DonorAdvised Funds Can This New Trend Save You on Taxes

Post on: 28 Апрель, 2015 No Comment

by Alden Wicker

This post originally appeared on LearnVest .

They may be able to save you money on taxes and help make giving to charity simple. We’re talking about the newest charitable-giving darling: donor-advised funds or DAFs. These philanthropic vehicles allow people to make a charitable contribution, receive a potentially sizable tax benefit, and decide not only which charities will receive their donation but also when exactly the money will be disbursed.

Michael Hardy, a Certified Financial Planner ™ and a partner at Mollot & Hardy. often recommends donor-advised funds to his clients. “It’s for people who want to donate some money–whether it’s current or in the future,” he says.

And it’s clear that he and his clients are not alone.

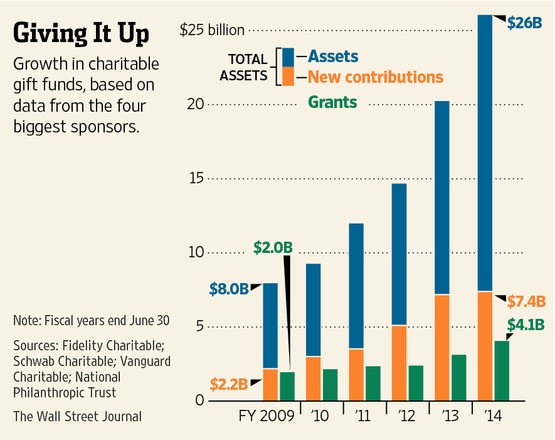

According to the National Philanthropic Trust. the number of donor-advised funds has grown steadily from 160,415 in 2007 to 201,631 in 2012—and the total amount of assets under management in DAFs also reached a high of over $45 billion in 2012. That same year, contributions to Fidelity Charitable, which is run by Fidelity Investments,reportedly rose by 89%. making it the second largest charity after the United Way. In fact, several well-known brokerage companies now offer DAFs, including Schwab, Vanguard and Calvert, to name a few.

There’s no doubt that donor-advised funds appear to be gaining traction, but it’s important to do your homework and understand both the benefits and the drawbacks of DAFs, including typically higher minimum contributions. So read on to find out how donor-advised funds work, whether they’re right for your financial situation—and how to help make sure your money is actually going to a good cause.

How Donor-Advised Funds Work

Put simply, if a mutual fund and a charity had a baby, it would produce a DAF. When you put money into a DAF, what you’re doing is taking funds that you’ve earmarked for a good cause and transferring them over—irrevocably—into the DAF. (You can also transfer over stocks or mutual funds, which many people do.) Once there, the assets are managed just like a mutual fund, and will hopefully grow tax-free until you’re ready to donate next month, next year or ten years from now. You can also dictate which nonprofit will receive the money and how much, and then the DAF writes out the check, so to speak. Seems simple, right?

Robert Berger, founder of the blog doughroller.net, is a big fan of DAFs. He and his wife use one for their charitable gifts. “In our case, it’s extremely easy,” he says. “We opened ours with Vanguard since we have a lot of investments with them. I literally just log into the charitable account, and I can transfer the individual stocks we own or Vanguard mutual funds. It takes a couple of minutes.”

4 of the Benefits of DAFs

Now that we’ve gotten the basics of how donor-advised funds work out of the way, here’s a simple breakdown of how these funds may be able to work in your favor:

- You may get a hefty tax deduction. When it’s time to do your taxes, you can deduct the full market value of your donation in the year that you donated. So if you bought $10,000 of stocks, and they appreciated to $15,000 in that tax year, if you moved them into a DAF, you get to deduct $15,000 on your taxes.

- You get tax-free growth. Once the assets are in the DAF, they appreciate tax-free. And you can even decide how to invest the money, whether it’s in long-term growth stocks if the plan is to donate years from now, or short-term bonds if you want to donate soon.

- You can typically donate to charities that don’t accept stock. “The primary reason that my wife and I became interested was because it was an easy way to contribute appreciated stock,” Berger says. “We give a fair amount of money to small charitable organizations that aren’t equipped to receive stocks or mutual funds, so when we decide that we want to make such a grant to a specific charity, Vanguard actually gives them a check for cash.”

Donating appreciated stock can be a huge benefit. If you had to sell appreciated stock yourself before donating the proceeds, you’d have to pay capital gains taxes, which would eat into the amount that the charity would receive—and your deductible contribution amount. By giving appreciated stock directly, you can help ensure that the full amount will be received by the charity and that your tax deduction is for the current value of the stock, without the impact of capital gains taxes.

For Hardy, that last perk is particularly desirable. “It kind of makes people feel like they have their own mini foundation,” he says of his clients who have DAFs. “It separates the money for a specific purpose, whereas keeping it in their own account might not feel the same.”

3 of the Drawbacks of DAFs