Does Reinvesting Dividends Matter Yes!

Post on: 5 Май, 2015 No Comment

Even with the fiscal cliff approaching and tax rates on dividends having the potential to go up, dividend paying stocks can still be a good investment. When you buy an individual stock, most brokerages offer you two options: pay dividends in cash, or reinvest the dividends. This can be an interesting choice for first time investors do you continue to invest more in a company, or do you take the cash and run?

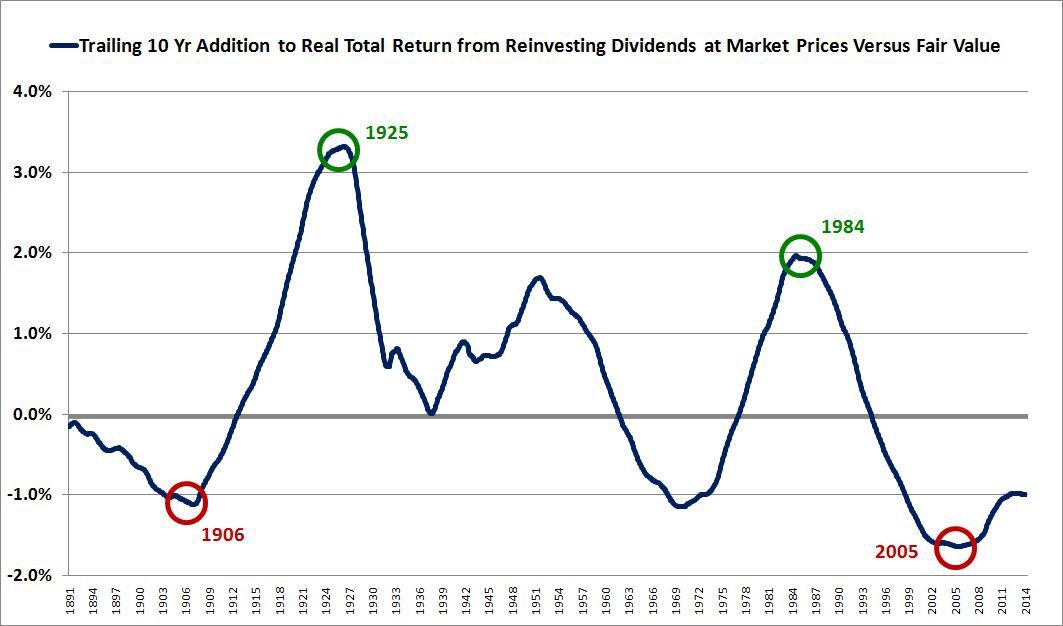

In a lot of circumstances, reinvesting the dividends can super-charge your returns, and that should be your first choice when opting to make the dividend reinvestment decision. Here is some of the math to prove it.

The Case for Reinvesting Dividends

The biggest case for reinvesting dividends is the power of compounding returns over time. It is the same case as putting money in a money market fund. If you invest in high-quality dividend paying stocks, like the dividend aristocrats. you not only get the perks of your income growing over time, but you also get to enjoy the potential price appreciation of the underlying stock.

Here is a good example. Say you invest $10,000 in Coca-Cola (KO), which pays a $1.02 per share (adjusted for split) dividend each year, and has consistently paid a quarterly dividend to shareholders since 1920.

Your $10,000 investment would buy you approximately 270 shares of Coca-Cola, which would earn you $275.40 per year in dividend income.

Now, if you reinvested that income at the same per-share price, you would now have 278 shares of Coca-Cola, which would earn you $283.56 the following year.

Over time, this compounding will continue to build, helping deliver better stock performance over time.

Heres some more math:

If youd invested in 400 shares of Coca-Cola in 1984 (the same year Warren Buffett invested in it), you would have seen a 12.8% return on your investment on just price and stock splits, not including any dividend reinvestment.

Now, if you would have just taken the dividends in cash over this period, Coca-Cola would have paid out a little over $181,000 in dividends. Thats a nice amount of cash, but just wait

If you would have reinvested those same dividends over time, not only would you have earned an additional $84,000 in dividends (since the reinvested shares would also have paid dividends , but the reinvested shares would have also appreciated another $230,000, boosting your return from 12.8% to almost 17%.

Granted, Coca-Cola is a great performer over time regardless of dividends paid, but this same math holds true for many companies. The fact is that dividend reinvestment will boost your returns over time, sometimes dramatically.

Times When You Shouldnt Reinvest Dividends

There are some times when you shouldnt reinvest the dividends you receive in a company stock. These are mostly unique situations, or cases for advanced investing strategies, but you should be aware of them nonetheless.