Dividend Stocks Blog

Post on: 2 Май, 2015 No Comment

by Robert Hauver

Looking for high dividend stocks with market support in 2015? As always, we are too, and we were surprised where we found them in the Energy sector. It was just weeks ago that this sector took a massive beating, with some energy dividend stocks losing up to 50% of their market value, as the price of crude oil collapsed.

However, its a new year and a new day for many Energy stocks the ever-fickle market has decided that oil isnt going to $10 a barrel, and that, maybe, some of these companies will survive after all, since they have viable business models.

Our High Dividend Stocks By Sector Tables . has been tracking these 3 high yielding stocks since early 2014. All 3 of them are LPs, which had relatively recent IPOs:

(You can find brief profiles for all 3 stocks at the bottom of this article.)

Performance:In autumn 2014, these 3 stocks all took a nosedive

but look how well theyve been doing lately theyve all had double-digit gains so far in 2015:

Dividends/Distributions: The table below compares these stocks latest quarterly distributions to their targeted minimum distribution. As you can see, all 3 of them are paying more than their minimum targeted distribution.

DLNG has the highest dividend yield, but DKL has the most consistent dividend hike record. However, the bottom line is that, unlike many Energy stocks, none of these stocks has cut their dividends. all of which are well-covered by distributable cash flow:

Options: Only DKL has fairly high options yields FISH doesnt have options, DLNGs options yields arent currently that attractive. Our free Covered Calls Table lists this May $40 call option, which, at a $2.50 bid, pays you nearly 5 tines the amount of DKLs next quarterly dividend .

Since the $40 call option is $.23 above DKLs price/share, it gives you a small amount of price gain potential, in addition to the call option income. However, its less than the $.51 quarterly dividend, if your DKL shares get assigned/sold away prior to the ex-dividend date. Here are the 3 main scenarios for this trade:

Selling Put Options: Our free Cash Secured Puts Table lists this May $35 put option, which has a much lower yield than the $40 call, since its further out of the money, (further away from DKLs price/share). The main attraction to this put trade, in addition to getting paid the $.85 put premium, is that it gives you a much lower breakeven cost, of $34.15.

Valuations: On a trailing and forward P/E basis, DLNG looks the cheapest. This makes sense, considering that it has only gained a bit over 2% over the past year, whereas FISH has gained over 43%, and DKL has gained over 25%.

So, even though DLNG is up over 24% in 2015, its price, P, hasnt outpaced its Earnings, E. Another useful way of looking at this, is to use Earnings Yield, which merely divides Earnings/Share by Price/Share, to obtain a comparative %:

Analysts Targets: DLNG is also over 20% below analysts average target price, the most discounted value among the group.

Financials: Its a mixed bag here although DLNG has the highest Operating Margin, it trails FISH nad DKL in some other metrics, and also carries more debt.

Profiles:

FISH- Marlin Midstream Partners, LP, together with its subsidiaries, acquires, owns, develops, and operates midstream energy assets in the United States. The company operates through two segments, Midstream Natural Gas and Crude Oil Logistics. It provides natural gas gathering, compression, dehydration, treating, processing, and hydrocarbon dew-point control and transportation services to producers, marketers, and third-party pipeline companies; and crude oil transloading services. The company also sells and delivers natural gas liquids to third parties. It serves small and large exploration and production companies, large pipeline companies, and natural gas marketers. Marlin Midstream GP, LLC operates as a general partner of the company. The company is headquartered in Houston, Texas.

DLNG- Dynagas LNG Partners LP, through its subsidiaries, operates in the seaborne transportation industry worldwide. The company owns and operates liquefied natural gas (LNG) vessels. Its fleet consists of 3 LNG carriers, each of which has carrying capacity of approximately 150,000 cubic meters operating under multi-year charters with BG Group and Gazprom. Dynagas GP LLC serves as the general partner of Dynagas LNG Partners LP. The company was founded in 2013 and is headquartered in Athens, Greece. DLNGs niche is that its vessels operate in the harsh northern seaborn route between Norway and Asia, which chops transit time by up to 40%.

DKL- DKL operates in two business segments: a Pipelines and Transportation segment and a Wholesale Marketing and Terminalling segment.

