Do ‘Customized’ TargetDate Funds Hit the Target

Post on: 16 Март, 2015 No Comment

As automatic enrollment becomes a staple of 401(k) plan design, the resulting deferrals are increasingly invested in target-date funds (TDFs). But a growing issue for plan sponsors is whether off-the-shelf TDFs are robust enough for their growing role in retirement plan investing.

Make no mistake, TDFs are the star of the show for 401(k) plans with automatic features. Some 85 percent of plans use a TDF as the default investment choice after automatically enrolling participants, according to Aon Hewitt’s 2013 Trends & Experience in Defined Contribution Plans study of 407 U.S employers.

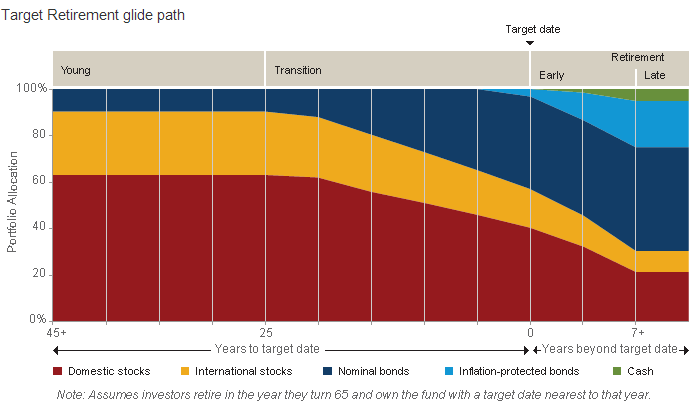

But some plan sponsors are considering whether it pays to purchase a customized series of TDFs, which use an asset allocation mix and glide path (the changes to asset allocation as the fund moves closer to the target retirement year) designed to meet the specific demographic needs of the plan sponsor’s workforce, rather than the population at large. The question is whether these are a better option for participants than the off-the-shelf TDFs offered in most 401(k) plans.

“Whether your participants are web developers in California or cattle ranchers in Wyoming, vocation and location should have an impact on the design of custom target-date solutions,” advised a 2014 report by the Morningstar Investment Management Group, Why Human Capital Matters to Retirement Plan Participants. One scenario in the study involved Joe the field engineer. Because Joe and his colleagues work in the oil industry and their risk of job loss is tied to volatility in that sector, “[their] employer could provide a custom target-date solution specifically designed to underweight asset classes with high correlation and exposure to energy stocks and commodities,” Morningstar noted.

How a series of TDFs is customized varies—for example, a tailored glide path might be created for an organization’s workforce, or a standard glide path might be used with customized funds.

The Aon Hewitt survey found that 16 percent of surveyed 401(k) plan sponsors offered some sort of customized TDF in 2013, up just slightly from the 15 percent that did so in 2011. But the use of customized glide paths increased somewhat more over that same time period, 13 percent in 2013 compared to 10 percent in 2011.

Preliminary results from the Towers Watson 2014 Defined Contribution Survey of 457 employers found that 22 percent are using custom TDFs and 27 percent are considering doing so in the future.

Plan Size Matters

The decision whether to offer custom TDFs often comes down to plan size. Quite simply, it can be difficult and expensive for small and even midsize 401(k) plans to offer custom TDFs. “Smaller plan sponsors do not have the expertise to make all the decisions required to complete a successful customization,” said Greg Carpenter, CEO of Employee Fiduciary, a 401(k) recordkeeper for small businesses. “Smaller sponsors choose the off-the-shelf funds precisely because [funds and glide path] are preset.”

Cost is another key concern. At their core, custom TDFs require an unbundled approach to investment management that plan sponsors would have to handle themselves or hire outside help to administer for them. For instance, custom TDFs require daily cash flow and liquidity management, rebalancing, security valuation, calculation of the fund’s net asset value, and ongoing maintenance of the glide path.

