Discounted Payback Period as a Capital Budgeting Method

Post on: 16 Март, 2015 No Comment

Using Discounted Cash Flows in the Payback Period Calculation

You can opt-out at any time.

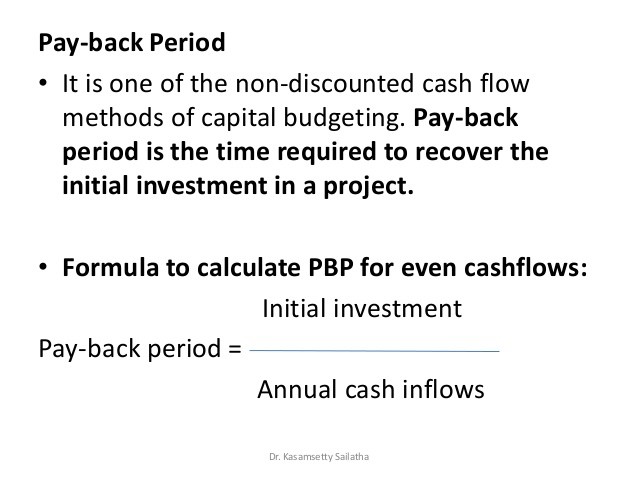

Payback period is a quick and simple capital budgeting method that many financial managers and business owners use to determine how quickly their initial investment in a capital project will be recovered from its cash flows. Capital projects are those that will last more than one year. Discounted payback period is different only in that it uses discounted cash flows in the calculation.

Disadvantages of Discounted Payback Period

Although the discounted payback period calculation is still widely used by managers as they like to know when they will recoup their initial investment. it has three major flaws:

- Time value of money is not considered when you calculate payback period. In other words, no matter in what year you receive a cash flow, it is given the same weight as the first year. This flaw will cause managers to overstate the time to recovery for the initial investment .

- A second flaw is the lack of consideration of cash flows beyond the payback period. If the capital project lasts longer than the payback period, then cash flows the project generates after the initial investment is recovered are not considered at all in the payback period calculation.

- The third, and perhaps most important, flaw is that discounted payback period does not really give the financial manager or business owner a solid decision criterion upon which to make an investment decision. In other words, since the business has to guess at the interest rate or cost of capital and because of the first two flaws of this capital budgeting method, it is not the best method to use to choose an investment project. It is a bit better than payback period since the cash flows are discounted. This third flaw of the discounted payback period can be dismissed if the weighted average cost of capital is used as the rate at which to discount the cash flows.

Advantages of Discounted Payback Period

There are only two real advantages for a business owner to use discounted payback period as a capital budgeting decision criteria. First, owners and managers like regular payback period to know how long it will take them to recover their initial investment. Using discounted payback period simply gives them a more finely tuned estimate of that.

Second, discounted payback period has an advantage over regular payback period for that very reason — cash flows are discounted and calculation gives a better estimate of payback period.

Calculation of Discounted Payback Period

The calculation for discounted payback period is a bit different than the calculation for regular payback period due to the fact that the cash flows used in the calculation are discounted by the weighted average cost of capital used as the interest rate and the year in which the cash flow is received. Here is an example of a discounted cash flow :

Imagine that the first year’s cash flow from a project is $400 and the weighted average cost of capital is 8%. Here is the formula:

Discounted Cash Flow Year 1 = $400/(1+i)^1

where i = 8% and the year = 1

The calculation for discounted payback period is the following. Imagine that a company wants to invest in a project costing $10,000 and expects to generate cash flows of $5,000 in year 1, $4,000 in year 2, and $3,000 in year 3. The weighted average cost of capital is 10%. There are steps that you use to calculate discounted payback period.

First, discount the cash flows back to the present or to their present value. Here are the calculations:

Year 0: -$10,000/(1+.10)^0 = $10,000

Year 1: $5000/(1+.10)^1= $4,545.45

Year 2: $4000/(1+.10)^2= $3,305.79

Year 3: $3000/(1+.10)^3= $2,253.94

Step 2 is to calculate the cumulative discounted cash flows:,/p>

Year 0: -$10,000

Year 1: -$ 5,454.55

Year 2: -$ 2,148.76

Year 3: $ 105.18

Discounted payback period occurs when the negative cumulative discounted cash flows turn into positive cash flows which, in this case, is between the second and third year.

DPP = Year before DPP occurs + Cumulative cash flow in year before recovery/discounted cash flow in year after recovery

DPP = 2 + $2,148.76/$2,253.94 = 2.95 years