DollarCost Averaging

Post on: 26 Июль, 2015 No Comment

Is dollar-cost averaging (DCA) a sound investing strategy?

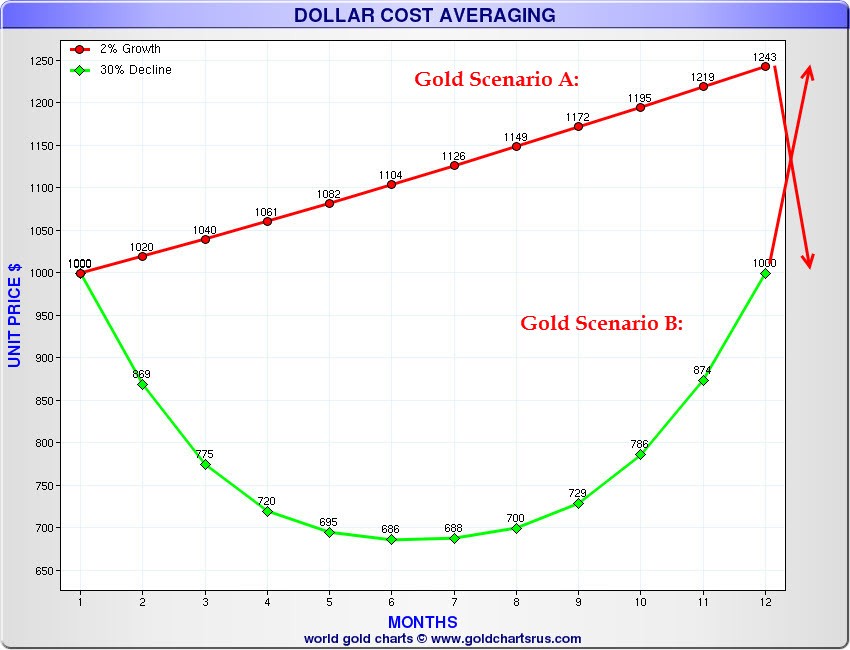

In theory, dollar-cost averaging allows you to invest smaller portions of your money over a longer period of time, reducing the chance that you pay a price too high for any individual investment. If your ideal allocation calls for $50,000 to be invested in the stock market through an index fund like VTSMX, rather than buying $50,000 worth of the fund in one day in a lump sum, dollar-cost averaging spreads that purchase in equal amounts out over days, weeks, months, or even years to reduce your exposure to daily fluctuations of the market. By investing the same dollar amount each time, you buy more shares when the price is lower and fewer shares when the price is higher.

In other words, if you buy $50,000 of VTSMX on January 1 and the stock market crashes on January 2 without recovering for six months, you might kick yourself for not having the cash available to buy when the price of the fund was more favorable in the months your investment on January 1.

Many brokers allow you to dollar-cost average or invest in a lump sum. Here are a few current special offers.

The only good reason for dollar-cost averaging is you may not have that $50,000 ready at one time. If you rely on investing only from money left over from your paycheck every two weeks, you dont have a lump sum available. Those who do have funds available might have already missed out by not investing earlier.

Investing in the stock market as soon as possible with whatever money you have available, in order to form your ideal asset allocation, beats dollar-cost averaging in the long run. Dollar-cost averaging would leave your ideal allocation unfulfilled by leaving a larger percentage of your total assets in cash, uninvested.

Overall, the stock market trends upward, even at the company level if that company is healthy. If you buy individual stocks of a healthy company, the price should move in an upward trend over the long term. Dollar-cost averaging will never be able to make up lost ground compared to investing an available lump sum because you will, on average, dollar-cost average your way into higher prices.

While there may be exceptions when looking at your investment performance in the short term, especially in an environment where stocks are stagnant or declining, but as a long term investing strategy, dollar-cost averaging fails. Small instances of luck will eventually give way to major trends. So far, almost every experiment Ive personally attempted has shown that I cannot reliably time the market as well as I want to. I almost always would have done better by just investing as soon as possible rather than sitting with cash.

Psychologically, however, dollar-cost average has a more important role. Spreading out the short-term exposure to any specific days stock price can make an investment in the stock market feel less risky. If youd otherwise be concerned about your investments that might fall 1%, 5%, 10%, or more in one day, dollar-cost averaging can help allay those fears. If you have those fears, you may want to reassess whether youre comfortable with the risk of the stock market in the first place.

Here are some links for thought:

Please share your dollar-cost averaging experiences, concerns, and thoughts.

Updated March 24, 2011 and originally published June 16, 2010. If you enjoyed this article, subscribe to the RSS feed or receive daily emails. Follow @ConsumerismComm on Twitter and visit our Facebook page for more updates.