As a result, they “are more expensive to administer and require some internal expertise to oversee,” said Holly Hollub-Verdeyen, director of defined contribution investments for Russell Investments. “Although custom target-date funds could theoretically be used by any plan sponsor, the reality is that they are really only an option for larger, more sophisticated plans with significant resources.”

In these cases, plans would need at least $100 million in assets or even more to make custom TDFs a reasonable option, Hollub-Verdeyen noted. With a larger asset base, plans can take advantage of lower cost funds for the underlying investments, such as institutional funds and “separate accounts,” in which fund investments are administered through an external investment manager.

What to Customize

For plans with sufficient assets to make custom TDFs a viable option, there are a number of ways these funds have the potential to help participants, advocates say. For one thing, the fund can adhere to the demographics among plan participants and the age at which most of them retire. If plan participants tend to retire early at age 55 or late at age 68 or 69, an off-the-shelf TDF may not meet their needs because it is assuming a retirement age of 65.

“The glide path of such a fund may not be appropriate for these populations,” said Martha Spano, a principal with Buck Consultants.

In addition, because custom TDFs often have the freedom to choose from a wide variety of investment options and asset classes, customized funds could make use of diversified investments not available in an off-the-shelf product, such as hedge funds, private equity, real estate and other asset classes that can provide more inflation protection as participants get closer to retirement.

“Off-the-shelf target-date funds construct their de-risking glide path based on the general population. They make broad assumptions about the circumstances and behavior of the typical participant, such as salary, contributions, career length and account balance,” said Hollub-Verdeyen. “Customized target-date funds replace these generic assumptions with data about actual participants collected from the employer.”

“This approach allows employers to customize the target-date fund based on the needs of the population, not some generic model,” said David O’Meara, senior investment consultant with Towers Watson. With these funds, “plan sponsors can define who is most dependent on the defined contribution plan and address their needs as adequately as possible.”

The Other Side: Custom TDFs Critiqued

The arguments underpinning the selling of custom TDFs are not without critics, some of them blistering, who charge that customization is a waste of plan sponsors’ money. For instance, pension consultant Ron Surz recently called the marketing of custom TDFs a “trillion dollar fraud” against plan sponsors.

“The fraud is that a glide path can actually be built to meet the unique needs of a diverse group of employees,” wrote Surz, president of PPCA Inc. and its subsidiary, Target Date Solutions. which provides services in investment manager due diligence and investment program design.

“There is a demographic that can be legitimately addressed by a target-date fund,” Surz continued. “It’s the one demographic that all defaulted participants have in common: lack of financial sophistication. The sole focus of all target-date fund glide paths should be on those who default their investment decisions,” making the asset allocation generally less volatile as the targeted retirement year approaches. End of story, in Surz’s view.

No matter what their goals for developing custom TDFs, “each plan sponsor or fiduciary body needs to determine whether they can build something better than what is available off-the-shelf,” O’Meara added. “And do they have the requisite expertise or are they willing to outsource the functions necessary to construct funds that are better suited for their participants or can provide superior risk-adjusted returns over what’s available off-the-shelf.”

The Next Wave

As employers explore new ways to help 401(k) plan participants make better investment decisions for retirement, custom TDFs could become even more granular to fit the needs of ever-smaller groups of employees — or even specific individuals. In these cases, the TDF would be tailored to reflect the plan’s place in the individual’s overall financial picture. For example, a participant with significant financial holdings outside the plan might be better able to handle a higher-risk target date investment in return for the promise of higher rewards.

“These highly customized funds would become another form of investment advice,” said Buck Consultants’ Spano. But it would come at a price. She estimated that this next evolution of personalized glide paths and asset allocation would cost an additional 100 to 200 basis points to the fund’s cost (the expense ratio) to participants.

Time will tell whether plan sponsors and participants will be willing to pay these higher fees for the purported ultimate customization.

Joanne Sammer is a New Jersey-based business and financial writer. Stephen Miller. CEBS, an online editor/manager for SHRM, contributed to this article .

Related SHRM Webcast:

Related SHRM Articles: