Derivatives & Corporate Credit

Post on: 25 Май, 2015 No Comment

Course Objectives

The goal of this one day workshop is to understand how the use of derivatives impacts the credit standing of a company. The course will enable participants to identify risk exposures, assess the credit impact of the derivative strategy employed to manage these risks, and evaluate the associated accounting and financial statement disclosure. Specifically participants will be equipped to:

- Identify the operating and financial risks to which a company is exposed and how derivatives are used to manage them

- Distinguish between hedging and trading strategies

- Understand how derivatives are accounted for under IFRS and US GAAP

- Assess how derivatives used is reflected in the financial statements and their impact on current and future operating performance and financial risk

- Recognise the warning signals of high risk in the use of derivatives.

Target Audience

Experienced credit and risk managers, relationship managers, fixed income investors or others responsible for assessing corporate counterparty risk.

Content

HEDGING WITH DERIVATIVES

A brief introductory section to identify the risks to which companies are exposed in order to understand the underlying rationale of the hedge strategy and evaluate the benefits and risks inherent in such strategy.

- Understand the risks faced by corporates: operating, financial, and investment flows and assets

- Uses of derivatives: hedging, trading, dynamic hedging

- Hedging: benefits and risks

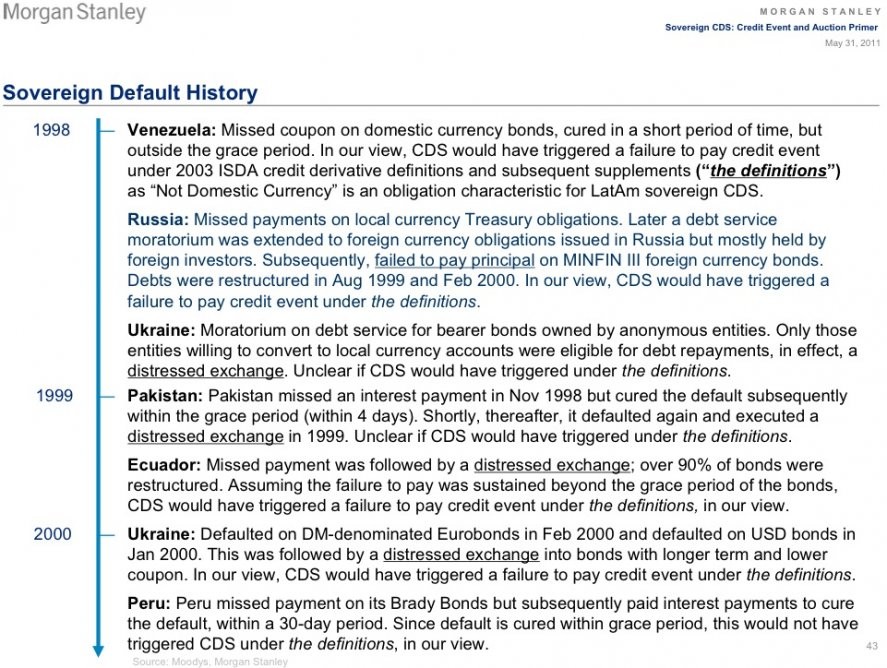

- Recent ‘derivative disasters’ involving corporates

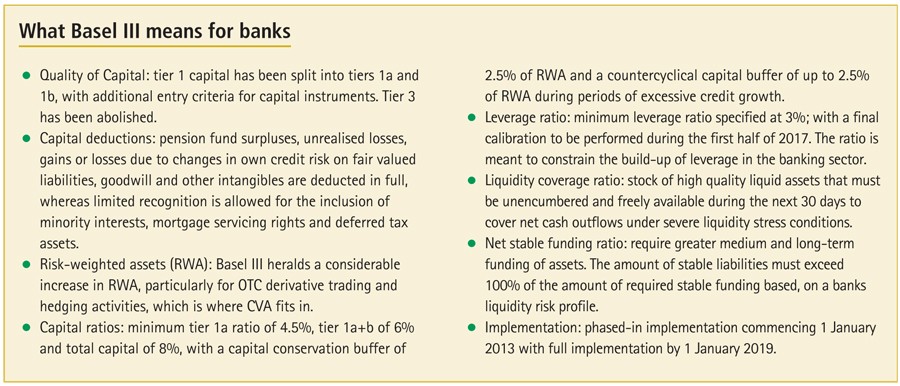

- Impact of the credit crunch and new legislation

DERIVATIVE ACCOUNTING AND FINANCIAL STATEMENT IMPACT

How derivatives are accounted for and the resulting impact on financial statements including the extent and usefulness of the disclosure

- Background to IAS 39 and FAS 133

- Where derivatives are reflected in the financial statements: balance sheet, income statement, statement of other comprehensive income

- Fair valuation challenges

- Hedge accounting overview:

- Fair value, cash flow, and foreign currency hedges of overseas operations

THE IMPACT ON CREDITWORTHINESS

A structured approach to assess the impact of a company’s derivative hedging strategy on its overall creditworthiness and any warning signs of potential problems associated with its risk management strategy

- Structured framework for risk assessment:

- Risks faced by the business

- Expectations of hedging use

- Specific risks: anticipatory hedging, over-hedging, exotic transactions