Pipelines and Transportation Segment consists of approximately 400 miles of crude oil pipelines, 16 miles of refined product pipelines, an approximately 600-mile crude oil gathering system and associated crude oil storage tanks with an aggregate of approximately 1.4 million barrels of active shell capacity.

Wholesale Marketing and Terminalling Segment provides marketing services for 100% of the refined products output of DKLs Tyler refinery, other than jet fuel and petroleum coke, and owns and operates five light product terminals.

Disclaimer: This article is written for informational purposes only, and isnt intended as investment advice.

Disclosure: Author has no positions yet in the stocks mentioned in this article.

by Robert Hauver

With all of the recent market volatility and dividend cuts in Energy-related dividend stocks, income investors are looking to other sectors for income stability.

(We maintain High Dividend Stocks By Sectors Tables which feature many high yielding stocks for each sector.)

Although its not known for having any high dividend stocks, you may want to consider the Housing industry for some income plays and potential price appreciation.

Weve found 3 homebuilder stocks which have been beating the S&P 500 over the past week, month and quarter. Two of these three stocks have also outperformed the market over the past year:

Strong Growth Ahead in Housing: Economists are predicting a big rise in household formations in 2015, a key figure for Housing. IHS predicts that 2015 will see the addition of 1.08 million new households, with economic growth driving up the rate of new formation. Single family housing production is expected to rise 26% in 2015. DHI and PHM both get a large part of their revenue from sales in warmer states, where home sales growth is expected to continue to outpace national growth, at a pace of 24%. TOL caters more to the upscale market, and has good exposure to the high end areas of New York City, and Washington, DC.

Dividends: PHM cut its quarterly dividend from 2009 through 2012, and reinstated in August 2013 at $.05. It maintained it at $.05 until December 2014, when it raised it by 60%, to $.08. TOL doesnt pay a dividend yet, but, as youll see further below, it does have attractive options yields.

Covered Calls Options: You can greatly improve upon these quarterly dividends by selling options. These 3 trades all have call premiums which pay much more than PHMs or DHIs next quarterly dividends. In fact, the DHI call option pays over 15 times DHIs next 2 quarterly dividend payouts.

Click here to read more

Disclaimer: This article was written for informational purposes only. Author not responsible for any errors or omissions.

Disclosure: Author is short put options on DHI, PHM, and TOL.

Copyright: 2015 Demar Marketing All rights reserved

by Robert Hauver

Looking for a safe place to hide during this latest market pullback? Healthcare was not only the leading sector in 2014- it has also led the market for most of 2015. Heres a look at how the Healthcare sector has fared vs. the S&P 500, over the last 3 months, which just about coincides with the market highs of September 18, 2014. The Healthcare sector is up 3.81%, vs. a -1.44% loss for the S&P 500:

Digging further, we found 2 high dividend stocks within the Healthcare sector, which have both outperformed this sector and the market HCP Inc. (HCP), (a Dividend Aristocrat), and Sabra Healthcare REIT, Inc. (SBRA).

Heres a chart of these 2 dividend paying stocks over the same 3-month period, vs. the S&P 500. HCP is up nearly 10%, and SBRA is up nearly 7% during this period, vs. a -1.44% loss for the S&P 500:

Dividends: Our High Dividend Stocks By Sector Tables . lists both of these stocks, in the Healthcare section. In addition, we also follow a third related high yield stock- Sabras preferred stock issue, SBRAP, which currently yields nearly 7%, and has also beaten the market during this same 3-month period, having risen 3.08%.

Although HCP has a low 5-year dividend growth rate of 2.94%, it has increased its dividend per share for 29 consecutive years.

SBRA has raised its quarterly dividend from $.32 in 2011, to the current $.39 payout. Sabra amply covers its SBRAP preferred dividends by a factor of 3.22, i.e. its net income is 3.22 times its preferred dividend payout.

