Dividends Capital Gains

Post on: 6 Июнь, 2015 No Comment

Dividends are defined by the IRS as distributions of money, stock, or other property a corporation pays you because you own stock in that corporation.

Cash Dividends

In the past, the receipt of cash dividend income in the form of a check or reinvested funds was a fully taxable event. As such, dividends were treated as another source of ordinary income and were taxed at your normal tax rate.

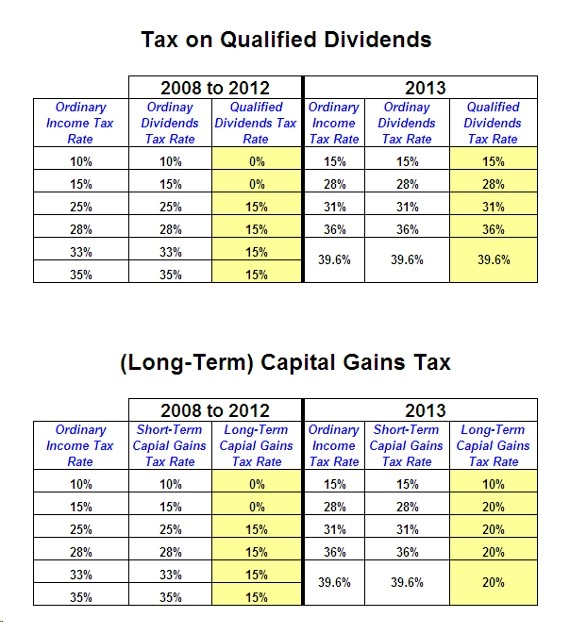

However, the Jobs and Growth Tax Relief Reconciliation Act of 2003 changed how some dividends are taxed. Investors pay lower tax rates on dividends received from domestic corporations and qualified foreign corporations. The lower rates also apply to dividends passed on to shareholders from a mutual fund that has received qualifying dividends from stock that it holds. However, the Act did not change the basic character of dividend income:

Dividends are still considered ordinary income and cannot be offset against net capital losses. Therefore dividends are not reported on scheduled d along with stock and option capital gains and losses.

Companies will send you a Form 1099-DIV to let you know that you received a dividend payment, but will not necessarily indicate if your dividends are qualified or not. It is up to you to examine carefully the many factors determining which of your dividends qualify as capital gains and should therefore receive the lower tax rate.

One such factor is the holding period. In order to qualify for the new lower taxes on dividends, an investor is required to hold the stock on which the dividends are paid for more than 60 days during the 120-day period that begins 60 days before the ex-dividend date. The ex-dividend date is the last date on which a shareholder of record is entitled to receive the upcoming dividend.

Dividends must also be received from a domestic corporation or a qualified foreign corporation. A qualified foreign corporation is one that is incorporated in a U.S. possession or is incorporated in a country that has a current tax treaty with the U.S. Check with the shareholders relations staff at the corporation you’re investing in to see if they are treated as a qualified foreign corporation.

Shareholders report qualified dividends to the IRS on Line 9(b) of Form 1040 or 1040A.

The tax is calculated by completing either the Schedule D Tax Worksheet or the Qualified Dividends and Capital Gain Tax Worksheet in the Form 1040 instructions.

All ordinary dividends are reported on IRS Form 1040, Line 9(a).

If dividends were $1,500.00 or less, shareholders may report them on Form 1040, Line 9(a) only; if more than an $1,500.00, they should also be recorded on Schedule B, Part II.

Dividends are not reported on the IRS Schedule D form. therefore TradeLog does not import or record cash dividends.

Stock Dividends / Stock Splits

When you receive a stock dividend. you actually receive additional shares of a company’s stock based on the number of shares you already own. This is not the same as a regular or cash dividend that you use to reinvest in more shares. With a true stock dividend, you have no option to receive cash.

Stock dividends are the same as stock splits where you end up with more shares than you previously had, but at a lower price. (Or less shares than you previously had at a greater price in the case of a reverse split.)

Stock dividends / stock splits are normally not taxable (subject to some exceptions) because your economic position as a shareholder generally doesn’t change as a result. The company issues more shares to each shareholder based on the number of shares they own. The total capitalization of the company and the ownership percentage of each shareholder doesn’t change, so the value of your holding is unchanged.

Stock dividends are usually expressed as percentages. If a company declares a 10% stock dividend, for example, it issues one share for every ten shares owned. In stock split terms this would be a 1 for 10 stock split because you get one extra share for every ten shares owned going into the split.

If you receive a stock dividend due to a stock split, you have to recalculate your cost basis for each share owned. the figure used to determine whether you have made a profit, when you finally sell the stocks. (Essentially, the basis is your cost per share adjusted for such events as the stock dividend).

Most brokers report stock dividends on their trade history reports or monthly statements as stock splits, but there is no consistent format of how these are reported from one broker to the next. So most trade accounting software programs do not adjust for stock splits automatically.

However, TradeLog features an Adjust for Stock split function which enable investors to make the necessary adjustment in a few easy steps. This function will change the number of shares owned as well as the price of these shares, thereby changing the cost basis of each share while the total amount paid for all of your open shares remains the same.

Dividend Reinvestments (DRIPs)

Dividend reinvestment plans (DRIPs) have become quite common and allow the investor to accumulate a significant amount of shares over time. The idea with drips is that any cash dividends received from owning a stock are automatically reinvested by purchasing new shares in that same stock.

Typically dividend reinvestments result in shares being repurchased in fractions of whole shares as the cash dividend may not be divisible into whole share amounts. This is similar to mutual fund purchases which generally are in fractional share amounts.

Dividends received from DRIPs are treated the same as cash dividends for tax purposes and taxes are due in the year the dividend was received even though the dividend was reinvested.

The shares purchased by the drip are treated the same as any other stock purchase and the cost basis for these shares is the price paid when reinvested. Capital gains or losses are realized when these shares are finally sold and get reported to the IRS on schedule d just like any other stock sale.

Please note: This information is provided only as a general guide and is not to be taken as official IRS instructions. Armen Computing Ltd. does not make investment recommendations nor provide financial, tax or legal advice. You are solely responsible for your investment and tax reporting decisions. Please consult your tax advisor or accountant to discuss your specific situation.