Do These 19 Companies Have Too Much Cash

Post on: 22 Апрель, 2015 No Comment

Everybody loves cash, but when it comes to investing, is a company’s large cash balance really a good thing? Most people understand that too much debt is bad and automatically assume too much cash is good. Maybe in your personal life that would be true, but not necessarily for corporations. In truth, having excessive cash can cause problems for a company, especially when it’s not being used to grow the company or returned to shareholders.

In good times, with reasonable borrowing costs, it makes sense for corporations to take on more debt to leverage up and pursue growth opportunities. What happens when times turn rough? How much cash should a company keep on hand to weather downturns?

In theory, a company should only keep enough cash on hand to cover capital expenditures and expenses, assuming they are cash flow positive. The quick ratio is often used to determine if companies have enough liquidity to meet short term obligations.

The higher the ratio, the more easily a company can meet short-term cash requirements. The quick ratio differs from the current ratio in that it excludes inventory, which can sometimes be difficult to convert into cash depending on the nature of the business. Theory says that any cash above this level should be returned to shareholders, and the company should turn to the debt markets if they wish to pursue new investment opportunities.

As we all know, there are exceptions to every rule. This theory was developed without taking into consideration economic fluctuations or the capital requirements of different industries. Companies generally like to keep a larger cash buffer for this very reason, especially in capital intensive or cyclical industries where they may need to weather downturns.

Probably the most recognized problem with a cash hoard is the opportunity cost given up. Especially in a low interest rate environment, it doesn’t make a whole lot of financial sense to keep that money in the bank. If managers can invest in projects or make acquisitions that give a higher return than the cost of capital, it makes sense to pursue those projects. If not, return the excess cash to shareholders either through buybacks or dividends.

Another reason I tend to dislike large cash positions is because of the sedentary attitude management will develop. Spending tends to get out of control and management feels less pressure to increase shareholder value. This also creates one of two agency problems with regards to management’s risk tolerance. If insider ownership of the common stock is low, they will often let the cash sit there, knowing they have job security and a paycheck as long as they don’t screw anything up. Conversely, if the majority of their salary is in options, they can be persuaded to take on excessive risk and could end up making bad investments. If a company is forced to raise capital in the debt markets, it generally brings greater scrutiny and control over how the company manages its capital.

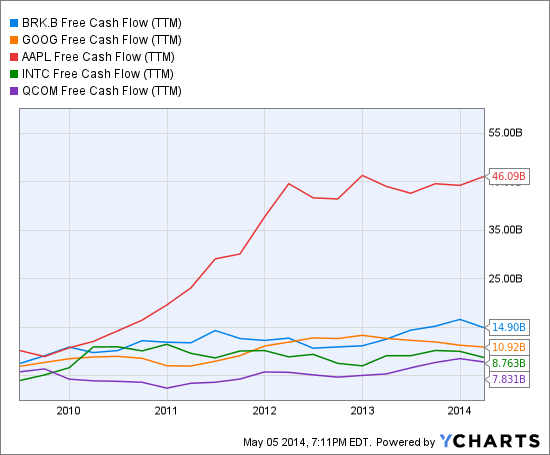

There are obviously worse problems to have than too much cash. A problem that was once only reserved for drug dealers is now worrying CFOs. Normally, they would invest in short-term securities, but with such low returns, those investments are hardly appealing. After much debate, Apple (NASDAQ:AAPL ) recently announced it would start a dividend and share repurchase program that would reduce cash by $45B over three years. Today, the S&P 500 yields just 1.87%, which is shockingly low considering the amount of cash on balance sheets.

In 1949, Benjamin Graham wrote in his book The Intelligent Investor . The typical management will operate with more capital than necessary, if the stockholders permit it- which they often do. Board’s today have the option of using the excess cash for share repurchases, dividends, strategic acquisitions, or capital investments.

Let’s take a look at several companies who would benefit from a better capital allocation strategy.

Net cash represents 80% of equity market capitalization.

Current Ratio: 3.94. Book Value: $2.36. Levered Free Cash Flow (12mo): $31M

Net cash represents 84% of equity market capitalization.

Current Ratio: 2.47. Book Value: $11.84. Levered Free Cash Flow (12mo): $2.48M

Net cash represents 60% of equity market capitalization.