Dollar Cost Averaging Versus Lump Sum Investing

Post on: 4 Май, 2015 No Comment

I ve always been suspicious of dollar-cost averaging. With DCA, rather than investing the cash you have all at once, you invest chunks of it over time. For example, you might invest $12,000 over the course of a year, $1,000 each month. In contrast, with lump sum investing, youd put the full $12,000 to work right away.

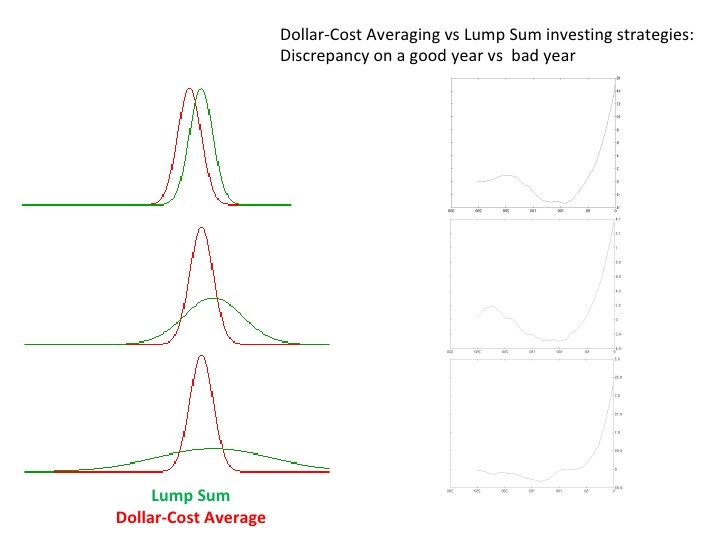

The problem with DCA as I see it is that it depends on market timing. With DCA, youll be better off only if the market declines during the period of time you are investing your money. If the market goes up, you will have wished youd invested everything at once.

Vanguard just released a study that reached the same conclusion (more or less). Called Dollar-cost averaging just means taking risk later (pdf), the study compared the historical performance of dollar-cost averaging with lump sum investing. The results

On average, we find that an LSI approach has outperformed a DCA approach approximately two-thirds of the time, even when results are adjusted for the higher volatility of a stock/bond portfolio versus cash investments. This finding is consistent with the fact that the returns of stocks and bonds exceeded that of cash over our study period in each of these markets.

Vanguard then provided the following explanation:

We conclude that if an investor expects such trends to continue, is satisfied with his or her target asset allocation, and is comfortable with the risk/return characteristics of each strategy, the prudent action is investing the lump sum immediately to gain exposure to the markets as soon as possible. But if the investor is primarily concerned with minimizing downside risk and potential feelings of regret (resulting from lump-sum investing immediately before a market downturn), then DCA may be of use. Of course, any emotionally based concerns should be weighed carefully against both (1) the lower expected long-run returns of cash compared with stocks and bonds, and (2) the fact that delaying investment is itself a form of market-timing, something few investors succeed at.

The results of the study are interesting because dollar-cost averaging has been a widely promoted way to enter the market. Yet CNN published a piece on the downside of DCA, as did Market Watch and my friends over at MSN .

The Vanguard report took it all a step further and actually put numbers into the mix. Assuming that an investor invests each month for a year versus a lump sum investment, the report examined which investor would be ahead 10 years later. Vanguard used rolling 10-year historical investment returns. The conclusion was that lump sum investors come out on top 67% of the time versus just 33% for those using DCA.

The result was a 2.3% improvement using lump sum over dollar-cost averaging.

Its important to note here that investing in a 401(k) each paycheck is a great way to invest. While it looks a lot like dollar cost averaging, its really not. You are investing what you can each pay period. Its not as if you are holding on to more money and waiting to invest next month. The Vanguard report made this clear:

Most popular commentary addresses DCA in terms of consistent investments made using current income—i.e. an employee transferring a portion of each paycheck into a retirement account. In that case, investable cash becomes available only in relatively small amounts over time, which makes DCA a prudent way to invest (and really the only sound alternative to accumulating that money in cash and then actively trying to time the market at some later point). Our research, in contrast, focuses on the strategies for investing an immediately available large sum of money. Here, the average performance results have favored lump-sum investing.

So which approach do you think is best?