Download Evaluating Hedge Fund and CTA Performance Data Envelopment Analysis Approach Wiley Finance

Post on: 16 Март, 2015 No Comment

Presenting Data Envelopment Review (DEA) — aquantitative approach to Download Buying Guide 2006 with Canadian Extra Free PDF assess the presentation of hedge money, funds of hedge money, and commmodity trading advisors. Steep yourself in this approach with this important new manual by Greg Gregoriou and Joe Zhu.This reserve steps beyond the classic trade-off between unmarried factors for possibility and homecoming within the determination of investments portfolios. For the very first time, a comprehensive procedure is definitely provided to create portfolios making use of multiple measures of chances and return simultaneously. This way represents a watershed in portfolio construction tips and is especially valuable for hedge account and CTA products.— Richard E. Oberuc, CEO, Burlington Hall Asset Therapy, Inc. Chairman, basis for Managed Derivatives ResearchOrder your own copy now!

EBook Reviews

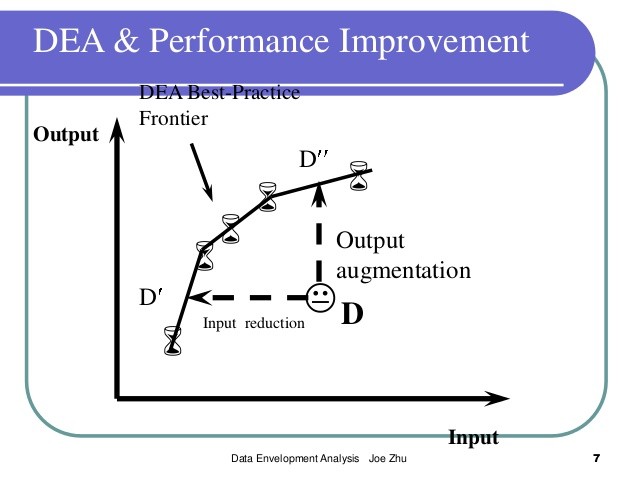

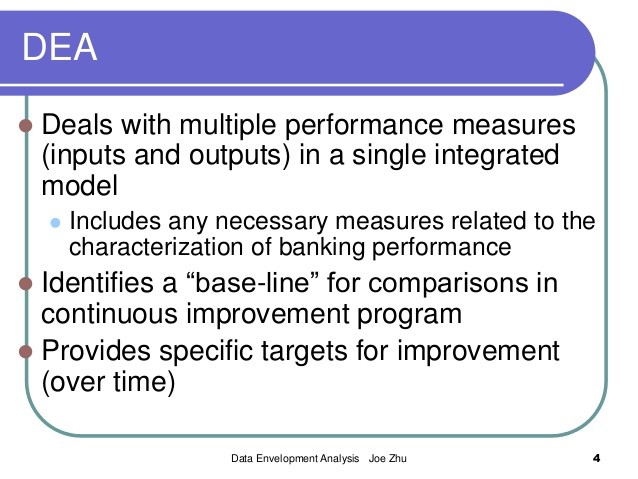

Examine # 1 The book applies a businesses management way — data envelopment study — to estimate the performance of hedge funds and CTAs. DEA is actually a multi-variate non-parametric linear optimization method that quantifies the commitment between several inputs and outputs. The method happens to be commonly found in businesses management, but in funds, financial investment management and portfolio pick, their use is truly nascent.The writers offer a fast introduction to DEA. we found it shallow. For anybody wanting a comprehensive, deeper, and a lot more recommended understanding the cloth, we would firmly recommend Zhu’s Quantitative Models for Efficiency Evaluation and Benchmarking, where the close derivation of the assorted ways offers a good understanding of the functional definitions of his approach. Chapters 6 to 9 provide the empirical studying of performance using hedge account and CTA data. The introductions are short and many of the content is definitely tables with final results. we would favor to produce seen a deeper explanation of the systems and the reasons why particular techniques are really more appropriate for the choice of particular show assessment. The multivariate approach is truly unique and oftentimes valuable when optimizing a portfolio given some sets of multi-collinear constraints. Just what this reserve does not have is a deeper review of this certain application.The book comes with a CD that contains Zhu’s DEA-Solver. This handy Excel add-in is helpful in adding DEA study.I produce used this approach for portfolio results assessment and found Zhu’s earlier mentioned book a bit more helpful than this manual. In my get the job done, we desired to uncover that mix of investments with the most efficient top and lower fractional minute distributions in a potential portfolio. It figured reasonably actually, slightly better than a regression approach. For the novice DEA user, my suggestions is truly to utilize this manual as an overview, but relate to Zhu when starting the analytical framework and applications.

Review # 2 I am always regarding the lookout for brand-new quantitative systems to complement my personal portfolio optimizers. I discover this approach pretty novel. It seems to do a good job at identifying effective funds from the non-efficient ones. Great fill, many thanks dudes.

Review # 3 The bit I got the manual I went straight to the CD to do all my consulting operate. Thanks to the CD I created over $125,000 US in a single week consulting making use of this applications and providing DEA scores of every hedge investment in my hedge fund database for a well-known fund of hedge money. It paid away my personal mortgage loan. DJ