Dollar How Do Foreign Currencies Fluctuate

Post on: 7 Июль, 2015 No Comment

Posted on Jul 12, 2010

Youve maybe heard that the dollar is stronger right now compared to the Euro than it used to be (which is why we’re half-seriously thinking of taking a Euro trip this summer). Let’s digest.

In order to be aware of our surroundings, it’s important to understand what it actually means when a newscaster says that a certain currency is “up” or “down” in a given month. For example: In 2008, a Euro cost almost $1.70—at the time of this writing, it was trading around $1.26. Meanwhile, in 2007, one U.S. dollar bought nearly 120 Japanese yen…if we went to Japan now, that same dollar would garner only about 88 yen.

Here’s what you need to know:

1. How Currencies Fluctuate

On a fundamental level, it’s about supply and demand. The dollar is worth more when there are more people who want to own dollars than there are actual dollars (in other words, when demand is more than available supply). When demand for the U.S. dollar drops, that doesn’t mean that people don’t want money anymore. It just means that they want to store their money in a different way (say, they want to keep Euros or yen instead).

2. What Would Make Someone Want Money In A Different Currency?

It’s all about confidence. If you thought that the U.S. dollar was going to plummet but that the Argentine peso was going to hold strong, you might buy pesos. Currency fluctuations are complicated and depend on a lot of macroeconomics; all the same, a great deal of the ups and downs of the dollar comes down to how people feel. If they’re confident the dollar will strengthen, they’ll buy in. If they’re suspicious about the economy, they’ll opt out.

3. Zimbabwe’s Inflation Rate Was 15 billion%! So, You Can See The U.S. Appeal

During inflation, each dollar becomes worth less (example: a loaf of bread that used to cost $2 might now cost $3). So, pretend for a moment that you were in Zimbabwe in 2008, where—according to the CIA World Fact Book —inflation was 14.9 billion percent: Money that you had one year would be almost worthless by the next year! If, however, you bought the equivalent amount in U.S. dollars, you would have held on to way more of your buying power by this year. Now you see why people like investing in stable economies .

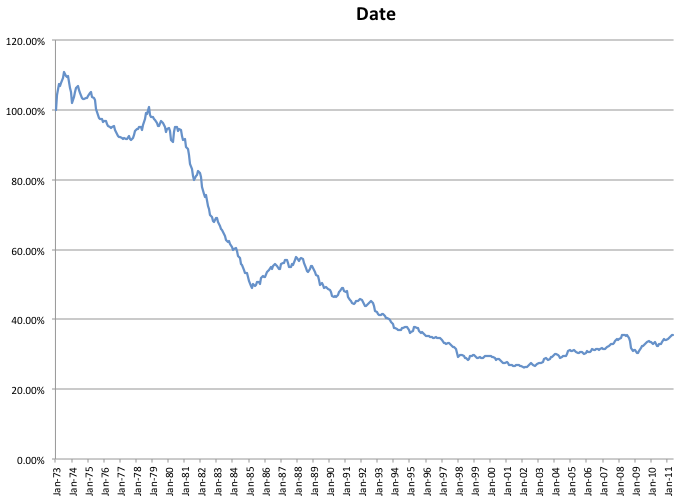

4. The U.S. Dollar Was Weak For A Few Years, But It’s Staging A Comeback

This has to do as much with other economies as it does with our own. When other countries have economic crises (think Greece!), the U.S. begins to look like an increasingly stable way to store cash.

5. What This Means For You: Cool Your Jets

We obviously don’t want you to plan a Euro trip you wouldn’t have taken otherwise, but if you were going to go anyway, enjoy the stronger dollar. Know that, although the economy can be pretty choppy, it’s regular for currencies to go up and down and that it’s a normal part of investing and life.

*Please note that, in the Daily email version of this article, we stated in the first bullet point that the value of the dollar increases when demand is less than available supply, whereas we really meant to say more. Unfortunately, the amendment to this typo didnt make it out in time for publication, but it has been amended in this blog post. This post on LearnVest Living is the correct version.