Diversification And Its Importance In Portfolio Management Finance Essay

Post on: 1 Май, 2015 No Comment

I often hear finance managers say an investment related proverb that goes like this; “be risk diverse, not risk adverse”. An inquisitive, or even not so inquisitive mind may wonder “what does this concept really mean?” and “why is it so important when investing?” This paper seeks to provide answers to the querying mind and to explain, not only by definition but also via demonstration the importance of having a diversified portfolio. It will also include reasons why investors should be risk diverse and not risk adverse.

Part 1: Diversification, Risk Management & Market Cycles

Investopedia defines diversification as “a technique that reduces risk by allocating investments among various financial instruments, industries and other categories.” Its main aim is to maximize returns hence the reason it is invested in different area that will each react differently when exposed to similar conditions. In short, diversification denotes the old saying “don’t put your eggs in one basket”. The article some sample portfolios emphasized the importance of having a diversified portfolio. It sees diversification as “the spreading of one’s money among various sorts of investments to limit risk and maximize growth potential.” These investments are primarily categorized by stocks, bonds and cash. Most investment professionals agree that, although it does not guarantee against loss, diversification is the most important component of reaching long-range financial goals while minimizing risk (Investopedia).

Risk Management

If one caught a whale the first time he or she ever picked up a fishing pole, perhaps they’d think of themselves as being lucky. If they year after year they reeled it back in with the same result, they’re assume that pond was the right place to be. Likewise, investors who purchased their first stock during one of the most extraordinary bull market in history (1982 -1999) conditioned themselves to believe that their pond (the equity market) was the correct place to be for year to year returns. What these investors discovered later though is the fact that markets move in cycles and like fishermen, they must monitor and adapt to the changing conditions.

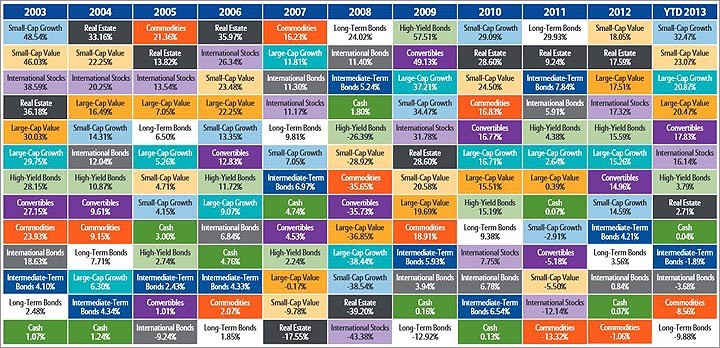

More than 100 years of equity market history has shown that there are uncertain cyclical movements in the market. With that fact being established, it is paramount that investors prepare for risk and build a portfolio that can withstand any economic environment. In doing so, they (the investors) should diversify among assets that have been historically proven to be defensive against risks that may be encountered in the three major economic environments; noninflationary growth, inflationary growth and recession. The article Rethinking Risk states that” a properly diversified portfolio can help preserve principal while taking advantage of opportunities that arise as the economy transitions across cycles”.

While history repeatedly shows the cyclical movements of the market, many investors today view bull markets as normal and therefore tend to chase returns at the expense of risk management with the reason being, prior to 2000s; no person significant losses were experienced. The term baby boomer is used to describe the generation that lived through the bear market (1966 to 1982). These boomers began to seriously invest during the bull period from 1982 – 1999. There they had consistently gained high levels of return with low volatility. What many of these investors faired wasn’t losing money; rather it was missing out on gains. For those who considered the bull markets to be the norm, the two bear markets of 2000s really did come as a shocker. Investors are therefore advised to rethink their assumptions about the equity market as it related to investing and risk. All investments involve risks. The closer the investor is to retirement the riskier the asset becomes because their compensation, savings and assets will generally decrease (outliving savings).