Don t Buy Gold as an Inflation Hedge

Post on: 15 Август, 2015 No Comment

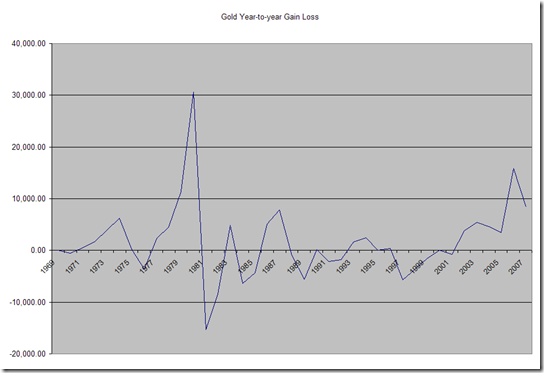

Buying gold as an inflation hedge is always in vogue. The problem is that there is little assurance that gold will consistently increase in line with rising prices. In the past century there have been a number of decades where gold prices consistently fell. It is much safer to find a few good miners and use their dependable dividends as a true inflation hedge.

In the past ten years inflation in the U.S. was generally between 1% and 4%. Inflation can be seen as too much demand chasing too few goods or too few goods for a given level of demand. The U.S. and Europe are dealing with record levels of unemployment, so demand pull inflation will be limited for the foreseeable future. There is little chance that supply side factors will increase inflation. Many miners are dealing with too much supply, and orders for mining equipment have fallen sharply.

Hyperinflation is almost always results from a combination of regime change, destruction of a nation’s real productive capacity or a large foreign debt. Seeing as the U.S. is facing none of these factors, the only inflation to worry about is the normal inflation of 1% to 4% per year.

Based on these numbers, good inflation hedge needs to grow by 3% per year. Is physical gold a good hedge? It may be or it may not, but there is little guarantee that it will consistently grow every year by 3%. In the past 12 months alone it has fallen by 23.5%. Falling gold prices are not a temporary event. From 1980 to 2001 the price of gold fell 59.8%.

A better inflation hedge

Miners with cost effective mines and stable dividends are a good inflation hedges. BHP Billiton ( NYSE: BHP ) runs a diversified mining operation and has steadily increased its dividend from $1.66 per share in 2010 to $2.28 per share in 2013. Given its current stock price around $68, the firm has a yield around 3.4%, right in the historical inflation range of 1% to 4%.

BHP Billiton is not primarily a gold miner, but it does have some gold mining operations. In recent quarter ending in September 2013 it mined 45,045 ounces of gold. While cutbacks in the iron ore markets have inspired the company to sell off a number of assets, overall it is in good standing with $28.8 billion in long-term debt against $70.7 billion in equity. BHP Billiton’s dividend growth may be compressed for the time being due to the current downturn, but it will keep paying its dividend year after year.

Rio Tinto ( NYSE: RIO ) is another big Australian miner. The company has a reasonable debt load with a total debt to equity ratio around 0.66 and growing production in the first three quarters of 2013 compared to 2012. Compared to BHP Billiton, Rio Tinto has less diversified operations. A relatively small portion of BHP Billiton’s income is dependent on iron ore, and its income is more secure in the long run.

Even gold miners offer inflation hedging dividends. Yamana Gold ( NYSE: AUY ) recently brought its all in sustaining cash costs down to $888 per gold equivalent ounce on a co-product basis. The company’s yearly dividend has exploded from $0.04 per share in 2009 to its current annualized rate of $0.26 per share. Low gold prices have forced Yamana to make its production profile more efficient and cut back low margin mines. These cuts are a positive sign of more efficient capex spending.

Be weary of debt

Miners with too much debt and a limited number of commodities can easily destroy their own dividends. As of September 2013 Barrick Gold ( NYSE: ABX ) had $14.6 billion in long-term debt for just $13.6 billion in equity. This high debt load has forced the company to cut its quarterly dividend from $0.20 per share down to $0.05 per share.

Adding more fuel to the fire, Barrick recently diluted existing shareholders by $3 billion to help pay down its debt load. Until its debt has fallen significantly and the company can make up for the lost future production in its defunct Pascua-Lama project, it is best to put this miner on the backburner.

Final thoughts

Gold is commonly portrayed as a great inflation hedge, but the reality is that miners are better inflation hedges. BHP Billiton has diversified operations and a strong dividend that is far above the current U.S. inflation rate of 0.96%. Rio Tinto is another option, but its operations are heavily dependent on iron ore. If you are comfortable with miners focused on gold, then Yamana’s low-cost operations are worth checking out.

The Motley Fool’s Top Stock for 2014

The market stormed out to huge gains across 2013, leaving investors on the sidelines burned. However, opportunistic investors can still find huge winners. The Motley Fool’s chief investment officer has just hand-picked one such opportunity in our new report: The Motley Fool’s Top Stock for 2014 . To find out which stock it is and read our in-depth report, simply click here. It’s free!