Dutch funds to boost bond allocations Pensions & Investments

Post on: 17 Апрель, 2015 No Comment

Long-duration fixed income, interest rate swaps to help funds cope with rule changes

AMSTERDAM Dutch pension plans are poised to scoop up longer duration bonds and interest rate swaps to fend off a one-two punch of new accounting and pension regulations.

Funds also are expected to hike their allocations to fixed income and look farther afield for fixed-income investments.

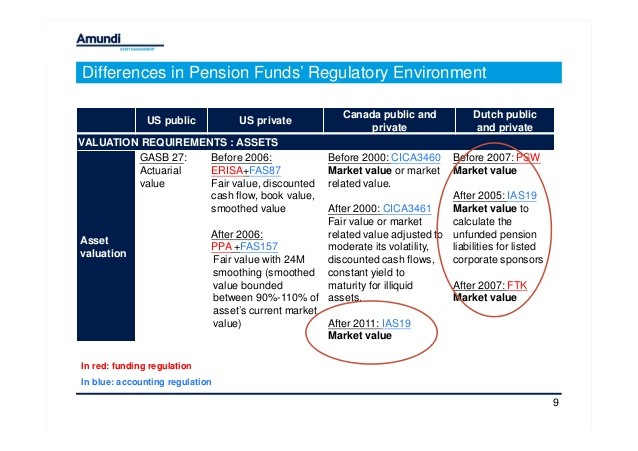

Both the new international accounting standard, IAS 19, which takes effect for publicly quoted companies in January, and the new supervisory framework, due January 2006, require pension plans to value liabilities at market rates.

Until now, Dutch pension plans were allowed to value liabilities at a discount rate of 4%.

Consultants and money managers active in the 450 billion ($580.9 billion) Dutch pensions market expect plans to match liabilities with assets by buying bonds with longer durations, making greater use of interest-rate swaps and investing in zero-coupon bonds. Fund executives say they are exploring the options and debating the merits of each approach.

As a result, up to 180 billion in pension assets over the next few years could be funneled to a broad range of bonds with durations of 15 years or more, according to Jeroen Tielman, chief executive officer at independent consultant FundPartners, Laren.

5-year bonds

Most Dutch pension plans now invest the majority of their fixed-income portfolios in five-year maturity euro-denominated government bonds, while their liabilities have a minimum duration of 15 years, said Bart Heenk, head of SEI Netherlands, Amsterdam.

As a result of the new rules, FundPartners’ Mr. Tielman expects pension plans to increase their overall allocation to fixed income to 65% of total assets from around 50% now, and extend their investment universe outside the eurozone to a wider range of lower correlated fixed-income instruments.

Sources said most Dutch pension plans are still on the drawing board with liability-driven investing and are debating the merits of buying longer-duration bonds in the face of rising interest rates.

Pension plans face a difficult trade-off between minimizing the volatility in the pension plan’s reserves and delivering greater investment returns through adding alpha, said Marc Van Heel, director-business development, Netherlands and Belgium, at PIMCO Europe, Rotterdam.

Large corporate funds such as the 4.2 billion Stichting Pensioenfonds Hoogovens, Ijmuiden, are believed to have already taken steps to invest in longer dated bonds, but the acute market sensitivity of these strategies means few plan executives are willing to talk about what they are doing.

Hoogovens earlier this year restructured its investment portfolio to take account of market valuation of liabilities and short-term solvency requirements. Jelles van As, chief investment officer at the fund, would not comment on reports that the fund had increased its fixed-income allocation 80% of plan assets from 52%.

Begun last year

Blue Sky Group, Amsterdam, which manages 9 billion in pension assets mainly for the KLM Royal Dutch Airlines staff pension plans, last year began buying inflation-linked global bonds and reducing its euro-denominated government bonds in order to better match its liabilities, according to Fons Lute, chief investment officer.

Currently 30% of the plans’ 4.3 billion fixed-income portfolio is invested in inflation-linked bonds, and Mr. Lute hopes to increase that to 50% within the next few months. The plans’ 1 billion real estate and 3.7 billion equity allocations will likely remain unchanged.

Blue Sky pension executives are also redefining fixed-income benchmarks to draw in longer dated bonds.

Blue Sky is in the fortunate position of being relatively well funded and not having to chase equity returns, he said. Using the current 4% discount rate to value its assets, the plans it manages are funded to between 145% and 174%.

Bob Puijn, director of financial assets at the 3.4 billion Stichting Pensioenfonds Akzo Nobel, Arnhem, said formal discussions on liability-led investing are taking place this month.

Plan executives at the 450 million Stichting Pensioenfonds CSM, Amsterdam, are considering long-term duration investing and using equities to reduce the overall risk profile of the pension plan, but no decisions have yet been made, said Hans van Errup, corporate treasurer at CSM NV, Amsterdam.

Until very recently, many plan executives were reluctant to buy longer-dated bonds in an environment of rising interest rates. But over the last few weeks there has been a shift in reaction and pension executives realize that they have to shift duration regardless of the investment implications of rising interest rates, said FundPartners’ Mr. Tielman.

The real issue is to manage the stability of the asset cover (asset-liability) ratio and not the investments, he added.

Tough search

Extending fixed-income duration is fine in theory, but pension executives and investment specialists are concerned the limited number of bonds with maturities beyond 15 years mean they will struggle to find investment opportunities.

And, Dutch pension plan executives are being bombarded with swap-based constructions by brokers and asset managers, said Blue Sky’s Mr. Lute.

Swaps are a generally a good alternative to accommodate the needs of pension plans when there is limited supply of long-term bonds, said FundPartners’ Mr. Tielman.

FundPartners currently is creating zero-coupon bonds to market to Dutch pension plans that are reluctant to use swaps. Zero-coupon bonds so far have not been widely used in the Dutch market.

Blue Sky Group’s Mr. Lute was concerned that swap strategies might bring additional credit and leverage risks to pension plans. The covenant of the Blue Sky Group prevents it from using investment instruments with leverage.

We are trying to look at traditional tools and, if necessary, fill the gap with things like swaps, but then we have to think about the leverage and credit risk that we are taking on, said Mr. Lute.

PIMCO has been working with a number of potential Dutch clients to restructure their fixed-income benchmarks to take account of the underlying cash flows that each plan faces, said PIMCO’s Mr. Van Heel.

And State Street Global Advisors is marketing a range of commingled funds with longer duration instruments for small and midsized pension plans, said Benoit Faly, managing director at SSgA Brussels.