Derivatives Investing Financial Web

Post on: 31 Март, 2015 No Comment

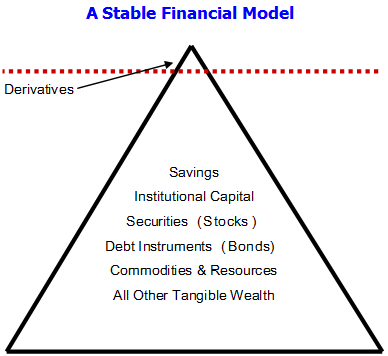

A derivative is a financial instrument which is derived, or developed from, from an underlying asset. Its main use is to either remove risk from or take on risk of a particular market position. Instead of trading the actual asset itself, counter parties execute an agreement to exchange money or some other consideration at a future point in time based upon the underlying asset. A common example of this operation is a futures contract . which is nothing more than an agreement to buy, sell or trade the underlying asset (or a cash flow from that asset) at a specific future point in time. The terms of the derivative — the payments between the tow parties — depend upon the performance of the underlying asset, though they may not necessarily correspond to that performance.

There are a number of financial instruments that are categorized as derivatives, but futures, forwards . options and swaps are by far the most common. Briefly, an option is a contract in which one counter party agrees to pay another counter party a fee for the right to buy something from or sell something to the other party, for a specific period of time. This right to trade with the other party does not carry with it an obligation to trade; in other words, the option holder may or may not exercise their right to trade. For example, an investor has concerns that the stock he owns may go down in price before he chooses to sell it. To reduce his risk of a lower selling price, he pays a fee (for the right to sell) to another investor who agrees to buy the stock at todays price. This is known as a put option. The first investor is using the option to manage the risk that the value of his stock may go down, while the other investor is using the option as a way to benefit from the possible increase of the stocks price as well as the fee income.

As time passed and markets evolved, contracts known as swaps came into existence. In a swap, one party exchanges cash flows with another party. For instance, one company may be repaying a fixed-rate loan, while another company may have a loan of variable rate. Each of the businesses decides that they would be better served by having the other type of loan. Rather than incurring the expense of refinancing to a different loan (if it is even possible), the two companies agree to swap cash flows, thus achieving the same effect. The first company pays the second based on its variable-rate loan, and the second company pays the first based on the fixed-rate loan (in practice, the two businesses will net out the amounts owing). By swapping cash flows in this manner, each company has, in essence, converted their loan to a more favorable one.

Derivatives can be based on many different types of assets, such as stocks . bonds . commodities, interest and exchange rates, or indices. The widely diverse range of potential underlying assets and payoff alternatives has led to a huge array of derivatives contracts that are available to be traded. As the growth of this market continues, derivatives are being used ever-increasingly to protect assets from drastic price fluctuations and at the same time they continue to be redesigned to cover the many different types of risk that todays investor faces.

$7 Online Trading. Fast executions. Only at Scottrade