Don t Fight the Fed Interest Rates and their Impact on the Stock Market

Post on: 5 Май, 2015 No Comment

by Sam Stovall

I have frequently been asked, What is the one thing an investor should monitor in order to gauge the health of the economy and the direction of the stock market?

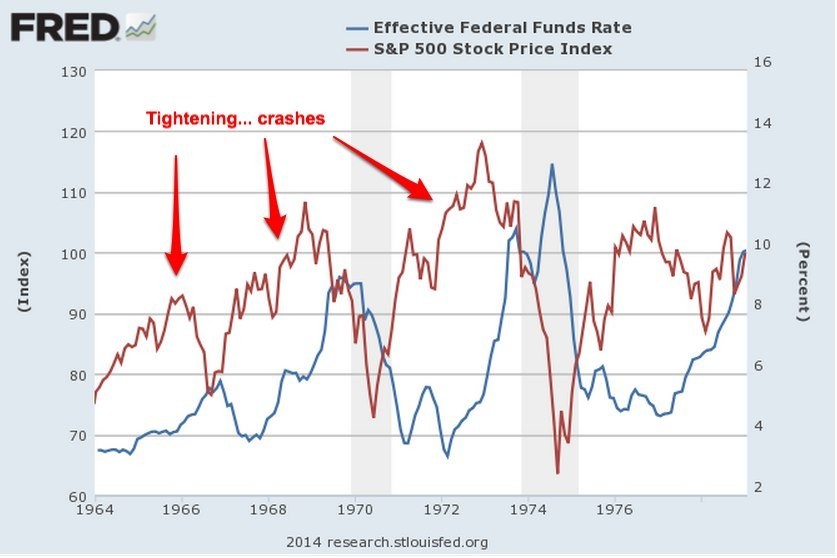

My response is interest rates. The mandate of the Federal Reserve is twofold: to promote economic growth and to keep inflation under control.

Think of it this way. If the economy were a car, the Feds responsibility as a driver would be to maintain a safe speed. If the Fed wanted to speed things up, then they would step on the gas by lowering interest rates. To slow things down, however, the Fed would need to tap or even slam on the brakes by raising interest rates and reducing the availability of capital.

The biggest challenge for the Fed is that our economy isnt a little red sports car that reacts nimbly to the application of the gas pedal or the brakes. Instead, the economy is more like a supertanker whose response time is remarkably slow. It usually takes between six and 12 months for the economy to feel the stimulation effects of lower rates. It also takes quite some time for the economy to slow down as a result of higher rates.

In the current market environment, the equity markets response time has been even slower than normal, despite the Feds rate reductions and unprecedented stimulative actions.

One reason could be that the recession and bear market were the result of higher energy prices, a worldwide credit crisis and a general crisis of investor confidence, not the result of higher interest rates. As a result, lower rates alone havent reversed the damage done to the economy and equity markets in the past 18 months. However, the Feds unprecedented efforts to loosen credit markets, support teetering financial institutions and stimulate economic growth will eventually take holdif one applies enough lighter fluid to their charcoal briquettes, they will eventually ignite.

Interest Rates and Earnings

So how do the raising and lowering of interest rates affect stock prices?

Investors buy stocks because they want a cut of the action. In the case of a stock, the action is price appreciation through earnings growth.

Earnings typically increase as a result of company-specific factors and economic considerations.

Company-specific factors include the desirability of the product or service the company offers, the markets it sells into, the quality of the management, and so on.

The economic considerations hone in on expected growth in the overall economy. As the economy rises, more and more goods and services are being produced, and an increasing number of people are finding jobs and receiving raises. These people, in turn, can then afford to purchase more goods and services. So when the economy expands, so do overall corporate earnings. This growth is frequently the result of the Federal Reserve having begun a rate-cutting program many months earlier.

After a cycle of interest rate increases, however, the reverse is true. Higher rates typically lead to slower demand. In addition, unemployment rises and corporate earnings growth contracts.

Substitutes and Present Values

An equity investor is concerned about rising and falling interest rates, not only because of how they affect the growth of the economy but also for reasons of substitution and present values.

Rising short-term interest rates also usually push up longer-term bond yields. If bond yields rise too much, however, investors begin to consider the possibility of selling their stocks in order to purchase typically less-risky bonds that now offer very attractive yields. This substitution effect, therefore, puts additional pressure on stock prices.

Interest rates also impact the valuation of earnings. When equity analysts evaluate the intrinsic value of a stock, they use a discounted cash-flow model. First, they estimate the future stream of cash flows that a company will produce. Second, they estimate the current worth of this future stream by discounting the future streams by the current interest rate. The higher the interest rate with which one discounts these future streams, the lower the present value of these streams.

Lastly, interest rates also have a direct impact on companiesparticularly those that continuously borrow money by issuing bonds in order to operate and grow. For these debt-heavy companies, higher interest rates will likely cause their interest expense to increase. As they retire old debt at lower interest rates, they will need to take on new debt at higher interest rates. This rising interest expense, which is paid to bond holders, will take an increasingly large chunk out of their overall earnings.

Therefore, the direction of interest rates is extremely important in projecting economic growth, earnings changes, substitutability, and present valuesall things analysts and investors look to when forecasting the attractiveness of stocks in general, and sectors in particular. You dont want to ignore, or underestimate, the impact that future interest-rate policy could have on the economy, corporate earnings, and your investments. You want to adjust your portfolios accordingly.

SPECIAL OFFER: Get AAII membership FREE for 30 days!

Get full access to AAII.com, including our market-beating Model Stock Portfolio, currently outperforming the S&P 500 by 4-to-1. Plus 60 stock screens based on the winning strategies of legendary investors like Warren Start your trial now and get immediate access to our market-beating Model Stock Portfolio (beating the S&P 500 4-to-1) plus 60 stock screens based on the strategies of legendary investors like Warren Buffett and Benjamin Graham. PLUS get unbiased investor education with our award-winning AAII Journal. our comprehensive ETF Guide and more – FREE for 30 days