Dividend Investors 3 Reasons to Buy and Hold the Bank of Montreal (USA)

Post on: 14 Май, 2015 No Comment

Dividend Investors: 3 Reasons to Buy and Hold the Bank of Montreal

Some think they have to choose between income and growth. But I say, why not have both?

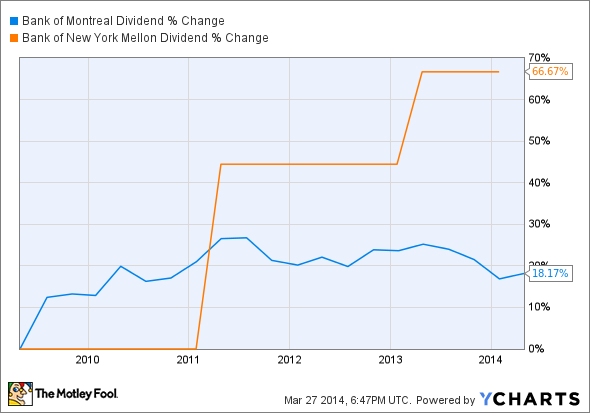

Today, the financial giant yields just over 4.1%. And over the past decade, the companys dividend has nearly doubled.

Yet this isnt some stodgy widow and orphan stock. For the 10 years ended February 16, the share price has produced an impressive total return of 125% handily topping the S&P/TSX Composite Index for the same period.

Of course, these are backward-looking numbers. However, theres reason to believe that BMO will continue to generate outsized returns. What the stock does in the short term is anybody’s guess, but over the long haul, I expect investors will be handsomely rewarded.

Here’s why:

1. It’s rock-solid

BMO is the hallmark of a wonderful business.

Despite grumbling about fees. most customers are happy with their banks or at least satisfied enough to stay with them. As firms like BMO begin offering more services, customers are increasingly tied to one lender.

According to rival Bank of Nova Scotia. about 15% of Canadians were prepared to switch banks five years ago. New data, however, shows that figure is now in the mid-single digits, and expected to plunge further.

With customers essentially trapped, BMO can easily pass on price hikes. Over the past five years, every dollar invested in the companys business generated 15 cents in return. By comparison, U.S. banks can barely earn half that figure. European financials are lucky to breakeven.

2. It’s a dividend machine

Its easy to find stocks that will pay handsome dividends for the next few quarters. But what about finding stocks you can count on to provide cash flow for years to come?

If history is any guide, BMO is the one dividend stock that you will be able to pass onto your grandchildren. The company has mailed a cheque to investors every single year since 1829 the longest streak of consecutive dividends in North America.

And this tradition isnt about to end anytime soon. Given BMOs AA credit rating from DBRS and more than $4.2 billion in annual profits, the dividend is one of the safest around.

3. It’s attractively valued

The recent drop in oil prices has clobbered stocks and even the banking industry is feeling the pain. Since May 1, BMO shares have plunged nearly 10%.

So, is it time to panic? Hardly.

After the recent selloff, there has never been a better time to scoop up the stock at a rare discount. Today, shares trade at about nine times forward earnings, which is below its peers and historical average.

Of course, BMO is no slam dunk. The Canadian consumer is overleveraged. That means the companys days of double-digit growth in retail banking are over, at least for the time being.

That caveat aside, management is still finding ways to trim costs. In addition, BMO sees a big expansion opportunity into the red hot U.S. market. Both initiatives should grow profits in the years ahead.

Long-term investors will almost certainly be rewarded with growing revenues, dividends, and a stock price that – while it remains unpredictable in the short term – should gradually rise over time.

Of course, BMO isn’t the only stock that cranks out reliable dividends. Check out our special FREE report: 1 Top Stock for 2015 — and Beyond . This blue-chip business has delivered distributions to shareholders every year since 1953. Click here now to get the full story!