Dividend Growth Investing At Work

Post on: 25 Май, 2015 No Comment

If one is a dividend growth investor, they are probably considered (or should be) the longest of the long-term investors. To the absolute amazement of other investors, once the stock is purchased, the dividend growth investor may not care what the price of that stock is as long as the dividends continue to grow.

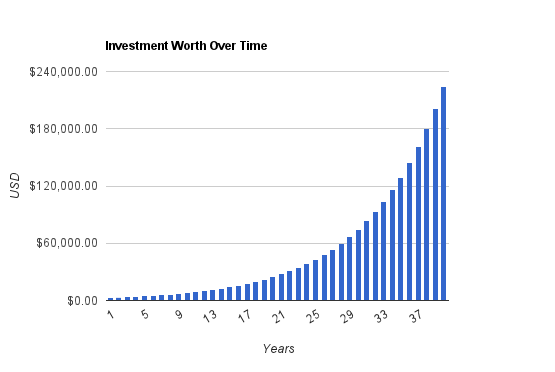

The substantial gains that are reaped by re-investing the growing dividends from our favorite stocks lies in the exponential power of compounding which often takes years to build into a noticeable contribution to a portfolio.

Because the re-investment process can seem unproductive and the dividend growth insignificant at first, it is easy for others to dismiss dividend growth investing as too conservative or even unprofitable. As much as we preach that slow and steady wins the race, even the most seasoned dividend growth investor can begin to question the effectiveness of the strategy from time to time.

A Real Life Example

Many times it takes a real life example of dividend growth investing to help to keep one motivated to continue the long. often boring, journey of building a portfolio of dividend growing common stocks .

The recent bid by InBev to take over Anheuser Busch (BUD) provided this motivating real-life example that what the essence of dividend growth investing is all about.

This is what the end-game of our dividend growth strategy should look like its beautiful!

In 1980, Sean Gorham bought his first piece of a public company: a $500 investment in Anheuser-Busch, even though he had no connection to the brewer or its St. Louis roots. Hes reinvested the dividends, or the cash payout shareholders receive, over the years.

Ive always admired how well the company is run. They exude a very clean image and a very American image, said Gorham, 48, an insurance agent who lives in York, Maine, about an hour northeast of Anheuser-Buschs Merrimack, N.H. brewery. Its been one of the best investments Ive had. The dividend I get every year is more than what I originally paid for the stock.

Anheuser-Busch stock began being traded in 1933 in the over-the-counter market, where brokers buy and sell among themselves rather than through a stock exchange. The company first was listed on the New York Stock Exchange on April 18, 1980, making it more widely accessible to individual investors.

In the past 28 years, Anheuser-Buschs stock has split four times. So one share bought in 1980 is now 24 shares hows that for creating shareholder value .

It Takes Time And Commitment

Obviously this example is one that has taken nearly 30 years to develop, but the fruits of the labor are tremendous.

Given this example, an investor who today is 30 or even 40 years old could begin to build a portfolio of dividend growing common stocks and expect to receive an excellent income in retirement that grows each year likely at a rate higher than inflation!

When one commits to the strategy of dividend growth investing, it requires an extreme amount of patience and discipline in the first few years. It may take as many as ten years of dividend growth before the re-invested dividends make significant contribution to the growth of the portfolio.

Reaching The Tipping Point

Many financial planners will dub a persons working years as the accumulation phase of ones life. This means that during these years (roughly from age 20-65) the purpose of investing is to accumulate assets that will allow the investor to hopefully maintain their current lifestyle in retirement.

During the first decade or two, accumulating assets is the most difficult as investors tend to have other important expenses such as purchasing a home, raising a family, retiring student loans and consumer debt etc.

While a full blown discussion on the time value of money is not necessary in this article, one must recognize that buying assets such as dividend growth stocks during the early years of the accumulation phase will allow for the advantages of compound growth to kick in and the tipping point will be reached faster.

The tipping point is the point where the return from investments begins to grow at a greater rate than expenses. You will notice that one does not say that investment income meets expenses because, it is known that expenses increase with inflation and (mortgage excluded) may actually have increased in retirement depending on medical needs etc.

Motivation To Follow A Proven Path

During the accumulation phase, success stories like the one above can prevent investors from straying from the proven path of investing in solid dividend growth stocks to fund a prosperous retirement.

Where do you get the motivation to stay committed to your investment strategy?