Developing a Profit Plan For Your Business

Post on: 12 Апрель, 2015 No Comment

Developing a Profit Plan for Your Business

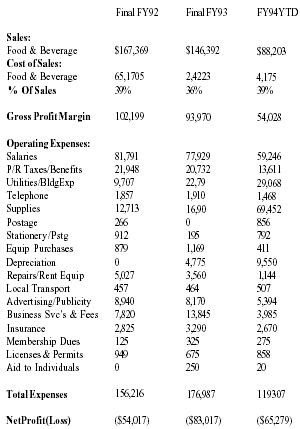

Profit planning is simply the development of your operating plan for the coming period. Your plan is summarized in the form of an income statement that serves as your sales and profit objective and your budget for cost.

How Is It Used?

The profit plan is used in the following ways:

- Evaluating operations. Each time you prepare an income statement, actual sales and costs are compared with those you projected in your original profit plan. This permits detection of areas of unsatisfactory performance so that corrective action can be taken.

- Determining the need for additional resources such as facilities or personnel. For example, the profit plan may show that a sharp increase in expected sales will overload the company’s billing personnel. A decision can then be made to add additional invoicing personnel, to retain an EDP service, or to pursue some other alternative.

- Planning purchasing requirements. The volume of expected sales may be more than the business’ usual suppliers can handle or expected sales may be sufficient to permit taking advantage of quantity discounts. In either case, advance knowledge of purchasing requirements will permit taking advantage of cost savings and ensure that purchased goods are readily available when needed.

- Anticipating any additional financing needs. With planning, the search for needed funds can begin as early as possible. In this way, financial crises are avoided and financing can be arranged on more favorable terms.

Advantages of Profit Planning

Profit planning offers many advantages to your business. The modest investment in time required to develop and implement the plan will pay liberal dividends later. Among the benefits that your business can enjoy from profit planning are the following:

Performance evaluation. The profit plan provides a continuing standard against which sales performance and cost control can quickly be evaluated.

Awareness of responsibilities. With the profit plan, personnel are readily aware of their responsibilities for meeting sales objectives, controlling costs, and the like.

Cost consciousness. Since cost excesses can quickly be identified and planned, expenditures can be compared with budget software even before they are incurred, cost consciousness is increased, reducing unnecessary costs and overspending.

Disciplined approach to problem-solving. The profit plan permits early detection of potential problems so that their nature and extent are known. With this information, alternate corrective actions can be more easily and accurately evaluated.

Thinking about the future. Too often, small businesses neglect to plan ahead: thinking about where they are today, where they will be next year, or the year after. As a result, opportunities are overlooked and crises occur that could have been avoided. Development of the profit plan requires thinking about the future so that many problems can be avoided before they arise.

Financial planning. The profit plan serves as a basis for financial planning. With the information developed from the profit plan, you can anticipate the need for increased investment in receivables, inventory, or facilities as well as any need for additional capital.

Confidence of lenders and investors. A realistic profit plan, supported by a description of specific steps proposed to achieve sales and profit objectives, will inspire the confidence of potential lenders and investors. This confidence will not only influence their judgment of you as a business manager, but also the prospects of your business’ success and its worthiness for a loan or an investment.

Limitations of Profit Planning

Profit plans are based upon estimates. Inevitably, many conֲditions you expected when the plan was prepared will change. Crystal balls are often cloudy. The further down the road one attempts to forecast, the cloudier they become. In a year, any number of factors can change, many of them beyond the conֲtrol of the company. Customers’ economic fortunes may decline, suppliers’ prices may increase, or suppliers’ inability to deliver may disrupt your plan.

The profit plan requires the support of all responsible parֲties. Sales quotas must be agreed upon with those responsible for meeting them. Expense budgets must be agreed upon with the people who must live with them. Without mutual agreement on objectives and budgets, they will quickly be ignored and serve no useful purpose.

Finally, profit plans must be changed from time to time to meet changing conditions. There is no point in trying to operate a business according to a plan that is no longer realistic because conditions have changed.