Preferred Long-Term Yield: The table below summarizes your net annualized yield for SBRAP, based upon 2 conditions:

1. You were to hold SBRAP until its 2018 liquidation date

2. Sabra redeems/buys back your SBRAP shares at the call date

Since SBRAP is trading at $1.08 above its $25.00 liquidation price, we subtracted this amount from the dividends that youd collect between now and 3/21/18. Youd end up with a $4.71 net profit, which equals a 5.54% annualized yield:

Disclaimer: This article was written for informational purposes only. Author not responsible for any errors or omissions.

Copyright: 2014 Demar Marketing All rights reserved

by Robert Hauver

As the price of crude oil has fallen this year, most energy-related stocks have gotten hammeredexcept for some refining stocks. Why? Because lower crude prices mean lower feedstock costs for refiners, and actually pump up refiners profit margins. This fact has not gone unnoticed by the market, which has favored some refiners over other energy-related stocks in recent weeks.

This article covers 2 dividend stocks which are beneficiaries of this turn in fortunes Marathon Petroleum, (MPC), and Phillips 66, (PSX). While these arent high dividend stocks . they do have high options yields, which well cover later on in the article.

MPC has done much better than PSX in all of the following time periods:

However, PSXs fortunes may be about to change Goldman Sachs analyst Neil Mehta just added PSX and MPC to his recommended Buy list on 11/18/14, and PSX is up over 3.7% over the last week.

Profiles:

MPC is engaged in refining, transporting, and marketing petroleum products primarily in the US. It operates through 3 segments: Refining & Marketing, Speedway, and Pipeline Transportation.

MPC refines crude oil and other feed stocks at its 7 refineries in the Gulf Coast and Midwest regions of the US; and purchases ethanol and refined products for resale. Its refined products include gasoline, distillates, propane, feed stocks and special products, heavy fuel oil, and asphalt.

MPC also sells transportation fuels and convenience products in the retail market through Speedway convenience stores, and transports crude oil and other feedstocks to its refineries and other locations.

MPC markets its refined products to resellers, consumers, independent retailers, wholesale customers, marathon-branded jobbers, its Speedway convenience stores, airlines, transportation companies, and utility companies, as well as exports its refined products.

As of2/4/14, MPC owned, leased, and had ownership interests in approximately 8,300 miles of pipeline, as well as owned and operated 1,480 convenience stores in 9 states of the United States; and operated 5,200 independently owned retail outlets in the 18 states of the United States.

PSX PSX Phillips 66 operates as an energy manufacturing and logistics company, operating in 4 segments: Midstream, Chemicals, Refining, Marketing and Specialties.

Refining buys, sells, and refines crude oil and other feedstocks into petroleum products, such as gasolines, distillates, and aviation fuels in the United States, Europe, and Asia.

Marketing and Specialties purchases for resale and markets refined petroleum products comprising gasolines, distillates, and aviation fuels in the United States and Europe. This segment manufactures and sells specialty products, such as petroleum coke, waxes, solvents, and polypropylene.

Midstream transports crude oil and other feedstocks to its refineries and other locations, as well as delivers refined and specialty products, also gathers, processes, transports, and markets natural gas; and transports, fractionates, and markets natural gas liquids in the United States.

Chemicals produces and markets ethylene, propylene, and other olefin products. It also manufactures and markets aromatics products, such as benzene, styrene, paraxylene, and cyclohexane, as well as polystyrene and styrene-butadiene copolymers.

Disclaimer: This article was written for informational purposes only. Author not responsible for any errors or omissions.

Copyright: 2014 Demar Marketing All rights reserved

by Robert Hauver

Looking for bargains in the high dividend stocks department? This article covers 2 relatively new dividend paying stocks, both of which have been hammered along with the rest of the Energy/Basic Materials complex over the past month. In October alone, the Energy sector is down over -13%, while the Basic Materials sector is down over -10%. A rising US $, plus fears of a global recession, and a glut of oil have put pressure on these groups.

However, we have 2 stocks which we feel represent attractive long term values for income investors, due to certain advantages that their operations enjoy:

Company Profiles:

New Source Energy Partners L.P. NSLP is engaged in the acquisition and development of oil and natural gas properties in the United States, and is rapidly growing its Oilfield Services division. Asof 12/13/13, NSLP had 124,759 gross acres in the Golden Lane field in east-central Oklahoma; and 161 gross proved undeveloped drilling locations. Its estimated proved reserves on its properties consisted of 20.6 MMBoe. NSLP is based in Oklahoma City, Oklahoma.

