Dollar Cost Averaging How Much at a Time

Post on: 26 Июль, 2015 No Comment

Budgeting small sums to invest regularly is a form of dollar-cost averaging.

Hemera Technologies/PhotoObjects.net/Getty Images

More Articles

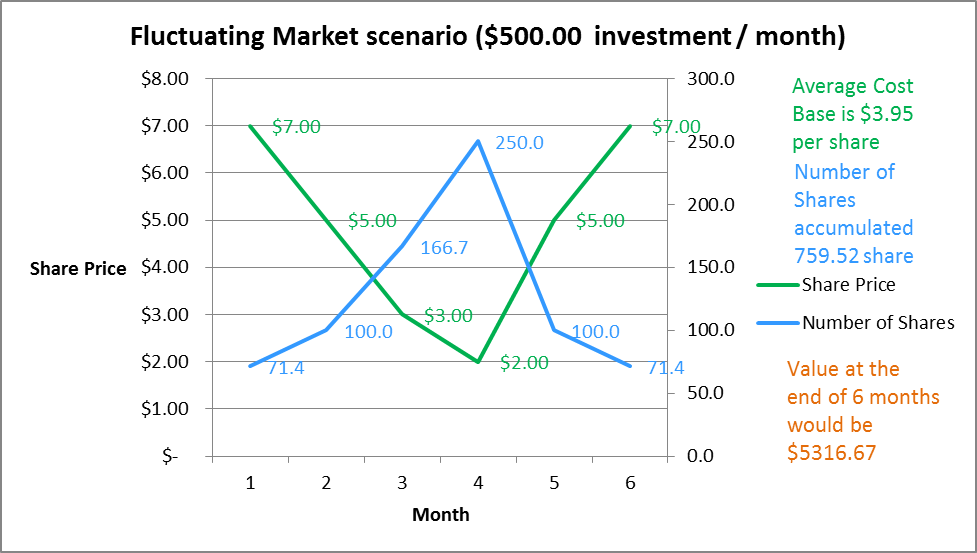

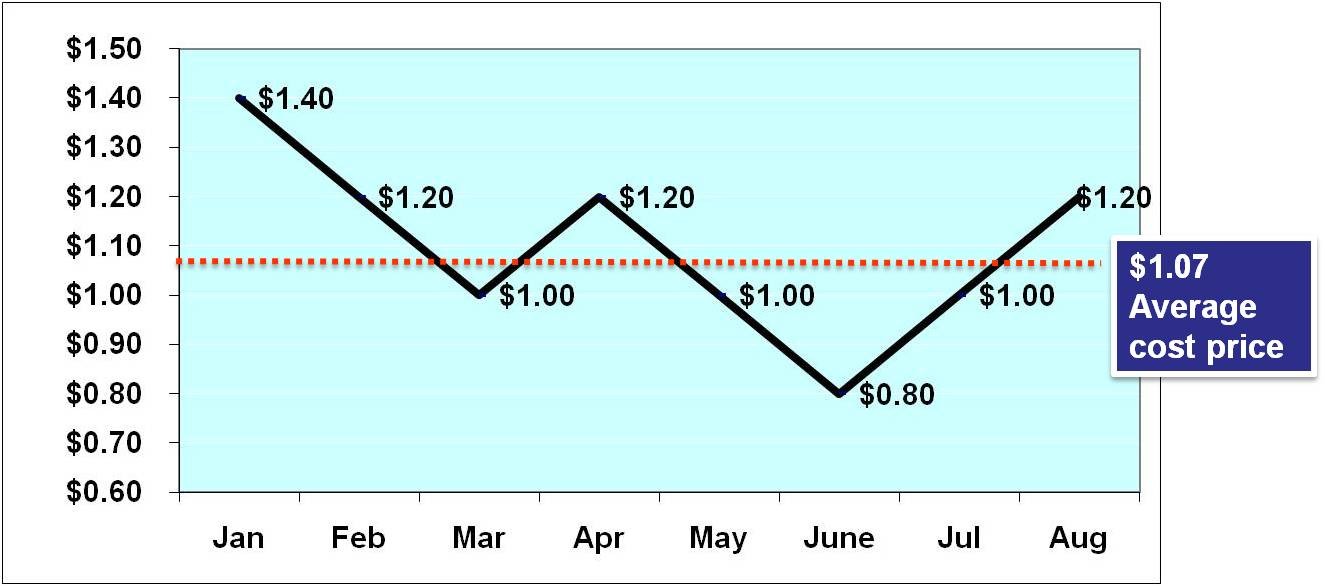

Dollar-cost averaging has been presented as a way to reduce risk when investing large sums of money. However, not everyone agrees. People talk about ‘dollar-cost averaging’ as if it were a way to cut risk. It isn’t, Kirk Spano, founder of Bluemond Asset Management, LLC, says in a 2012 MarketWatch article. However, investing regularly may help you build your retirement nest egg steadily over time.

Regular Investment

Savers on a budget can invest relatively small sums each month into a 401(k) or individual retirement account, not as a way to reduce risk but because of financial necessity. They can budget an amount from each paycheck to take advantage of the gains of regular investing over long periods. You can use dollar-cost averaging this way, investing an amount each month that you can afford. Patricia Lovett-Reid, vice president and managing director of TD Wealth Management in Toronto, says this type of investing doesn’t guarantee a better rate of return, but it does guarantee discipline.

Lump-Sum Investment

To take advantage of dollar-cost averaging to invest a larger sum of cash, you must determine the time frame you wish to space the investment out over to determine how much to invest each period. For example, if you want to invest a $48,000 in a growth stock mutual fund through dollar-cost averaging over the next year, you should make 12 equal monthly investments to the fund of $4,000 a month. If the fund has a higher minimum investment, you can invest $12,000 every quarter and accomplish the same goal.

Portfolio Allocation

Setting a portfolio allocation and investing your money in one lump sum will allow you to meet those allocation goals. Let’s say you have $100,000 to invest and you decide to invest 70 percent in stock mutual funds and 30 percent in bonds. You can make a one-time investment of $70,000 in the mutual funds and $30,000 in the bonds. Dollar-cost average investing will take you longer to reach your target amount. If you practice dollar-cost averaging over a year, and the market falls, your investments may perform slightly better. However, if the market rises, dollar-cost averaging could reduce your investment performance over lump-sum investing.