Advantages vs. Disadvantages

Despite the limitations of profit planning, the advantages far outweigh the disadvantages. A realistic plan, established yearly and reevaluated as changing conditions require will provide performance guidelines that will help you control every aspect of your business with a minimum of analysis and digging for financial facts.

Guide Objectives

In this guide, you will learn how to do the following:

Develop a forecast for sales and gross profit, considering all of the various internal and external factors that are relevant to the forecast.

Develop budgets for operating expenses to quickly detect excessive expenses so that corrective action can be taken and purchasing commitments held within budgetary limits.

Estimate net profit so that you can determine whether or not the projected return on your investment is satisfactory. You will also be able to determine how much cash will be generated from operations either for reinvestment in the business or to compensate owners for their investment.

Forecasting Sales And Gross Profit

Development of your profit plan should usually begin with a forecast of your expected sales and gross profit for the coming year. The sales and gross profit must be considered together since they are so closely interrelated. Gross profit percentages are determined by pricing policy, which also affects expected sales volume. A decision to increase the expected gross profit percentage will usually tend to decrease expected sales, while reducing the expected gross profit perֲcentage should increase sales.

A second major reason for beginning the profit plan with a sales forecast is that the volume of expected sales often determines a number of other factors such as the following:

Expected changes in variable expenses, those expenses that tend to change in direct proportion to changes in sales. These could include expenses such as sales commissions or delivery costs.

The impact of the added sales volume on the various fixed costs of operating your business. These costs, by definition, do not tend to vary in direct proportion to changes in sales volume. However, substantial increases in sales over an extended period can force an increase in many fixed expenses. For example, a sales increase realized through the addition of many new accounts could affect bookkeeping and credit costs.

The ability of present resources such as storage space, display area, delivery capability, or supervisory personnel to accommodate the added volume.

The need for funds to invest in increased inventory or accounts receivable to accommodate sales increases.

Cash generated from operations to meet current operating needs as well as expansion requirements, debt repayments, and owners’ compensation.

Realism

A realistic sales forecast must rely on careful analysis of market potential and the ability of your business to capture its share of this potential. The forecast should not be based upon what you would like to do or what you hope to do. It must be what you can do and what you will do.

Any forecast of a sales increase must be supported by realistic expectations for stronger market demand and specific marketing steps that will be taken to capture a share of this market.

The key to successful forecasting is realism. You only fool yourself if you reject reality in forecasting. Such foreֲcasts serve neither as a realistic planning basis nor as a reliable means of performance evaluation.

Your forecast can be the basis for important decisions such as decisions to add personnel, lease additional facilities, or increase promotional costs. If these decisions are based upon unrealistic sales expectations, any money expended on them will be wasted.

Forecasts are often presented to lenders or potential investors to guide them in their decisions. If they lack confidence in your forecast, they will certainly be reluctant to commit their funds to your business.

Every forecast should be supported by carefully considered, specific action plans. It is inadequate to forecast a sales increase of 20% or 30% without plans for specific actions to achieve the increase. These actions could include the introֲduction of new products, opening of new branches, market expansion, commitments from new customers, increased requireֲments from existing customers, additional salesmen, or an intensified promotional effort to attract new customers.

Analyzing Current Sales and Gross Profit

Your sales and gross profit forecast begins with analysis of current performance. Sales are usually divided into various categories. Each category is examined individually to deterֲmine expected sales for the coming year.

Selecting Sales Categories

The selection of categories will depend upon the nature of your business. For example, a food broker selling to a large number of relatively small accounts might be interested priֲmarily in analyzing sales by product. The owner of a single retail store might choose to analyze sales by selling departֲment, while the owner of a retail chain would probably be interested in analyzing sales by outlet. An insurance broker with several agents might categorize sales by agent. An individual wholesaler might consider sales by sales territory.

Factors Affecting Sales

After categories have been selected and current sales divided among them, the various factors which can affect sales in each category must be considered. These factors could be either internal or external. Internal factors are those that you can influence. External factors are those that affect the market served by your business, but are generally beyond your control.

Internal Factors

The following are typical internal factors that could influence your sales forecast: