Dollar Cost Averaging Actual Results From the Past 10 Years

Post on: 4 Май, 2015 No Comment

by Darwin on January 29, 2013

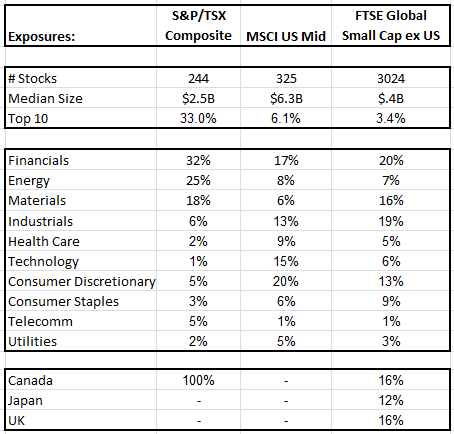

Dollar cost averaging is one of the most popular and basic investing tips out there when it comes to basic theory and practice. There are many positives, and a few negatives worth considering if youre going to dollar cost average your investments rather than use a different method. To put the real results into perspective though, I crunched some numbers of how you would have fared over the past 10 years if you had performed any of three different investment methods:

- Dollar Cost Average Monthly I modeled $1000 invested at the closing market price every month for 10 years. Total investment was $120,000.

- Dollar Cost Average Annually I modeled $1200 invested at the closing market price every year for 10 years. Total investment was $120,000.

- Initial One-Time Investment I modeled a single one-time investment of $120,000 at the start of the 10 year period.

- I used the Nasdaq as my proxy QQQ ETF (for more on ETF investing in indices, leveraged ETFs, commodities and more, visit my other site ETFBase.com ). The reason I used QQQ instead of the more common SPY representing the S&P500 was two-fold. First off, the Nasdaq is more volatile and whatever thesis results from this exercise would be more pronounced. And after all, if youre investing for the long-term and anticipate stock prices always move up over long enough periods of time, you want to be in higher beta investments. Secondly, I also wanted to minimize the impact of dividends. See, I was kinda lazy and was looking for a directional/magnitude result here and didnt want to complicate things by having to include dividend payments each quarter, reinvesting those dividends, etc. Since the dividend yield on QQQ is less than half that of SPY, the effect of ignoring dividends is much more palatable for this exercise.

Im including a screen shot of the raw data and a graphical representation of the results. What youll find is that of course, because the index was up relatively substantially over a 10 year period, youd have been better off having invested all your money up-front rather than dollar cost averaging along the way. Now, you may just think, anyone confronted with the options would always do that since the returns would be higher. But no, to the contrary, the human psyche plays games of guilt on us. Many people are so risk averse that even if they had $120,000 laying around today, they would NOT invest it as a lump sum. They would sooner hold some in cash and gradually invest it into an index over many years in a dollar cost average fashion rather than invest it all at once. They figure (rightly so) that if they invest at a lousy interval like right before a major crash, they wont lose 50% of their investment within a short period of time. So, theres no right answer here looking forward. Historically, most times youd have been better off having invested up front but of course if you cherry pick a start date just prior to a crash, the results will be to the contrary.

(click to enlarge)

Regardless, for the most recent 10 year period, here are the actual results:

- Dollar Cost Average Monthly $194K

- Dollar Cost Average Annually $208K

- Initial One-Time Investment $339K

(click to enlarge)

Its interesting to note that theres not much difference at all whether you invested monthly or annually, but the one-time investment showed a huge gain, almost tripling your money over the 10 year period. This would probably be a triple if you threw in the dividends, which I excluded of course.

If dollar cost averaging is something youre interested in, there are some great low-cost online investment houses, some of which are offering signup bonuses right now. Use one of these links to get the following promotions:

- OptionsHouse — 100 Free Trades with a New Account

- ETrade Trade free for 60 days and get up to $500 in Bonuses

- OptionsExpress $100 Bonus with a new account

If youre going to start dollar cost averaging or trade in general, you might as well get a bonus even if you have a few accounts! (I do).

And of course, to keep track of it all in a nifty, no-hassle format so you can see your net worth every day, just sign up for a free account with Personal Capital .

Do You Dollar Cost Average?