Июнь, 2015 No Comment

Categories

Dynamic Risk Management

GRATHAMS CAUTIOUS OUTLOOK

Jeremy Grantham is one of the current asset allocation gurus on Wall Street. He was co-founder of Batterymarch Financial Management in 1969 prior to founding his current firm, GMO. Mr. Grantham has been featured in Forbes, Barrons and Business Week and is routinely quoted by the financial press. He earned his undergraduate degree from the University of Sheffield (U.K.) and an M.B.A. from Harvard Business School.

Jeremy Grantham projects 10 flat and volatile years for stocks from the average of 10 previous bubble bursts.

Click image for full size

As one can see, the historic precedent for the equity market over the next decade would not thrill most investors. Grantham, for his part, has a few areas in which he sees the potential for returns (or at least the avoidance of losses). He calls for a normal weighting to the global equity markets, but one should steer clear of low quality domestic stocks. Larger companies with sustainable cash flows and solid business models will be able to deliver higher returns over the next seven years than their risker small cap counterparts. In fact, Grantham calls for a negative real return for small capitalization stocks.

Safety, as it turns out, serves as Granthams primary theme. He recommends investors “tilt†their portfolios toward safer assets wherever possible. For instance, with interest rates at record a low, Grantham suggests avoiding duration risk in bonds. The price of bonds move inversely with interest rates; so if interest fall, the bond is worth more and vice versa. When, not if, interest rates rise, bondholders with more duration (interest rate sensitivity) will suffer more than those whose bonds have shorter duration. His firms seven year asset class forecast predicts most fixed income asset classes will also have negative real returns, with Emerging Market Debt as the exception returning a modest real 1.3%. Grantham also stress that investors should not be too proud to hold “substantial†cash reserves over the foreseeable future. Finally, Grantham is a firm believer in limited natural resources on the planet. In the past, he has eloquently defended the Malthusian argument that exponential population growth and economic development will strain many, if not all, of Earths natural reserves. Subsequently, as an investor, he has taken interest in commodities as well as companies that help bring them to market. Grantham recognizes that volatility in commodities make it difficult for many investor, therefore, he is constructive over the long-term (10 years) on many natural resources. He does admit, however, that there is a coin flips chance that the current global slowdown and normalized weather patterns may provide a lower entry point for investors. That is, commodities very well may see price declines in the short-term.

DONT FIGHT THE FED

While Grantham has a less than rosy outlook over the next seven to ten years, numerous factors such as fiscal policy, a global economic slowdown, a trade war, unexpected new technologies and industries or multitude of other factors could dramatically change the forecast. Perhaps the most influential factor for the United States is the Federal Reserves monetary policy. Certainly over the past few years, the Fed has had a profound influence on markets as the chart from Doug Short (dshort.com) below illustrates.

Click image for full size

The graph displays that while fiscal policy (PDCF, TALF, TARP, etc.) was not immediately effective in the markets; the Feds zero interest rate policy as well as quantitative easing (QEs) had an enormous influence. The S&P 500 (indicated in blue above) rallied significantly during both QEs periods in which the Fed injected more money into the economy exhibiting investors drive for more risky assets. On the other hand, at the end of each easing period, the stock market fell as investors became more risk adverse.

The key question becomes what will be the Feds policy going forward. The central bank has already declared its intention to keep their benchmark interest near zero through at least 2013. As the economy stumbles again with threats of a credit crisis in Europe, would the Fed undergo more quantitative easing programs, and would it have the same effect of driving investors into riskier assets? The consensus remains that while further monetary stimulus may occur in the near term, over the intermediate term the Fed will significantly reduce its balance sheet, which has ballooned over three times since 2007. Whatever happens over the next few years with monetary policy, investors should remember the old maxim of “Dont Fight the Fed!â€