OCI Resources LP: OCIR is engaged in the trona ore mining and soda ash production businesses in the US and internationally. As a natural soda ash producer, OCI Resources has a big cost advantage over synthetic producers. It has approx. 23,500 acres of subsurface leased/licensed mining areas in the Green River Basin of Wyoming. OCIR also processes trona ore into soda ash, which is a raw material in flat glass, container glass, detergents, chemicals, paper, and other consumer and industrial products. OCI Resources LP is based in Atlanta, Georgia.

Dividends: Our High Dividend Stocks By Sectors Tables . lists both of these dividend stocks, (in the Energy and Basic Materials sections).

Both stocks have whopper dividend yields, thanks to the fall pullback OCIRs dividend yield is nearly 10%, and NSLPs is over 12%.

They should both be going ex-dividend soon, sometime around 1/30/15:

Disclaimer: This article was written for informational purposes only. Author not responsible for any errors or omissions.

By Robert Hauver

Who says you cant have it both ways? Preferred stocks, often pooh-poohed as being stodgy, with minimal price gains, are having a good year in 2014, with many issues outperforming the market via price gains alone.

If you want well-covered dividend income, but, also some potential for price gains, you ought to consider buying the newest preferred shares issued by CHS Inc. (CHSCM), a large cooperatively-owned Midwestern US company which deals in both Energy and Agriculture.

CHS is a bit different from most publicly traded companies they dont have common stock. Instead, they issue preferred shares, which trade on the NASDAQ.

Profile: CHS Inc. is a globally integrated Fortune 100 company supplying energy, crop nutrients, grain marketing services, animal feed, insurance, financial & risk management services and food & food ingredients. CHS employs over 10,000 people across North America and in 24 other countries around the globe.

CHS is committed to a cooperative business model, as reflected by its ownership, made up of 600,000 producers, the majority whom are throughout 1,100 member cooperatives and 77,000 are served through CHS local service centers. CHS also has 16,000 preferred stockholders. (CHS doesnt have any common shares). The company is governed by a 17-member board of farmers and ranchers, who are elected by its cooperative-owners and producer-owners.

Dividends: Weve had our sights on CHSCP for years, having listed it in our High Dividend Stocks By Sector Tables . (and all of the CHS preferred shares are now listed in the Consumer Staples section). The thing is, weve never been able to buy any of its shares near their $25 liquidation price, due to price gains on themuntil now.

Last week, CHS issued its newest series of preferred shares -

Disclaimer: This article was written for informational purposes only. Author not responsible for any errors or omissions.

by Robert Hauver

The Energy sector continues to lead all other sectors in 2014. As of 7/16/14, this sector, as measured by the XLE etf, was up 12.73% year to date, vs. 7.16% for the S&P500, and only 3.3% for the DOW. The XLE etf is dominated by large cap dividend stocks, such as Conoco Phillips, (COP), which is its 4th largest holding, after Exxon, Chevron, and Schlumberger.

When looking at performance, however, the majors, such as Exxon and Chevron, have greatly underperformed independent Conoco, which is up over 22% so far in 2014, vs. gains of only 5.2% for Chevron and 2.6% for Exxon.

COP also has the second highest dividend yield in the group, at 3.39%, having just raised its quarterly dividend from $.69 to $.73.

We screened for other dividend paying independent oil & gas stocks, to see if there are some other worthwhile outperformers in that sub-industry. We came up with Delek Logistics LP, (DKL), a relatively new, (NOV 2012 IPO),small cap high dividend stock, which we recently added to our High Dividend Stocks By Sectors Tables .

