Double Barrier Options

Post on: 16 Март, 2015 No Comment

Overview

The payoff of a simple European or American style call or put option depends only on the value of the asset, not on the path taken to get there. A double barrier option has a lower barrier and an upper barrier. These barriers control the option. Once either of these barriers is breached, the status of the option is immediately determined: either the option comes into existence if the barrier is an in or knock in barrier, or ceases to exist if the barrier is an out or knock out barrier.

Double barrier options of many types exist and it is best to try to understand these options by considering several key features. The first feature is the underlying option which can be a:

- European style, call or put option

- American style, call or put option

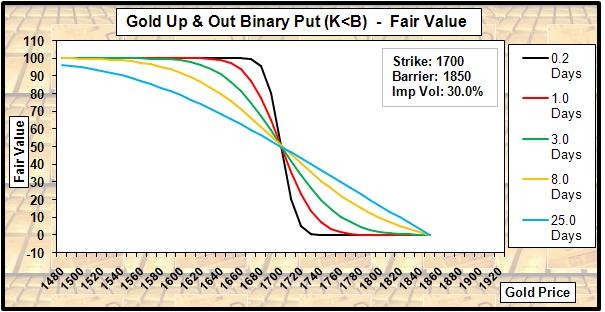

- Binary option. cash or nothing, asset or nothing depending on whether barrier is hit or not hit

Other possibilities exist, for example an Asian option. but we will not consider these in this document (nor are the functions relevant for any other cases).

The second feature is the combination of barriers. The options can be:

- A double knock-out (DKO) or in another name, one touch knock-out, Barrier Option. In this case, both the lower and upper barrier are knock-out barriers. Initially the holder of the option owns a call or a put option. If at any time, either barrier is breached, the option is lost (knocked-out). In some cases, at knock-out, the holder may receive a rebate.

- A double knock-in (DKI), or one touch knock-in, Barrier Option In this case, if either barrier is breached, the holder of the barrier option is knocked-in to, i.e. now owns, a call or put option. In cases where the option is never knocked-in, the holder may receive a rebate.

- An upper barrier knock-out (UKO) double Barrier Option In this case, if the upper barrier is breached prior to the lower barrier, the option holder is knocked out. If the lower is breached prior to the upper or neither barrier is breached, the holder owns the option.

- An upper barrier knock-out (UKO2) double Barrier Option In this case, if the upper barrier is breached prior to the lower barrier, the option holder gets nothing. If the lower barrier is breached prior to the upper, the holder receives an option. If neither barrier is breached, the holder gets nothing.

- A lower barrier knock-out (LKO) double Barrier Option In this case, if the lower barrier is breached prior to the upper barrier, the option holder is knocked out. If the upper barrier is breached prior to the lower or neither barrier is breached, the holder owns an option.

- A lower barrier knock-out (LKO2) double Barrier Option In this case, if the lower barrier is breached prior to the upper barrier, the option holder gets nothing. If the upper barrier is breached prior to the lower, the holder receives an option. If neither barrier is breached, the holder gets nothing.

- An upper barrier knock-in (UKI) double Barrier Option In this case, if the upper barrier is breached prior to the lower barrier, the option holder receives a call or put option. If neither barrier is breached, the holder owns an option.

- A lower barrier knock-in (LKI) double Barrier Option same as a UKI, switch lower and upper.

- A double touch knock-out Option (DTKO) In this case, the holder initially holds a call or but option. However, if both the upper and lower barriers are breached during the life of the option, the holder is knocked out.

- A double touch knock-in Option (DTKI) In this case, if both the upper and lower barriers are breached during the life of the option, the holder is knocked-in to a call or put option.

With all of these various barrier functions, the specification of rebates is possible. These rebates (cash or asset amounts) can be specified if one or the other barrier is hit or if neither barrier is hit. Using these rebate features is a way of including digital / binary payoffs that depend on barrier levels.

The final feature is the type of monitoring that is done at the barriers. Several possibilities exist:

- Each barrier is continuously monitored for the life of the option.

- Each barrier is partially monitored for specific windows during the life of the option. During these windows, the barriers are monitored continuously.

- Each barrier is partially monitored for specific windows during the life of the option. During these windows, the barriers are monitored at discrete dates.

- Each barrier is discretely monitored at specific dates during the life of the option.

We also note the following convention: the fair value and risk statistics for options which have knocked out historically are zero, where historically includes the present day. In the case of a standard DKO option for which the underlying price is less than the lower barrier value, or greater than the upper barrier value, all statistics are thus equal to zero, except the probability of breaching the barrier, which is equal to one. For partial and/or discretely monitored barriers, the same will be true if the barriers exist, and are monitored, on the valuation date of the option.

To find out more information about double barrier options and how to value them, contact a FINCAD Representative .