Click image for full size

IMPLICATIONS FOR ASSET ALLOCATION

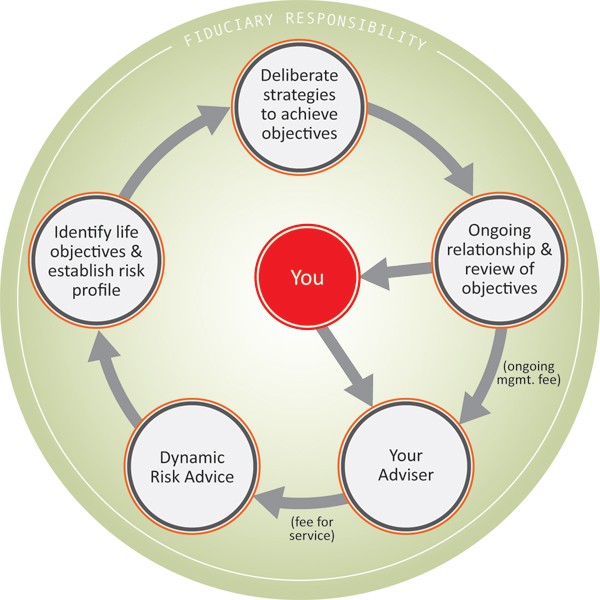

The common thread between Grantham, central bank policy, and market analysts as whole is that volatility and lower real returns from traditional assets will be around for the next few years at a minimum. Thus, it is important for institutions to examine their return expectations and ways to meet their required investment returns.

Most institutional investors such as endowments, foundations, and pension plans, have an investment goal of 5% over the rate of inflation. This is in line with the actuarial interest rate assumption of most pension plans which averages 7.5% to 8.0% nationwide, and accomplishes the most common spending policy of endowments and foundations, which is 5%, plus keeping the principal indexed to inflation.

Asset allocation has always been one of the most important decisions investors make, and with the volatility and uncertainty of the current environment, it is one of the most difficult. Studies indicate that the asset allocation decision accounts for a majority of an investors experience in both risk and return. Most sophisticated investors have an asset allocation policy including a target allocation for each asset class, and an allowable range collared around each target. This is known as Strategic or Static Asset Allocation. Over long periods of time Strategic Asset Allocation has accomplished the goals of most investors. However, long term is more than 25 years! In the shorter term the investment goals have been difficult to achieve with only a Strategic Asset Allocation system, and the traditional 60% equity / 40% fixed income indexed strategy has failed to meet the goal.

THE IMPORTANCE OF ASSET ALLOCATION

The chart below displays various asset class returns over the past 15 years. As one can see, returns vary greatly year to year. For instance, look at emerging market equities (purple box color). In 2007, the index returned nearly 40%. The next year, however, it fell over 53% and in 2009 it rose 79% (though still below its level at the end of 2007). With that much volatility, many investors lost faith in the emerging market asset class at the wrong time and missed the subsequent rally in 2009. In fact, a recent study by J.P. Morgan Asset Management found that stocks and bonds both returned 7.7% and 6.1% respectively over the last 20 years. There is no combination of stocks and bonds over this period that would earn the required 8% return of most pensions, foundations and endowments. J.P. Morgan also found that an average investor returned a mere 2.6% over this period. Clearly, investors buy and sell assets at less than ideal times.

ACTIVE ASSET ALLOCATION

So what steps can institutional investors take to meet their return requirements? For decades, a blend of stocks and bonds, traditional assets, appeared to be the answer. Over the past fifteen years, however, the mix of 60% stocks and 40% bonds (black dot on the chart) has not met the common bench mark of inflation plus 5% for spending (light blue). The next step involved diversifying into new asset classes. These assets classes may have included foreign securities, real estate, commodities and master limited partnerships (MLPs). By doing so, investors could beat the inflation plus 5% benchmark (red dot) albeit by taking on slightly more risk. As illustrated in the asset class table above many of the new asset class added had more volatility and during times of markets stress like 2008, they did not offer the correlation benefits investors had previously expected.