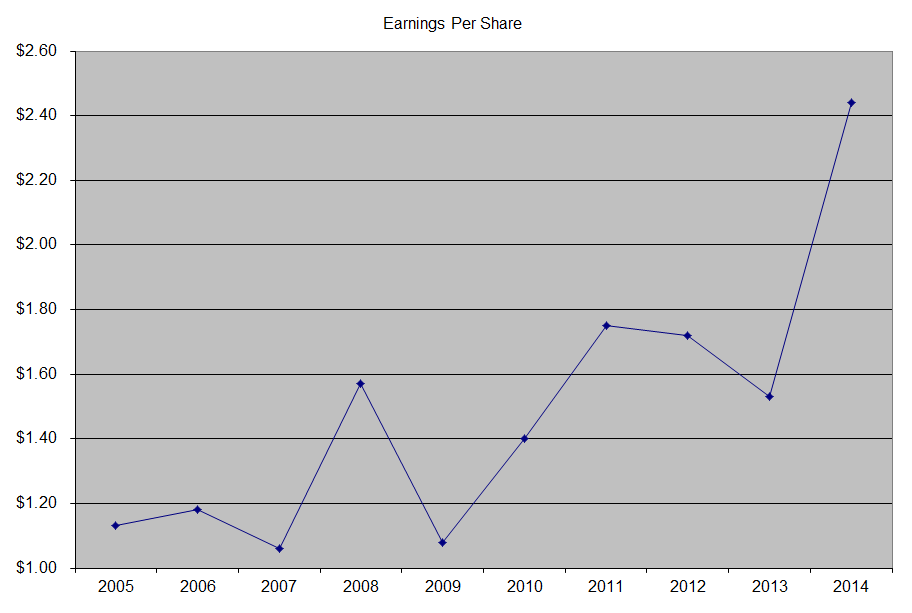

Dividends/Distributions: After spinning off its refining division, Phillips 66 (PSX), in 2012, COP has gone from paying $.66 to $.69, and now $.73 a quarter. DKL has raised its quarterly distribution 5 straight times since its IPO.

Options: Although COP just went ex-dividend, you can still earn an attractive options yield on it, via selling November 2014 covered calls, which will also allow you to either capture the next quarterly dividend, in October, or get paid even more $ if your shares get assigned. DKL has a much higher option yield, but its shares are much closer to its strike price.

Disclaimer: This article was written for informational purposes only. Author not responsible for any errors, omissions, or actions taken by third parties as a result of reading this article.

by Robert Hauver

After rising nearly 24% in 2013, the Energy sector continues to be a winner in 2014, having risen 6.69% as of May 21, 2014. But how have dividend stocks within this sector fared? As it turns out, there are 3 winners from the Energy section of our High Dividend Stocks by Sector Tables . that have handily outperformed the market as a whole, and whose performance has also beaten the Energy sectors by a long shot in 2014.

These 3 energy stocks are all LPs, which offers you additional benefits LPs must pay out 90% of their earnings, in return for not paying taxes, which often results in a high dividend yield; and tax efficiency, since the high yield distributions that you receive will be partially sheltered, via offsets, such as depreciation, on the K-1 form youll receive at tax time.

The full company profiles are at the bottom of this article.

Heres how these stocks have fared in 2014 and over the past trading month. Compare this with the S&P, which was up 2.15% year-to-date, as of 5/21/14, and up 13.11% over the past year:

Dividends: All 3 of these stocks yield over 5%, (GLP yields over 6%), and go ex-dividend in late July/Early August. Theyve all steadily raised their dividends over the past 5 years. Coverage-wise, GLP leads the pack, with a 2.6x distribution coverage ratio. (LPs refer to their dividends as distributions, and their shares as units.) Click here to read more

Disclaimer: This article was written for informational purposes only. Author not responsible for any errors, omissions, or actions taken by third parties as a result of reading this article.

by Robert Hauver

The market has had a bumpy ride so far in 2014, with February turning in the best performance, rising over 4%, after Januarys -3.6% pullback. Cap this off with a less than 1% gain for the S&P 500 in March, and youve got an unimpressive 1.3% gain for the first quarter:

With this kind of up and down ride, youd want to find some dividend stocks which offer defense, in addition to income. With the pullback in many biotech stocks, the Healthcare sector no longer leads,(although its still up nearly 5%), but has given way to the Utilities sector, which is up over 10% year-to-date.

