Dollar Cost Averaging v Sum Investment

Post on: 4 Май, 2015 No Comment

Youve probably heard of dollar cost averaging. I do it down here in Florida when the ocean water starts to cool down in the fall. I start with just my toes in the water and over the course of ten minutes, Im in up to my head. It doesnt change anything about my situation other than my comfort level. If I were to run in to the water instead of taking a series of slow, tentative steps, I would be used to the water faster and enjoying my swim ten minutes earlier.

In many situations, your money works the same way. Dollar cost averaging is one of those well-known investing ideas that were all supposed to believe but it only works as intended for certain investors.

How it Works

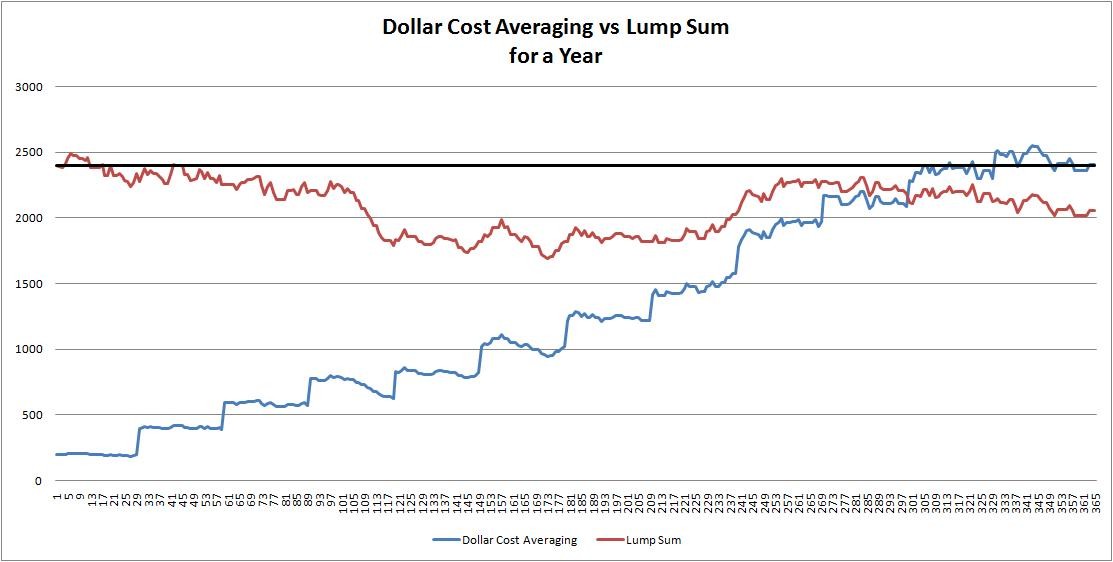

You and I cant time the market. If we could, we would all be filthy rich but it isnt possible. Dollar cost averaging allows us to buy or sell in small increments over time. This, in theory, takes market timing out of our investing decisions because were not trying to find the top or bottom of a market move. Most inexperienced investors will try to find the tops and bottoms but all will fail when their results are measured over a longer time frame. Even the relative few day traders that turn a profit dont try to find tops and bottoms.

The Debate

The problem I run in to when putting clients money to work is that there is never a perfect time. In bull-acting markets, it always seems overvalued and ready for a big drop. In bear-style markets, we know its going to go back up but if I buy now, there might be more pain ahead. The only slightly less anxious time to buy is when the market is moving sideways but even that indicates that at some point there will be an explosive move up or down. If I can capture an extra one or two percent for a client, it helps them from the very beginning and makes me look like a more astute investor than I am.

But statistics show that Im just as likely to get it wrong as I am to get it right. Its impossible to predict the market moves so if I wait too long, Im losing out on dividend payments and regardless of what the market is doing, its medium term (two to five years) outlook is likely better than what cash or a treasury is paying.

Stock Traders

Dollar cost averaging works well for stock traders. By its nature, stock trading is market timing. If a trade is going well, I can dollar cost average out of the position. Maybe I take the profits and keep the original investment intact. If its not going well but it hasnt hit the price where I cut my losses completely, I can sell out of half the trade. Im not advocating any trading strategies but dollar cost averaging removes the all or nothing mentality out of short term trading. Hedging can do that as well but thats not what were exploring here.

Long Term Investors

Long term investors arent looking for short term gains. Short of a catastrophic event, theyre likely not going to take their money out of the market for decades. Because of this, they arent so much interested in short term valuations of their product. Getting all of the money in to the market where dividends are captured as quickly as possible is how consistent and sustainable wealth is created. Even one dividend payment compounded over 30 years is a significant sum of money. That one $50 dividend payment missed as a result of waiting for the perfect time turns in to more than $200 by the time a portfolio has to be liquidated.

Bottom Line

For those reasons, I tell clients that we should get their money to work now. If theyre a little uneasy about running in to the ocean with their money, we put it to work a little more slowly but waiting for the perfect time doesnt help your portfolio. Youll never find it.