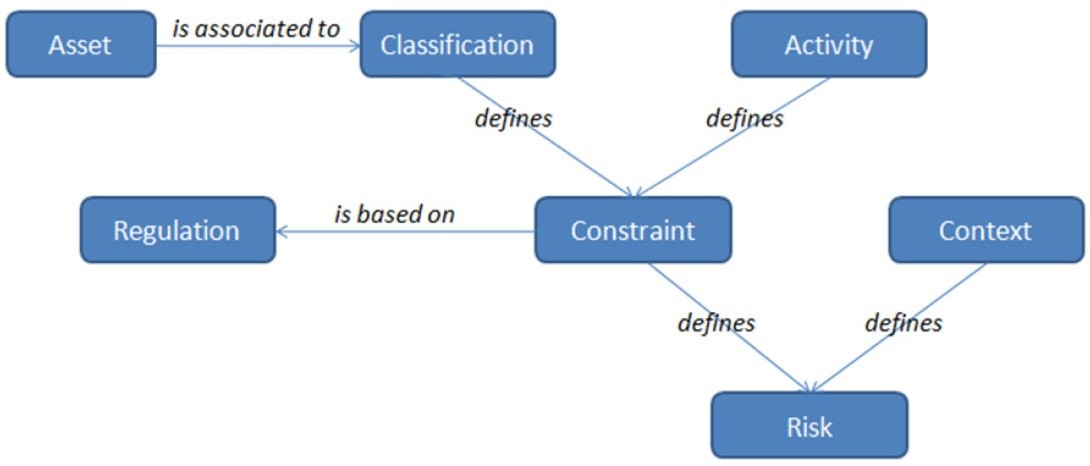

The final step to a stronger asset allocation, which should be beneficial with the expected market turbulence over the next few years, is to add a level of dynamic risk management. Equitas dynamic risk management tool aims to identify asset classes that exhibit either positive or negative intermediate trend on a monthly basis. In other words, invest in asset classes that appear to being going up for the next month and do not invest in those that appear to be going down.

While the dynamic risk management tool may be extremely helpful in identifying investments, it does not complete the active asset allocation process. In order to build a more efficient portfolio, assets should be rebalanced from the negative (non-invested) to the positive asset classes. The green dot below displays a hypothetical back-test when implementing Active Asset Allocation. As one can observe, the Active Asset Allocation both lowers risk and increases return historically.

Click image for full size

*Please see important disclaimers at the end of the paper

*Disclaimers & Disclosures

The preceding slides are an illustrative backtest based on a hypothetical allocation following a rules-based technical indicators approach using underlying indices or managers. They do not represent an actual portfolio returns and past performance is no guarantee of future results. Additionally, trading, tax, and management costs are not included.

The pro forma numbers reported above are models only, based on the quantitative rules based approach discussed above; however, the funds investment strategy was not employed during the time period shown for the pro forma results. Furthermore, the funds actual strategy and investment selections may vary substantially over time from that used to determine the model results. Thus, the pro forma model is of limited use in predicting future performance and actual results may vary significantly from the pro forma model.

This information has been prepared by Equitas Partners L.L.C. and while it has been obtained from sources deemed to be reliable, no guarantee is made with respect to its accuracy. Past performance is not necessarily indicative of future results. This does not constitute an offer or a solicitation of an offer to buy a security. Any offer or solicitation must be made only by means of a delivery of a definitive private offering memorandum.

This document is preliminary and for information purposes only. It is not an offer of, or a solicitation for, the sale of a security, nor shall there be any sale of a security in any jurisdiction where such an offer, solicitation, or sale would be unlawful. An investment in the Equitas Active Asset Allocation strategy may only be made pursuant to the applicable offering documents.

This document is intended for authorized recipients only and must be held strictly confidential. This document may not be reproduced or distributed in any format without the prior written approval of Equitas Partners, LLC or its investment manager.

Past performance is not necessarily indicative of future results. The information contained in this document should be considered in conjunction with the Disclosures and Definitions at the end of this document. Certain information contained herein has been obtained from third parties deemed to be accurate and reliable. While such information is believed to be reliable, Equitas Partners, LLC and its investment manager assume no responsibility for such information.

All information in the above report comes from sources deemed to be reliable but Equitas makes no guarantee of its accuracy. Both the Active Asset Allocation and Base Asset Allocation Portfolio are hypothetical backtested portfolios and here for illustrative purposes only . They do not represent actual portfolio performance returns. The Active Asset Allocation Portfolio is calculated net of a 1% annual management fee deducted quarterly, no portfolios account for trading, tax, underlying management or other expenses. Past performance is no guarantee of future results. Risk and return are measured by standard deviation and arithmetic mean, respectively. This graphic is for illustrative purposes only and not indicative of any specific investment. An investment cannot be made directly in an index.

The various benchmark indices referenced in the performance results portrayed herein are broad-based measurements of changes in market conditions based on the performance of widely held equity and debt securities. The strategies used to deliver the performance results portrayed herein may not invest in all securities comprising the benchmark indices. The inclusion of benchmark indices is intended to be for comparative purposes only because the indices are typically used to gauge the general securities markets or particular relevant sectors; they are not meant to be indicative of either the Base Asset Allocation Portfolio or the Active Asset Allocation Portfolios performance, asset composition or volatility.