Heres a look at the chart for the Utilities ETF, XLU:

We looked further into XLUs top holdings, and came up with these top 5 utility stocks, all of which are large cap dividend paying stocks. Another common feature is that they all have somewhat lower forward P/Es, meaning that their earnings should improve in their next fiscal year. Duke, DUK, and Southern, SO, have the lowest P/Es, relative to their 5-year P/E ranges:

This is how theyve performed year-to-date, and over the past month, and over the past 52 weeks. Nuclear-based Excelon, EXC, has outperformed the pack year-to-date, and over the past month, but is still up only 3.62% over the past year. Contrasting with that performance is more steady Next Era Energy, NEE, which has made over half of its 1-year 25.90% gains, by rising 13.61% in 2014:

Dividends: With their 4%-plus dividend yields, Southern CO. SO, and DUK, are both listed in the Utilities section of our High Dividend Stocks By Sector Tables . Although their yields are lower, Dominion, D, and NEE, have the best 5-year dividend growth rates:

Options: If you want to add more downside protection to these stocks, selling covered calls offers you more immediate income, and a lower breakeven. NEE has the most attractive call options of the group. This June $97.50 call pays $2.60, over 3 times NEEs next quarterly dividend. (Our free Covered Calls Table has more info on this and over 30 other trades.)

Here are the major income scenarios for this trade. The $97.50 strike price is $1.07 above NEEs price/share, which amply rewards you if your shares get assigned prior to the ex-dividend date for the $.73 dividend:

Selling cash secured put options is another way to profit from these defensive stocks. In fact, if you sell puts below the stocks share price, youll get an even lower breakeven, and improve upon their defensive nature. This is another June trade, but this put has a $95.00 strike price, and a $92.05 breakeven, which is 4.5% below NEEs price/share. You wont receive any dividends, but, just like selling calls, youll be paid your option premium within 3 days of the trade, often sooner. You can find more info about this and over 30 other trades in our Cash Secured Puts Table .

Financials: Its a mixed bag, Dominion and Next Era have an edge over the rest of the group for some of these metrics, but they do carry more debt:

Valuations: Excelon has the lowest valuations for these metrics:

Disclosure: Author was long shares of Southern, SO, at the time of this writing.

Disclaimer: This article was written for informational purposes only. Author not responsible for any errors, omissions, or actions taken by third parties as a result of reading this article.

by Robert Hauver

We thought wed take a different approach in this article, and look at high dividend stocks within the S&P 500 that are performing well in 2014, vs. those that are oversold and/or undervalued. Not surprisingly, 3 out of 5 of these top dividend stocks are from the Utilities and Healthcare sectors, which are the 2 top sectors year to date.

Performance through 3/17/14: A Financial stock, AIV, is the top performer of this group so far in 2014, but, interestingly, made most of its gains in January and February, and is only up around 2% in March.

Garmin, (GRMN), a tech stock, has made all of its net gains over the past month.

The more defensive Utilities stocks, PEG and AEE, show a more balanced performance, both rising in January and February, in addition to the past trading month.

Dividends: With its 4%-plus yield, weve added Public Enterprise Group, (PEG), to the Utilities section our High Dividend Stocks By Sector Tables . Youll also find Lilly, (LLY), in the Healthcare section of the tables.

Options: 2 of these dividend paying stocks also have fairly high options yields Garmin and Lilly. Weve listed July Covered Call trades for both stocks below. Both stocks have ex-dividend dates for their next quarterly dividends, prior to the July call expiration, so you can effectively increase your overall yield substantially, via the combo of the dividend and option yields.

Garmins call option payout is nearly 5 times its dividend, and Lillys call option pays 4 times its dividend.

You can find more details on these and over 30 other trades in our free Covered Calls Table .

Both trades have call options which are enough above the stocks share/price, to amply replace the dividend income, via price gains, if your shares get assigned prior to the ex-dividend date.

Here are the major income scenarios for the Garmin trade:

Cash Secured Puts: Our Cash Secured Puts Table also lists July put trades for Garmin and Lilly, (along with over 30 other trades). These put option trades both have strike prices which are below these stocks current price/share, thereby achieving a lower breakeven:

Financials:

Disclosure: Author held no positions as of yet in any of the stocks mentioned in this article at the time of this writing.